Capital One 2008 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124

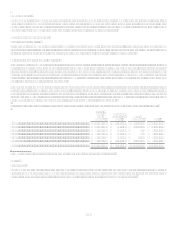

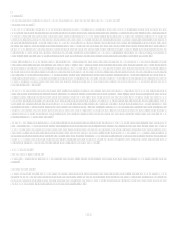

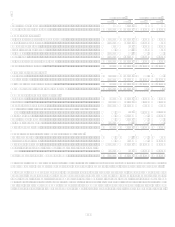

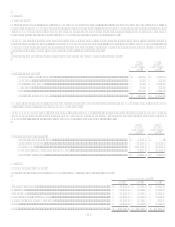

Pre tax amounts recognized in cumulative other comprehensive income that have not yet been recognized as a component of net

periodic benefit cost consist of:

Pension Benefits

Postretirement Benefits

2008

2007

2008

2007

Transition obligation................................................................................................. $

$

$ $

Prior service credit....................................................................................................

22,312 31,940

Net actuarial gain (loss) ............................................................................................ (78,746) 15,574

(8,797) 4,858

Cumulative other comprehensive income................................................................. $ (78,746) $ 15,574 $ 13,515 $ 36,798

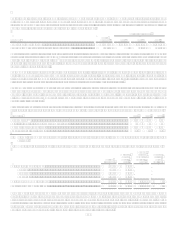

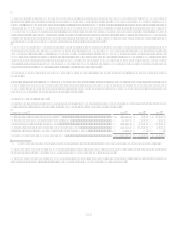

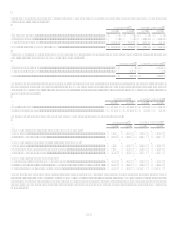

Pretax amounts in cumulative other comprehensive income that are expected to be recognized as decreases (increases) of net periodic

benefit cost for the year ending December 31, 2009 consist of:

Pension Benefits

Postretirement Benefits

Prior service cost (credit) ........................................................................................................ $ $ (7,839)

Net actuarial loss (gain) .......................................................................................................... 5,750

Total........................................................................................................................................ $ 5,750 $ (7,839)

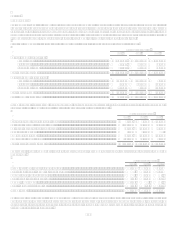

The following table sets forth the aggregate benefit obligation and aggregate fair value of plan assets for plans with benefit obligations

in excess of plan assets. Based on the status of the Companys pension plans, the information presented also represents the aggregate

pension accumulated benefit obligation and aggregate fair value of plan assets for pension plans with accumulated benefit obligations

in excess of plan assets.

Pension Benefits

Postretirement Benefits

2008

2007

2008

2007

Benefit obligation ...................................................................................................

.

$ 189,751 $ 207,926 $ 73,700 $ 59,783

Fair value of plan assets..........................................................................................

.

$ 192,605 $ 308,335 $ 6,981

$ 8,356

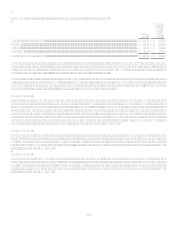

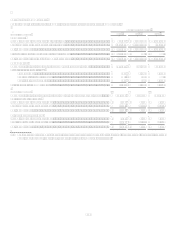

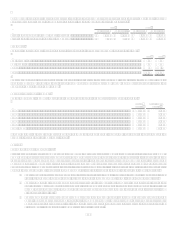

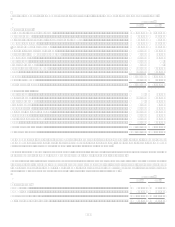

The following table presents weighted-average assumptions used in the accounting for the plans:

Pension Benefits

Postretirement Benefits

2008

2007

2008

2007

Assumptions for benefit obligations at measurement date:

Discount rate.............................................................................................................

.

6.3% 6.2% 6.3 % 6.3 %

Rate of compensation increase..................................................................................

.

n/a n/a n/a n/a

Assumptions for periodic benefit cost for the year ended:

Discount rate.............................................................................................................

.

6.3% 5.6% 6.3 % 5.7 %

Expected long-term rate of return on plan assets ......................................................

.

7.5% 7.5% 7.5 % 7.5 %

Rate of compensation increase..................................................................................

.

n/a 4.0% n/a n/a

Assumptions for year-end valuations:

Health care cost trend rate assumed for next year.....................................................

.

n/a n/a 9.4 % 9.3 %

Rate to which the cost trend rate is assumed to decline (the ultimate trend rate) .....

.

n/a n/a 4.5 % 5.0 %

Year the rate reaches the ultimate trend rate.............................................................

.

n/a n/a 2028 2017

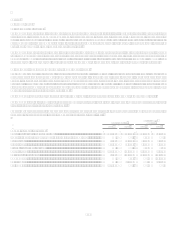

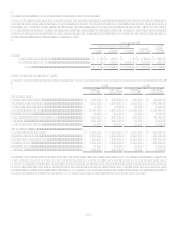

To develop the expected long-term rate of return on plan assets assumption, consideration was given to the current level of expected

returns on risk-free investments (primarily government bonds), the historical level of the risk premium associated with the other asset

classes in which the portfolio is invested and the expectations for future returns of each asset class. The expected return for each asset

class was then weighted based on the target asset allocation to develop the expected long-term rate of return on assets assumption for

the portfolio.