Capital One 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

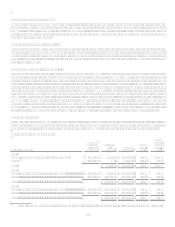

Federal Reserves Discount Window

The Federal Reserves Discount Window allows eligible institutions to borrow funds from the Federal Reserve, typically on a short-

term basis, to meet temporary liquidity needs. Borrowers must post collateral, which can be made up of securities or consumer or

commercial loans. As of December 31, 2008, the Company was eligible to borrow up to $4.2 billion through the Discount Window.

The eligible amount is reduced dollar for dollar by borrowings under the TAF program. During 2008, the Company did not borrow

funds from the Discount Window.

Federal Reserves Term Auction Facility

The Federal Reserves TAF is designed to help increase liquidity in the U.S. credit markets. The Federal Reserve auctions collateral-

backed short-term loans under TAF. The auctions allow financial institutions to borrow funds at an interest rate below the Federal

Reserves discount rate. As of December 31, 2008, the Company was eligible to borrow up to $2.1 billion under the TAF. The eligible

amount is reduced dollar for dollar by borrowings made under the Discount Window. During 2008, the Company did not borrow

funds through the TAF.

Term Asset-Backed Securities Loan Facility

In December of 2008, the Federal Reserve Bank of New York (FRBNY), the U.S. Treasury and the Federal Reserve Board

announced its intentions to launch the Term Asset-Backed Securities Loan Facility (TALF). TALF is a funding facility that will

help financial markets and institutions meet the credit needs of households and small businesses and thus to support overall economic

growth in the current period of severe financial strains by supporting the issuance of asset-backed securities (ABS) collateralized by

student loans, auto loans, credit card loans, loans guaranteed by the Small Business Administration (SBA), as well as certain types

of mortgage loans. Under the current specification of the TALF, the FRBNY will lend up to $1 trillion on a non-recourse basis to

holders of certain AAA-rated ABS backed by newly and recently originated consumer and small business loans, as well as

commercial mortgage-backed securities, private-label residential mortgage-backed securities, and other asset-backed securities. The

FRBNY will lend an amount equal to the market value of the ABS less a haircut and will be secured at all times by the ABS. The U.S.

Treasury will provide credit protection to the FRBNY in connection with the TALF. As of the date of this report, it is expected that

TALF will commence operations during March 2009. As of the date of this report it is undetermined whether the Company will desire

to participate in the TALF program. Such determination will be made after the final terms and conditions of TALF are released.

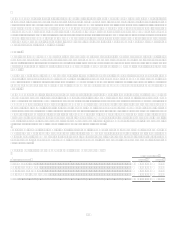

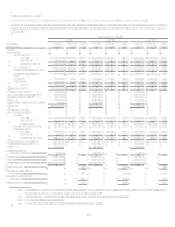

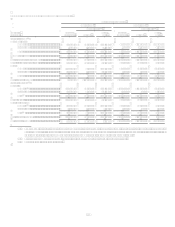

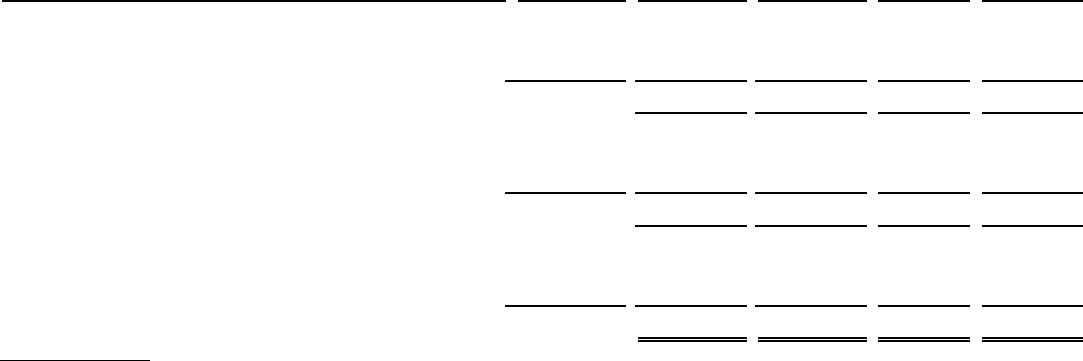

Funding Obligations

Information regarding the Companys funding obligations is disclosed in Tables 11 and 12. Table 11 reflects the costs of short term

borrowings of the Company as of and for each of the years ended December 31, 2008, 2007 and 2006. Table 12 summarizes the

amounts and maturities of the contractual funding obligations of the Company, including off-balance sheet funding obligations.

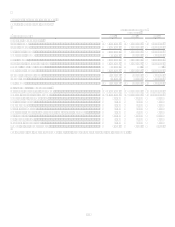

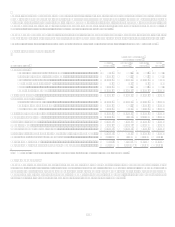

Table 11: Short Term Borrowings

(Dollars in Thousands)

Maximum

Outstanding

as of any

Month-End

Outstanding

as of

Year-End

Average

Outstanding

Average

Interest

Rate

Year-End

Weighted

Average

Interest

Rate

2008:

Federal funds purchased and resale agreements $ 6,311,810 $ 832,961 $ 3,261,190 1.90% .0007%

Other(1) 4,964,750 351,960 7.83 N/A

Total $ 832,961 $ 3,613,150 2.48% .0007%

2007:

Federal funds purchased and resale agreements ........................$ 3,504,745 $ 683,186 $ 1,689,647 4.74% 3.19%

Other .......................................................................................... 4,345,490 4,345,490 2,635,113

5.91 5.88

Total........................................................................................... $ 5,028,676 $ 4,324,760 5.45% 5.51%

2006:

Federal funds purchased and resale agreements ........................$ 3,736,470 $ 3,736,470 $ 1,662,961 4.20% 5.27%

Other .......................................................................................... 3,198,710 1,716,055 1,323,998

5.75 5.89

Total........................................................................................... $ 5,452,525 $ 2,986,959 4.89% 5.28%

(1) In 2008, the Company repaid certain borrowings under lines of credit associated with securitizations of auto consumer loans.