Capital One 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 44

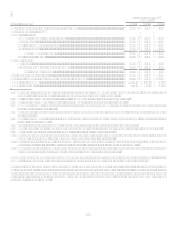

Acceleration of Equity Awards

During the second quarter of 2007, a charge of $39.8 million was taken against salaries and associate benefits. This charge was taken

as a result of the accelerated vesting of equity awards in conjunction with the transition of the Banking leadership team, consistent

with the terms of the awards. This charge is not included as a restructuring charge associated with our 2007 cost initiative.

Income Taxes

We recognized a $69.0 million one-time tax benefit in the second quarter of 2007 resulting from previously unrecognized tax benefits

related to our international tax position. In addition, we recognized a $29.7 million reduction in retained earnings associated with the

adoption of FIN 48 in 2007.

Business Outlook

The statements contained in this section are based on our current expectations regarding the Corporations 2009 financial results and

business strategies. Certain statements are forward looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995. Actual results could differ materially from those in our forward looking statements. Factors that could materially

influence results are set forth throughout this section and in Item 1A Risk Factors.

2009 Expectations

The Company expects continued pressure on profitability as deteriorating global economic conditions continue to have an impact on

credit performance and require the Company to increase its provision for loan losses.

Credit:

As of December 31, 2008, the Companys allowance is consistent with an outlook for $8.6 billion of managed losses in

2009. This loss outlook assumes that the U.S. unemployment rate increases to around 8.7% by the end of 2009, and that

home prices, as measured by the Case-Schiller 20-City Index, decline by an additional 10 percentage points by the end of

2009.

The Company expects 2009 provision expense levels to be higher than 2008 provision expense levels.

In addition to the effects of the weakening economy, the Company expects that in 2009 the charge-off rate in the U.S.

Card sub-segment will be adversely impacted by (i) continuing pressure from the unsecured closed-end loans included in

the U.S. Card sub-segment; and (ii) from the implementation of the OCC minimum payment policies. The Company

expects that the conversion to the OCC minimum payment policies will increase the U.S. Card charge-off rate by

approximately 10 basis points in the first quarter of 2009, and by approximately 50 basis points in subsequent quarters of

2009. The Company expects that the impact of the new minimum payment policies on the Companys charge-off levels

will begin to subside in 2010 as customers adjust to the new policies. The impact of the new policies has been factored

into the Companys expectations for charge-off levels in the U.S. Card sub-segment, as discussed above, and in the

Companys outlook for total company managed charge-off dollars for the next twelve months associated with the

allowance for loan and lease losses.

The Company expects that the charge-off rate in the U.S. Card sub-segment will be around 8.1% in the first quarter of

2009.

Earning Assets: The Company expects that new loan originations, reduced by weakening demand from credit worthy borrowers, will

not be sufficient to offset rising charge-offs, normal amortization and attrition, and weaker credit card spending. As a result, the

Company expects a decline in managed loans. We expect that the decline in earning assets will be more modest, resulting in a

continuing shift from loans to high-quality investment securities backed by mortgage and consumer loans.

Deposit Growth: The Company expects deposits in the Local Banking segment to grow in 2009. The Company also expects to

continue to maintain disciplined pricing and deposit margins in 2009.

Revenue Margin: The Company expects a modest decline in 2009 revenue margin as compared to 2008 revenue margin, although

there may be variability between quarterly periods.

Cost Management: The Company expects to continue to benefit from cost cutting actions taken in 2007 and 2008 and will pursue

additional efforts to achieve sustainable efficiency through cost reductions, including realizing synergies from the Chevy Chase Bank

acquisition.