Capital One 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

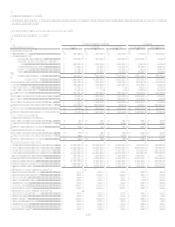

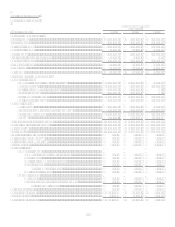

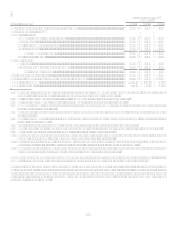

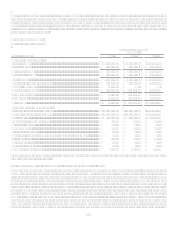

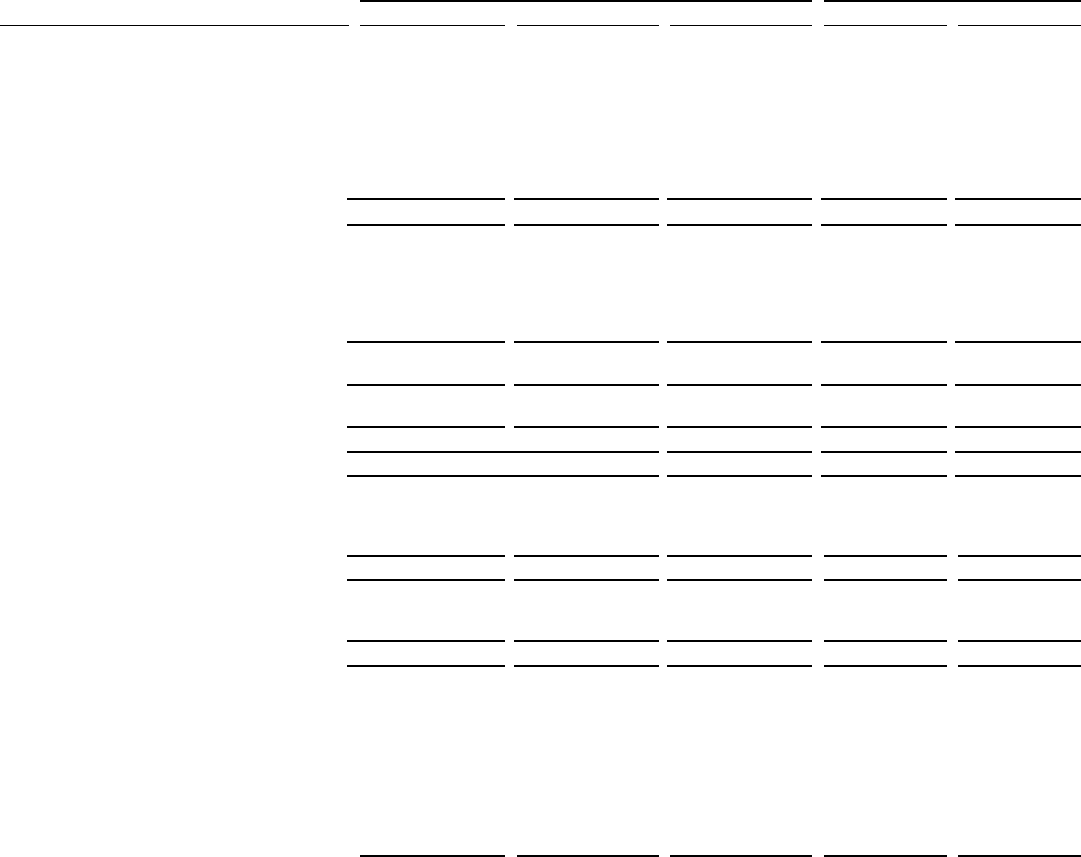

VI. Financial Summary

Table 1 provides a summary view of the consolidated income statement and selected metrics at and for the years ended December 31,

2008, 2007 and 2006.

CAPITAL ONE FINANCIAL CORPORATION

Table 1: Financial Summary

Year Ended December 31,

Change

(Dollars in thousands) 2008

2007(2)

2006(4)(2)

2008 vs. 2007

2007 vs. 2006

Earnings (Reported):

Net Interest Income ....................................................... $ 7,148,715

$ 6,529,845 $ 5,091,446 $ 618,870 $ 1,438,399

Non-Interest Income:

Servicing and securitizations............................. 3,384,468

4,840,677 4,209,637 (1,456,209) 631,040

Service charges and other customer-related

fees............................................................... 2,232,363

2,057,854 1,770,340 174,509 287,514

Mortgage servicing and other............................ 105,038

166,776 177,893 (61,738) (11,117)

Interchange ........................................................ 562,117

500,484 549,074 61,633 (48,590)

