Capital One 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

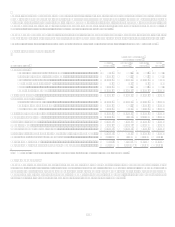

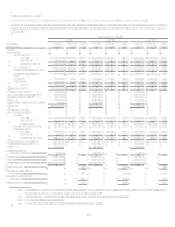

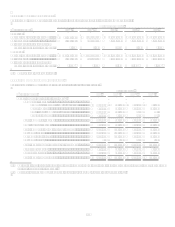

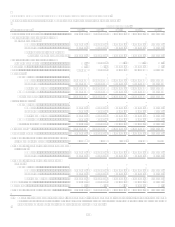

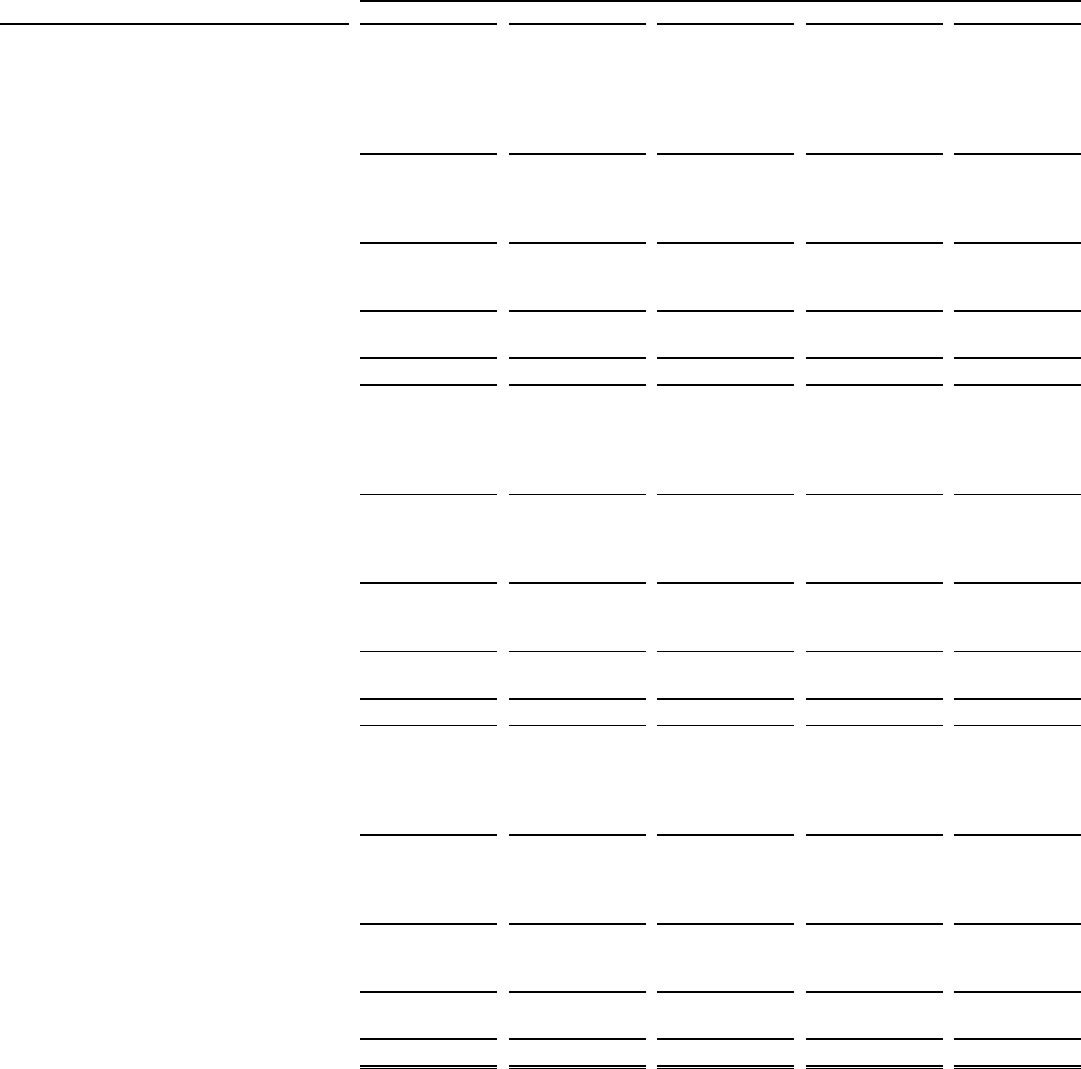

TABLE CMANAGED LOAN PORTFOLIO

Year Ended December 31

(Dollars in thousands) 2008

2007

2006

2005

2004

Year-End Balances:

Reported loans held for investment:

Consumer loans........................................

