Capital One 2008 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

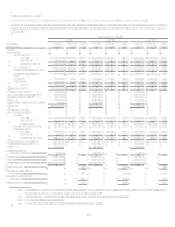

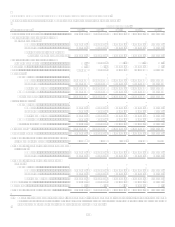

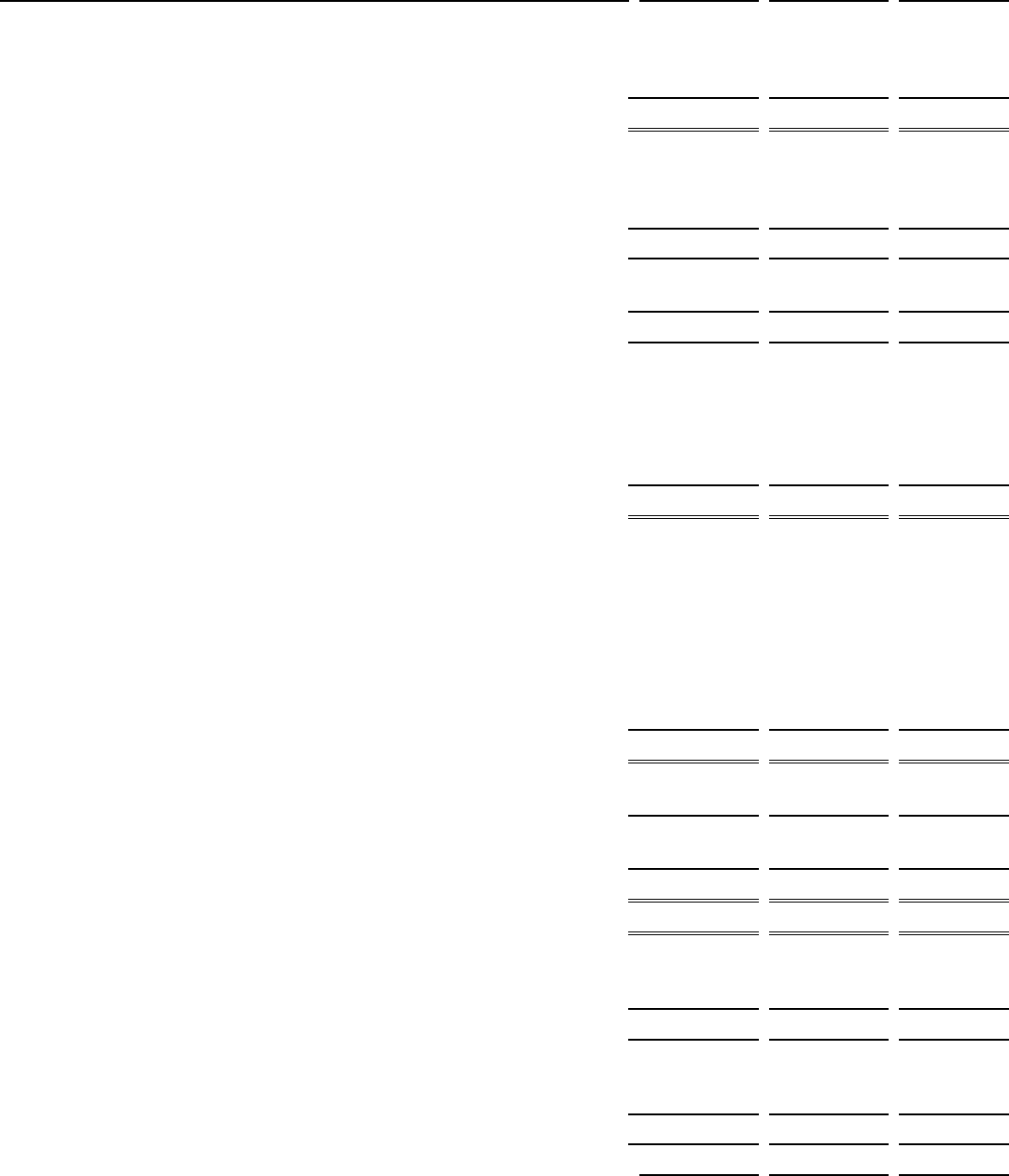

CONSOLIDATED STATEMENTS OF INCOME

Year Ended December 31 (In Thousands, Except Per Share Data)

