Capital One 2008 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

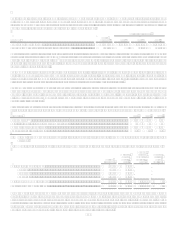

Note 8

Deposits and Borrowings

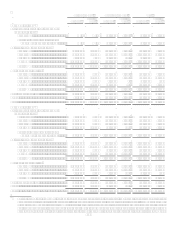

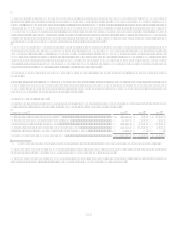

Borrowings as of December 31, 2008 and 2007 were as follows:

2008

2007(1)

Outstanding

Weighted

Average

Rate

Outstanding

Weighted

Average

Rate

Deposits

Non-interest bearing deposits................................................................

.

$ 11,293,852 N/A $ 11,046,549 N/A

Interest-bearing deposits(1) .....................................................................

.

97,326,937 2.64% 71,714,627 3.67%

Total deposits........................................................................................

.

$ 108,620,789 $ 82,761,176

Senior and subordinated notes

Bank notesfixed rate .........................................................................

.

$ 1,923,426 5.97% $ 3,525,699 5.49%

Corporation-fixed rate...........................................................................

.

5,355,591 6.03% 6,087,007 5.75%

Corporation-variable rate......................................................................

.

1,029,826 2.47% 1,100,000 5.43%

Total senior and subordinated notes......................................................

.

$ 8,308,843

$ 10,712,706

Other borrowings

Secured borrowings ..............................................................................

.

$ 7,510,838 2.63% $ 13,067,562 4.60%

Junior subordinated debentures.............................................................

.

1,648,268 7.38% 1,645,656 7.39%

FHLB advances.....................................................................................

.

4,877,179 2.85% 6,841,789 4.63%

Federal funds purchased and resale agreements ...................................

.

832,961 0.01% 683,186 3.19%

Other short-term borrowings(1) ..............................................................

.

402 N/A 4,574,776 5.88%

Total other borrowings..........................................................................

.

$ 14,869,648

$ 26,812,969

(1) Certain prior period amounts have been reclassified to conform with current period presentation.

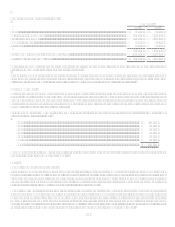

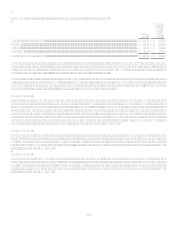

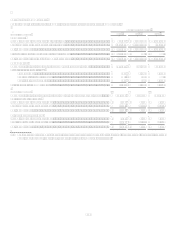

Deposits

Interest-Bearing Deposits

As of December 31, 2008, the Company had $97.3 billion in interest-bearing deposits of which $11.3 billion represents large

denomination certificates of $100 thousand or more. As of December 31, 2007, the Company had $71.7 billion in interest-bearing

deposits of which $10.0 billion represents large denomination certificates of $100 thousand or more.

Borrowings

Senior and Subordinated Notes

The Senior and Subordinated Global Bank Note Program gives COBNA the ability to issue securities to both U.S. and non-U.S.

lenders and to raise funds in U.S. and foreign currencies. The Senior and Subordinated Global Bank Note Program had $1.8 billion

and $3.2 billion outstanding at December 31, 2008 and 2007. Prior to the establishment of the Senior and Subordinated Global Bank

Note Program, COBNA issued senior unsecured debt through its $8.0 billion Senior Domestic Bank Note Program, of which zero and

$168.0 million was outstanding at December 31, 2008 and 2007, respectively. COBNA did not renew the Senior Domestic Bank Note

Program or future issuances following the establishment of the Senior and Subordinated Global Bank Note Program.

Prior to 2008, the Company issued senior and subordinated notes that as of December 31, 2008 had a par amount outstanding of $7.7

billion. The outstanding balance of senior and subordinated bank notes in the table above include $605 million and $104 million

related to fair value accounting hedges at December 31, 2008 and 2007, respectively. See Note 17 for a further discussion of fair value

interest rate hedges. The weighted average stated rate included in the table above is before the impact of these interest rate derivatives.

None of the senior and subordinated notes outstanding at December 31, 2008 are callable. During 2008, securities totaling $1.8 billion

were called or matured.

During 2008, the Company repurchased approximately $1.1 billion of certain senior unsecured notes, recognizing a gain of

approximately $53.3 million in non-interest income.

In September 2007, the Company issued $1.5 billion of 6.75% senior notes due September 15, 2017.