Credit cards ...................................

Domestic ............................. $ 16,954,281

$ 13,130,866 $ 18,102,140 $ 16,389,054 $ 16,536,789

International........................ 2,873,764

3,661,661 3,203,148 3,356,415 4,017,585

Total credit card .................. 19,828,045

16,792,527 21,305,288 19,745,469 20,554,374

Installment loans............................

Domestic ............................. 10,130,678

9,966,818 7,057,270 5,763,538 4,475,838

International........................ 119,320

354,556 637,982 551,460 493,846

Total installment loans........ 10,249,998

10,321,374 7,695,252 6,314,998 4,969,684

Auto loans................................................ 21,491,285

25,038,294 23,180,455 18,041,894 9,997,497

Mortgage loans......................................... 10,663,598

12,296,575 12,586,905 5,281,009

Total consumer loans.......................................... 62,232,926

64,448,770 64,767,900 49,383,370 35,521,555

Commercial loans............................................... 38,784,845

37,356,257 31,744,239 10,464,311 2,694,036

Total reported loans held for investment ............ 101,017,771

101,805,027 96,512,139 59,847,681 38,215,591

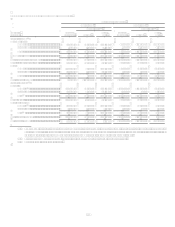

Securitization adjustments:

Consumer loans........................................

Credit cards ...................................

Domestic ............................. 36,605,663

38,885,887 35,430,763 33,059,990 32,088,151

International........................ 5,727,873

7,645,332 7,906,309 6,740,949 6,023,346

Total credit card .................. 42,333,536

46,531,219 43,337,072 39,800,939 38,111,497

Installment loans............................

Domestic ............................. 935,800

1,968,688 2,899,221 2,621,652 2,163,538

International........................

Total installment loans........ 935,800

1,968,688 2,899,221 2,621,652 2,163,538

Auto loans................................................

110,448 468,823 1,116,761

Mortgage loans.........................................

Total consumer loans.......................................... 43,269,336

48,610,355 46,705,116 43,539,352 40,275,035

Commercial loans............................................... 2,649,647

947,035 2,934,013 2,140,458 1,370,673

Total securitization adjustments ......................... 45,918,983

49,557,390 49,639,129 45,679,810 41,645,708

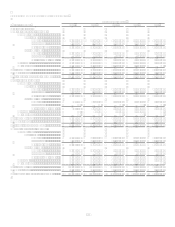

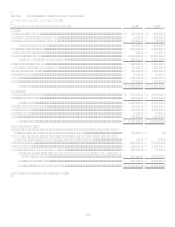

Managed loans held for investment:

Consumer loans........................................

Credit cards ...................................

Domestic ............................. 53,559,944

52,016,753 53,532,903 49,449,044 48,624,940

International........................ 8,601,637

11,306,993 11,109,457 10,097,364 10,040,931

Total credit card .................. 62,161,581

63,323,746 64,642,360 59,546,408 58,665,871

Installment loans............................

Domestic ............................. 11,066,478

11,935,506 9,956,491 8,385,190 6,639,376

International........................ 119,320

354,556 637,982 551,460 493,846

Total installment loans........ 11,185,798

12,290,062 10,594,473 8,936,650 7,133,222

Auto loans................................................ 21,491,285

25,148,742 23,649,278 19,158,655 9,997,497

Mortgage loans......................................... 10,663,598

12,296,575 12,586,905 5,281,009

Total consumer loans.......................................... 105,502,262

113,059,125 111,473,016 92,922,722 75,796,590

Commercial loans............................................... 41,434,492

38,303,292 34,678,252 12,604,769 4,064,709

Total managed loans held for investment ........... $ 146,936,754

$ 151,362,417 $ 146,151,268 $ 105,527,491 $ 79,861,299