Capital One 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

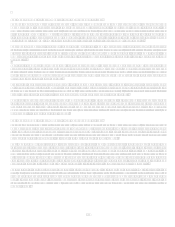

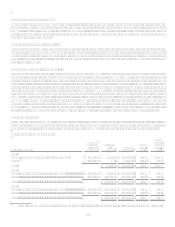

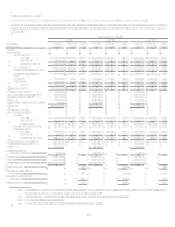

Credit Ratings

The Company also meets its liquidity needs by accessing the capital markets for long-term funding by issuing asset-backed securities

and senior and subordinated debt. Rating agencies base their ratings on numerous factors, including liquidity, capital adequacy, asset

quality and quality of earnings. Significant changes in these factors could result in different ratings. Table 10 provides the senior

unsecured debt credit ratings of the Corporation, COBNA and CONA as of December 31, 2008.

Table 10: Senior Unsecured Debt Credit Ratings

Capital One Financial

Corporation

Capital One

Bank (USA), N.A.

Capital One, N.A.

Moodys(1)........................................................................................................... A3 A2 A2

S&P(1) ................................................................................................................. BBB+ A- A-

Fitch, Inc. ........................................................................................................... A- A- A-

Dominion Bond Rating Service ......................................................................... BBB*** A* A*

(1) As of the date of this report, Moodys and S&P have the Company on a negative outlook.

* low *** high

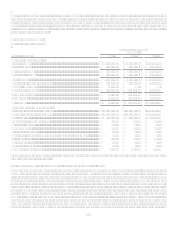

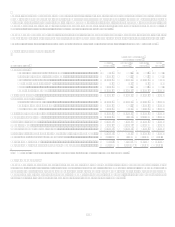

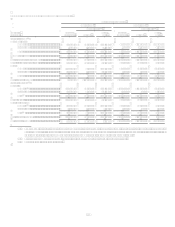

Loan Securitizations

The Company actively engages in securitization transactions of loans for funding purposes. The Company receives the proceeds from

third party investors for securities issued from the Companys securitization vehicles which are collateralized by transferred

receivables from the Companys portfolio. The Company removes loans from the reported financial statements for securitizations that

qualify as sales in accordance with SFAS 140. Alternatively, when the transfer would not be considered a sale but rather a financing,

the assets will remain on the Companys reported financial statements with an offsetting liability recognized in the amount of proceeds

received.

The Companys securitizations have maturities from 2009 to 2025. The revolving securitizations have accumulation periods during

which principal payments are aggregated to make payments to investors. As payments on the loans are accumulated and are no longer

reinvested in new loans, the Companys funding requirements for loans increase accordingly. Securitization transactions may amortize

earlier than scheduled due to certain early amortization triggers, which could require the Company to fund spread accounts, reduce the

value of its retained residual interests and ultimately require loans that would have been sold off of the balance sheet to remain on the

Companys balance sheet and accelerate the need for alternative funding. Additionally, early amortization of securitization structures

would require the Company to record higher reserves for loan and lease losses and would also have a significant impact on the ability

of the Company to meet regulatory capital adequacy requirements. As of December 31, 2008, no early amortization events related to

the Companys off-balance sheet securitizations have occurred.

The Company believes that it has the ability to continue to utilize securitization arrangements as a source of liquidity; however, a

significant reduction, termination or change in sale accounting for the Companys off-balance sheet securitizations could require the

Company to draw down existing liquidity and/or to obtain additional funding through the issuance or recognition of secured

borrowings or unsecured debt, the raising of additional deposits or the slowing of asset growth to offset or to satisfy liquidity needs.

The Company has committed securitization conduits of $12.0 billion, of which, $6.2 billion was outstanding as of December 31, 2008.

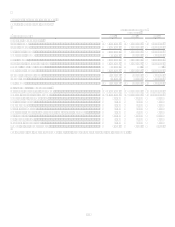

Senior and Subordinated Notes

Other funding programs established by the Company include senior and subordinated notes. At December 31, 2008, the Company had

$8.3 billion in senior and subordinated notes outstanding that mature in varying amounts from 2009 to 2017, as compared to $10.7

billion at December 31, 2007.

Included in senior and subordinated notes on the Companys balance sheet are notes issued under COBNAs Senior and Subordinated

Global Bank Note Program (the Program). The Program gives COBNA the ability to issue securities to both U.S. and non-U.S.

lenders and to raise funds in U.S. and foreign currencies, subject to conditions customary for transactions of this nature. Notes may be

issued under the Program with maturities of thirty days or more from the date of issue. The Program was last updated in June 2005. At

December 31, 2008, COBNA had $1.8 billion in bank notes outstanding under the Program.