Capital One 2008 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.118

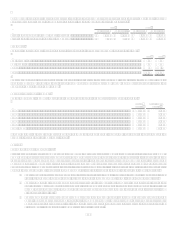

Accelerated Vesting Option Grants

Entrepreneur Grant IV

In April 1999, the Companys Board of Directors approved a stock option grant to senior management (Entrepreneur Grant IV).

This grant was originally composed of 7,636,107 options to certain key managers (including 1,884,435 options to the Companys

CEO and former COO) with an exercise price equal to the fair market value on the date of grant. The CEO and former COO gave up

their salaries for the year 2001 and their annual cash incentives, annual option grants and Senior Executive Retirement Plan

contributions for the years 2000 and 2001 in exchange for their Entrepreneur Grant IV options. Other members of senior management

had the opportunity to give up all potential annual stock option grants for 1999 and 2000 in exchange for this one-time grant. All

performance-based option accelerated vesting provisions lapsed during 2004; as such the options will now vest in accordance with the

ultimate vesting provisions. Fifty-percent of the stock options held by middle management vested on April 29, 2005, and the

remainder vested on April 29, 2008. In 2003, the former COOs options associated with Entrepreneur Grant IV were forfeited in

accordance with the terms of the employment agreement between the former COO and the Company. Options under this grant qualify

as fixed as defined by APB 25, accordingly no compensation expense was recognized.

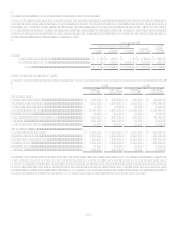

Associate Stock Purchase Plan

The Company maintains an Associate Stock Purchase Plan (the Purchase Plan). The Purchase Plan is a compensatory plan under

SFAS 123R; accordingly the Company recognized $4.3 million, $5.2 million and $4.8 million in compensation expense for the years

ended December 31, 2008, 2007 and 2006, respectively.

Under the Purchase Plan, associates of the Company are eligible to purchase common stock through monthly salary deductions of a

maximum of 15% and a minimum of 1% of monthly base pay. To date, the amounts deducted are applied to the purchase of unissued

common or treasury stock of the Company at 85% of the current market price. Shares may also be acquired on the market. An

aggregate of 8.0 million common shares has been authorized for issuance under the 2002 Associate Stock Purchase Plan, of which

4.6 million shares were available for issuance as of December 31, 2008.

Dividend Reinvestment and Stock Purchase Plan

In 2002, the Company implemented its dividend reinvestment and stock purchase plan (2002 DRP), which allows participating

stockholders to purchase additional shares of the Companys common stock through automatic reinvestment of dividends or optional

cash investments. The Company has 7.5 million shares available for issuance under the 2002 DRP at December 31, 2008.

Employee Stock Ownership Plan

The Company has an internally leveraged employee stock ownership plan (ESOP) in which substantially all former employees of

Hibernia participate. In accordance with the merger agreement with Hibernia, assets of the ESOP trust were allocated solely for the

benefit of participants who were employees of Hibernia and its subsidiaries immediately prior to the merger date. The ESOP trust

owned 924,443 and 1,012,658 shares of common stock at December 31, 2008 and December 31, 2007, respectively. The Company

makes annual contributions to the ESOP in an amount determined by the Companys Board of Directors (or a committee authorized

by the Board of Directors), but at least equal to the ESOPs minimum debt service less dividends received by the ESOP. Dividends

received by the ESOP in 2008 were used to pay debt service. As of December 31, 2008, the debt had been fully repaid.

The ESOP shares were initially pledged as collateral for its debt. As the debt is repaid, shares are released from collateral and

allocated to active participants. The remaining collateral shares are reported as a reduction to paid-in capital in equity. As shares are

committed to be released, the Company reports compensation expense equal to the current market value of the shares, and the shares

become outstanding for earnings per share calculations. Dividends on allocated ESOP shares are recorded as a reduction of retained

earnings; dividends on unallocated ESOP shares are recorded as a reduction of contributions due to the ESOP.

Compensation expense of $4.4 million and $6.2 million relating to the ESOP was recorded by the Company for the years ended

December 31, 2008 and December 31, 2007, respectively. The ESOP held 924,443 and 842,751 allocated shares at December 31,

2008 and December 31, 2007, respectively. At December 31, 2008, there were no shares held in suspense. At December 31, 2007,

there were 169,907 shares held in suspense with a fair value of $8.0 million.