Capital One 2008 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

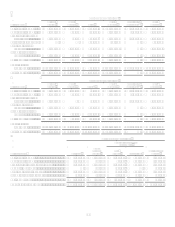

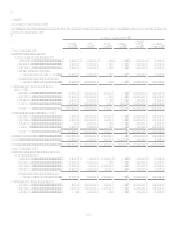

Expected Maturity Schedule(1)

1 Year

or Less

15

Years

510

Years

Over 10

Years

Market

Value

Totals

Amortized

Cost Totals

Non GSE .........................................

.

25,485 2,847,786 31,004 7,209 2,911,484 2,920,845

Total CMO ......................................

.

57,951 8,347,975 441,936 7,209 8,855,071 8,856,897

Mortgage backed securities

Fannie Mae......................................

.

22,839 3,376,353 121,978 3,521,170 3,496,254

Freddie Mac.....................................

.

187 1,586,909 238,687 1,825,783 1,833,879

Other GSE .......................................

.

3,049 110,262 107,979 221,290 220,152

Non GSE .........................................

.

1,488,653 1,488,653 1,489,676

Total MBS.......................................

.

26,075 6,562,177 468,644 7,056,896 7,039,961

Asset backed securities .............................

.

225,262 1,514,146 52,485 1,791,893 1,796,531

Other .........................................................

.

316,274 165,771 52,945 156,434 691,424 696,091

Total..........................................................

.

$ 1,170,383 $ 17,209,577 $ 1,237,984 $ 163,643 $ 19,781,587 $ 19,759,317

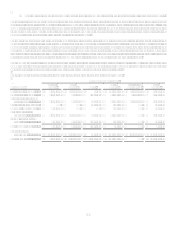

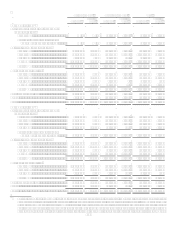

December 31, 2006(1)

U.S. Treasury and other U.S.

government agency obligations

U.S. Treasury...................................

.

$ $ 115,091 $ 112,066 $ $ 227,157 $ 232,298

Fannie Mae......................................

.

224,675 745,467 29,175 999,317 1,006,724

Freddie Mac.....................................

.

148,131 315,727 97,469 561,327 571,019

Other GSE .......................................

.

49,546 228,074 991 278,611 280,532

Total U.S. Treasury and other U.S.

Government agency obligations .

.

422,352 1,404,359 238,710 991 2,066,412 2,090,573

Collateralized mortgage obligations

Fannie Mae......................................

.

25,346 1,253,198 136,627 1,415,171 1,430,629

Freddie Mac.....................................

.

12,400 3,688,955 187,114 3,888,469 3,930,347

Other GSE .......................................

.

215,459 7,659 223,118 225,740

Non GSE .........................................

.

8,748 902,681 32,076 7,315 950,820 966,571

Total CMO ......................................

.

46,494 6,060,293 363,476 7,315 6,477,578 6,553,287

Mortgage backed securities

Fannie Mae......................................

.

314 3,037,593 413,527 17,392 3,468,826 3,484,867

Freddie Mac.....................................

.

21 576,705 236,076 812,802 828,915

Other GSE .......................................

.

5,939 77,890 28,550 2,895 115,274 115,538

Total MBS.......................................

.

6,274 3,692,188 678,153 20,287 4,396,902 4,429,320

Asset backed securities .............................

.

150,367 995,856 20,799 1,167,022 1,176,543

Other .........................................................

.

573,830 205,383 154,268 410,652 1,344,133 1,294,608

Total..........................................................

.

$ 1,199,317 $ 12,358,079 $ 1,455,406 $ 439,245 $ 15,452,047 $ 15,544,331

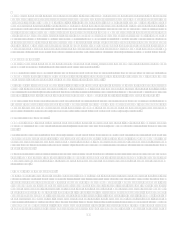

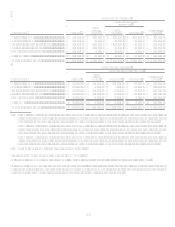

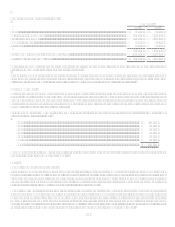

(1) Certain information as of December 31, 2007, and 2006 has been revised in these tables from the versions that appeared in prior

10-Ks to correct certain expected maturity information and to reclassify securities among investment categories and make

certain other immaterial revisions. Information as of December 31, 2006, has been revised to reflect that expected maturities are

based on weighted average remaining life instead of contractual life, which resulted in certain investments shifting from the

category of securities with expected maturities over 10 years to the category of securities with expected maturities of 1-5 years.

Further, information for the periods ended December 31, 2006, and December 31, 2007, has been revised to reclassify securities

among investment categories so that all tables in this Note reflect consistent classification of securities among investment

categories.

(2) Other GSE and FDIC Debt Guarantee Program (DGP) include investments in senior unsecured debt issued under the DGP of

$542.5 million in market value as of December 31, 2008.