2008

2007

2006

Interest Income:

Loans held for investment, including past-due fees.....................................................$ 9,460,378 $ 9,500,128 $ 7,046,473

Securities available for sale ......................................................................................... 1,224,012 950,972 676,712

Other ............................................................................................................................ 427,609 627,056 441,550

Total interest income.................................................................................................... 11,111,999 11,078,156 8,164,735

Interest Expense:

Deposits ....................................................................................................................... 2,512,040 2,906,351 1,814,797

Senior and subordinated notes ..................................................................................... 444,854 577,128 411,643

Other borrowings ......................................................................................................... 1,006,390 1,064,832 846,849

Total interest expense .................................................................................................. 3,963,284 4,548,311 3,073,289

Net interest income ...................................................................................................... 7,148,715 6,529,845 5,091,446

Provision for loan and lease losses .............................................................................. 5,101,040 2,636,502 1,476,438

Net interest income after provision for loan and lease losses ...................................... 2,047,675 3,893,343 3,615,008

Non-Interest Income:

Servicing and securitizations ....................................................................................... 3,384,468 4,840,677 4,209,637

Service charges and other customer-related fees ......................................................... 2,232,363 2,057,854 1,770,340

Mortgage servicing and other ...................................................................................... 105,038 166,776 177,893

Interchange .................................................................................................................. 562,117 500,484 549,074

Other ............................................................................................................................ 459,985 488,432 294,080

Total non-interest income ............................................................................................ 6,743,971 8,054,223 7,001,024

Non-Interest Expense:

Salaries and associate benefits ..................................................................................... 2,335,737 2,592,534 2,224,676

Marketing..................................................................................................................... 1,118,208 1,347,836 1,444,324

Communications and data processing.......................................................................... 755,989 758,820 712,001

Supplies and equipment ............................................................................................... 519,687 531,238 460,419

Occupancy ................................................................................................................... 377,192 322,510 215,636

Restructuring expense.................................................................................................. 134,464 138,237

Goodwill impairment................................................................................................... 810,876

Other ............................................................................................................................ 2,157,874 2,386,835 1,886,635

Total non-interest expense ........................................................................................... 8,210,027 8,078,010 6,943,691

Income from continuing operations before income taxes ............................................ 581,619 3,869,556 3,672,341

Income taxes ................................................................................................................ 497,102 1,277,837 1,245,964

Income from continuing operations, net of tax ............................................................ 84,517 2,591,719 2,426,377

Loss from discontinued operations, net of tax ............................................................. (130,515) (1,021,387) (11,884)

Net income (loss).........................................................................................................$ (45,998) $ 1,570,332 $ 2,414,493

Net income (loss) available to common shareholders..................................................$ (78,721) $ 1,570,332 $ 2,414,493

Basic earnings per common share

Income from continuing operations .............................................................................$ 0.14 $ 6.64 $ 7.84

Loss from discontinued operations .............................................................................. (0.35) (2.62) (0.04)

Net income (loss) per common share...........................................................................$ (0.21) $ 4.02 $ 7.80

Diluted earnings per common share

Income from continuing operations .............................................................................$ 0.14 $ 6.55 $ 7.65

Loss from discontinued operations .............................................................................. (0.35) (2.58) (0.03)

Net income (loss) per common share...........................................................................$ (0.21) $ 3.97 $ 7.62

Dividends paid per common share...............................................................................$ 1.50 $ 0.11 $ 0.11

See Notes to Consolidated Financial Statements.