Other .................................................................. 459,985

488,432 294,080 (28,447) 194,352

Total non-interest income ................................. 6,743,971

8,054,223 7,001,024 (1,310,252) 1,053,199

Total Revenue(1) .................................... 13,892,686

14,584,068 12,092,470 (691,382) 2,491,598

Provision for loan and lease losses................................ 5,101,040

2,636,502 1,476,438 2,464,538 1,160,064

Marketing....................................................................... 1,118,208

1,347,836 1,444,324 (229,628) (96,488)

Restructuring expenses.................................................. 134,464

138,237 (3,773) 138,237

Goodwill impairment charge(8)...................................... 810,876

810,876 138,237

Operating expenses........................................................ 6,146,479

6,591,937 5,499,367 (445,458) 1,092,570

Income from continuing operations before taxes.......... 581,619

3,869,556 3,672,341 (3,287,937) 197,215

Income taxes .................................................................. 497,102

1,277,837 1,245,964 (780,735) 31,873

Income from continuing operations, net of tax ............. 84,517

2,591,719 2,426,377 (2,507,202) 165,342

Loss from discontinued operations, net of tax(5) ........... (130,515) (1,021,387) (11,884) 890,872 (1,009,503)

Net income (loss)........................................................... $ (45,998) $ 1,570,332 $ 2,414,493 $ (1,616,330 ) $ (844,161)

Net income (loss) available to common shareholders .. $ (78,721) $ 1,570,332 $ 2,414,493 $ (1,649,053 ) $ (844,161)

Common Share Statistics:

Basic earnings per common share:

Income from continuing operations, net of tax ............. $ 0.14

$ 6.64 $ 7.84 $ (6.50) $ (1.20)

Loss from discontinued operations, net of tax(5) ........... (0.35) (2.62) (0.04) 2.27 (2.58)

Net Income (loss) per common share............................ $ (0.21) $ 4.02 $ 7.80 $ (4.23) $ (3.78)

Diluted earnings per common share:

Income from continuing operations, net of tax ............. $ 0.14

$ 6.55 $ 7.65 $ (6.41) $ (1.10)

Loss from discontinued operations, net of tax(5) ........... (0.35) (2.58) (0.03) 2.23 (2.55)

Net Income (loss) per common share............................ $ (0.21) $ 3.97 $ 7.62 $ (4.18) $ (3.65)

Selected Balance Sheet Data(3):

Reported loans held for investment (period end).......... $ 101,017,771

$ 101,805,027 $ 96,512,139 $ (787,256) $ 5,292,888

Managed loans held for investment (period end) ......... 146,936,754

151,362,417 146,151,268 (4,425,663) 5,211,149

Reported loans held for investment (average) .............. 98,970,902

93,541,825 63,577,279 5,429,077 29,964,546

Managed loans held for investment (average) .............. 147,812,265

144,727,006 111,328,595 3,085,259 33,398,411

Allowance for loan and lease losses.............................. 4,523,960

2,963,000 2,180,000 1,560,960 783,000

Interest bearing deposits (period end)........................... 97,326,937

71,714,627 73,913,876 25,612,310 (2,199,249)

Total deposits (period end)............................................ 108,620,789

82,761,176 85,561,946 25,859,613 (2,800,770)

Interest bearing deposits (average)................................ 82,735,627

73,764,911 45,592,382 8,970,716 28,172,529

Total deposits (average) ................................................ $ 93,507,646

$ 85,211,616 $ 50,526,789 $ 8,296,030 $ 34,684,827

Selected Company Metrics (Reported) (3):

Return on average assets (ROA) ................................... 0.05% 1.79% 2.55% (1.74) (0.76)

Return on average equity (ROE)................................... 0.33% 10.28% 14.97% (9.95) (4.69)

Net charge-off rate......................................................... 3.51% 2.10% 2.21% 1.41 (0.11)

Delinquency rate (30+ days) ......................................... 4.37% 3.66% 2.74% 0.71 (0.92)

Net interest margin ........................................................ 5.37% 5.38% 6.06% (0.01) (0.68)

Revenue margin............................................................. 10.44% 12.01% 14.38% (1.57) (2.37)

Risk adjusted margin (6) ................................................. 7.83% 10.40% 12.71% (2.57) (2.31)

Selected Company Metrics (Managed) (3):

Return on average assets (ROA) ................................... 0.04% 1.33% 1.70% (1.04) (0.37)

Net charge-off rate......................................................... 4.35% 2.88% 2.84% 1.47 0.04

Efficiency ratio (7) .......................................................... 43.14% 47.30% 50.17% (4.16) (2.87)

Delinquency rate (30+ days) ......................................... 4.49% 3.87% 3.02% 0.62 0.85

Net interest margin ........................................................ 6.37% 6.46% 6.88% (0.09) (0.42)

Revenue margin............................................................. 9.39% 9.85% 10.66% (0.46) (0.81)

Risk adjusted margin (6) ................................................. 5.81% 7.40% 8.23% (1.59) (0.83)