Capital One 2008 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.138

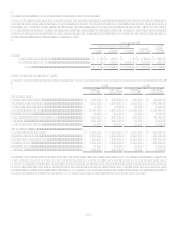

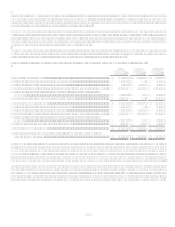

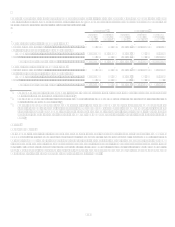

Hedge of Net Investment in Foreign Operations

The Company uses forward exchange contracts to protect the value of its investment in its foreign subsidiaries. Realized and

unrealized foreign currency gains and losses from these hedges are not included in the income statement, but are shown in the

translation adjustments in other comprehensive income. The purpose of these hedges is to protect against adverse movements in

exchange rates.

For the years ended December 31, 2008, 2007, and 2006, net gains (losses) of $6.8 million, $(0.5) million, and $1.5 million,

respectively, related to these derivatives were included in the cumulative translation adjustment.

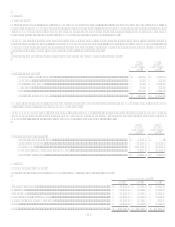

Non-Trading Derivatives

The Company uses interest rate swaps to manage interest rate sensitivity related to loan securitizations. The Company enters into

interest rate swaps with its securitization trust and essentially offsets the derivative with separate interest rate swaps with third parties.

The Company uses interest rate swaps in conjunction with its auto securitizations. These swaps have zero balance notional amounts

unless the pay down of auto securitizations differs from its scheduled amortization.

The Company uses interest rate swaps and To Be Announced (TBA) forward contracts in conjunction with its mortgage servicing

rights portfolio. These derivatives are designed to offset changes in the value of mortgage servicing rights attributable to interest rate

fluctuations.

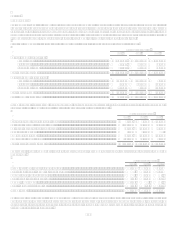

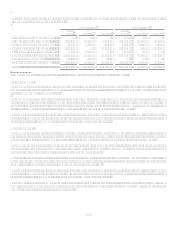

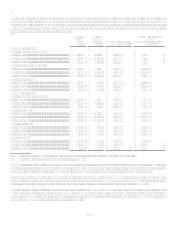

In third quarter 2007, the Company shut down the mortgage origination operations of its wholesale mortgage banking unit,

GreenPoint. The results of the mortgage origination operation of GreenPoint have been accounted for as a discontinued operation and

have been removed from the Companys results of continuing operations for all periods presented. Prior to the shutdown of

GreenPoint, the Company entered into commitments to originate or purchase loans whereby the interest rate of the loan was

determined prior to funding (interest rate lock commitment). Interest rate lock commitments on mortgage loans that the Company

intended to sell in the secondary market were considered freestanding derivatives. These derivatives were carried at fair value with

changes in fair value reported as a component of gain on sale of loans. In accordance with Staff Accounting Bulletin No, 105,

Application of Accounting Principles to Loan Commitments, interest rate lock commitments were initially valued at zero. Changes in

fair value subsequent to inception were determined based on current secondary market prices for underlying loans with similar

coupons, maturity and credit quality, subject to the anticipated probability that the loans would fund within the terms of the

commitment. The initial value inherent in the loan commitments at origination was recognized through gain on sale of loans when the

underlying loan was sold. Both the interest rate lock commitments and the related hedging instruments were recorded at fair value

with changes in fair value recorded in current earnings as a component of gain on sale of loans. However, as of December 31, 2008

and 2007, the Company has zero loan commitments due to the shutdown of GreenPoint.

These derivatives do not qualify as hedges and are recorded on the balance sheet at fair value with changes in value included in

current earnings in non-interest income.

For the years ended December 31, 2008, 2007, and 2006, the Company recognized gains/(losses) on the non-trading derivatives of

$105.6 million, $52.6 million and $(38.2) million, respectively.

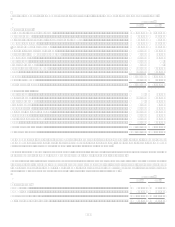

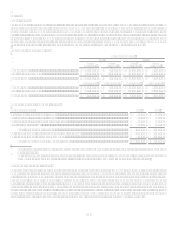

Trading Derivatives

The Company enters into customer-oriented derivative financial instruments, including interest rate swaps, options, caps, floors, and

foreign exchange contracts. These customer-oriented positions may be matched with offsetting positions to minimize risk to the

Company.

These derivatives do not qualify as hedges and are recorded on the balance sheet at fair value with changes in value included in

current earnings in non-interest income.

For the years ended December 31, 2008, 2007, and 2006, the Company recognized gains on the trading derivatives of $6.8 million,

$3.2 million and $3.9 million, respectively.

Credit Default Swaps

The Company has exposure to credit default swaps related to loss mitigation for certain manufactured housing securitization

transactions issued by Greenpoint Credit LLC in 2000. The maximum exposure of these credit default swaps is $37.5 million and

$40.9 million as of December 31, 2008 and December 31, 2007, respectively. The fair value of the Companys obligations under the

credit default swaps was $20.8 million and $30.8 million at December 31, 2008 and 2007, respectively, and is recorded as other

liabilities. See Note 18 for additional information about manufactured housing securitization transactions.