Capital One 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 38

Securitization transactions may amortize earlier than scheduled due to certain early amortization triggers, which could require the

Company to fund spread accounts, reduce the value of its retained residual interests and ultimately require the off-balance sheet loans

to be recorded on the Companys balance sheet and accelerate the need for alternative funding. Additionally, early amortization of

securitization structures would require the Company to record higher reserves for loan losses and would also have a significant impact

on the ability of the Company to meet regulatory capital adequacy requirements. As of December 31, 2008, no early amortization

events related to the Companys off-balance sheet securitizations have occurred.

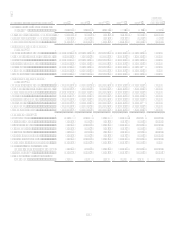

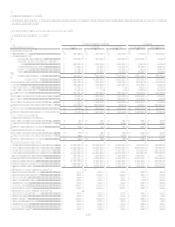

The amounts of investor principal from off-balance sheet loans as of December 31, 2008 that are expected to amortize into the

Companys loans, or be otherwise paid over the periods indicated, are summarized in Table 12. Of the Companys total managed

loans, 31% and 33% were included in off-balance sheet securitizations for the years ended December 31, 2008 and 2007, respectively.

Servicing Activities

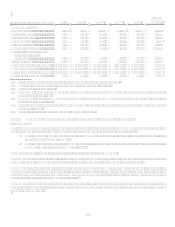

The Company services mortgage loans that have been sold through either whole loan sales or securitizations with servicing retained.

MSRs, are recognized when mortgage loans are sold in the secondary market and the right to service these loans are retained for a fee,

and are carried at fair value; changes in fair value are recognized in mortgage servicing and other. The Company may enter into

derivatives to economically hedge changes in fair value of MSRs. The Company typically does not have any continuing involvement

other than its right to service the loans and the Company does not hold subordinate residual interests or enter into other guarantees or

liquidity agreements with these structures. The Company records the MSR at estimated fair value and has no other loss exposure over

and above the recorded fair value. See Item 8 Financial Statements and Supplementary DataNotes to the Consolidated Financial

StatementsNote 13 for quantitative information regarding MSRs.

Community Development Activities

As part of its community reinvestment initiatives, the Company invests in private investment funds that make investments in common

stock of VIEs or provide debt financing to VIEs to support multi-family affordable housing properties. The Company receives

affordable housing tax credits for these investments. The activities of these entities are financed with a combination of invested equity

capital and debt. The Company is not required to consolidate these entities because it does not absorb the majority of the entities

expected losses nor does it receive a majority of the entities expected residual returns. The Company records its interests in these

unconsolidated VIEs in loans held for investment, other assets and other liabilities. The Companys maximum exposure to these

entities is limited to its variable interests in the entities and the creditors of the VIEs have no recourse to the general credit of the

Company. The Company has not provided additional financial or other support during the period that it was not previously

contractually required to provide. See Item 8 Financial Statements and Supplementary DataNotes to the Consolidated Financial

StatementsNote 20 for quantitative information regarding Other Variable Interest Entities.

The Company holds variable interests in entities (Investor Entities) that invest in community development entities (CDEs) that

provide debt financing to businesses and non-profit entities in low-income and rural communities. Investments of the consolidated

Investor Entities are also variable interests of the Company. The activities of the Investor Entities are financed with a combination of

invested equity capital and debt. The activities of the CDEs are financed solely with invested equity capital. The Company receives

federal and state tax credits for these investments. The Company consolidates the VIEs of which it absorbs the majority of the entities

expected losses or receives a majority of the entities expected residual returns. The assets of the entities consolidated by the Company

at December 31, 2008 and December 31, 2007 were approximately $189.7 million and $102.1 million, respectively. The assets and

liabilities of these consolidated VIEs were recorded in cash, loans held for investment, interest receivable, other assets and other

liabilities. In addition to the amounts above, the Company had involvement with entities where we held a significant variable interest

in the VIE but were not deemed to be the primary beneficiary as the Company would not absorb the majority of expected losses or

receive a majority of the expected residual returns. Accordingly, these entities were not consolidated by the Company. The assets of

the entities that the Company held a significant variable interest in but was not required to consolidate at December 31, 2008 and

December 31, 2007 were approximately $46.6 million and $12.0 million, respectively. The Company records its interests in these

unconsolidated VIEs in loans held for investment and other assets. The Companys maximum exposure to these entities is limited to

its variable interests in the entities. The creditors of the VIEs have no recourse to the general credit of the Company. The Company

has not provided additional financial or other support during the period that it was not previously contractually required to provide.

See Item 8 Financial Statements and Supplementary DataNotes to the Consolidated Financial StatementsNote 20 for

quantitative information regarding Other Variable Interest Entities.