Capital One 2008 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.146

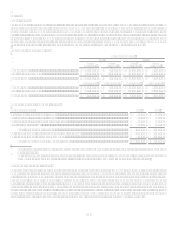

The Company may purchase and sell mortgage-backed securities and other asset-backed securities related to its investment portfolio.

See Note 4 Securities Available for Sale for more detail on the Companys investment portfolio. The Companys investment

portfolio consists of CMBS, CMO, MBS and ABS investments that were issued by QSPEs or VIEs that are subject to the

requirements of FIN 46(R). The Companys variable interest in these structures is limited to high quality or investment grade

securities and the Company does not hold subordinate residual interests or enter into other guarantees or liquidity agreements with

these structures. The Company records its investment securities at fair value and has no other loss exposure over and above the

recorded fair value. The Company is not considered to be the primary beneficiary and the Company does not hold a significant interest

in any specific structure.

As part of its community reinvestment initiatives, the Company invests in private investment funds that hold ownership interests in

VIEs or provide debt financing to VIEs to support multi-family affordable housing properties. The Company receives affordable

housing tax credits for these investments. The activities of these entities are financed with a combination of invested equity capital and

debt. The assets of these entities at December 31, 2008 and December 31, 2007 were approximately $5.2 billion and $4.1 billion,

respectively. The Company is not required to consolidate these entities because it does not absorb the majority of the entities

expected losses nor does it receive a majority of the entities expected residual returns. The Company records its interests in these

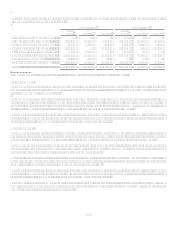

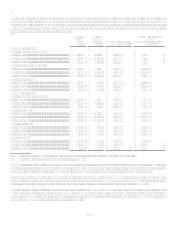

unconsolidated VIEs in loans held for investment, other assets and other liabilities. As referenced in the table below, the Companys

maximum exposure to these entities is limited to its variable interests in the entities. The creditors of the VIEs have no recourse to the

general credit of the Company. The Company has not provided additional financial or other support during the period that it was not

previously contractually required to provide.

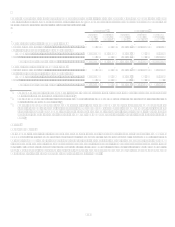

The Company holds variable interests in entities (Investor Entities) that invest in community development entities (CDEs) that

provide debt financing to businesses and non-profit entities in low-income and rural communities. Investments of the consolidated

Investor Entities are also variable interests of the Company. The activities of the Investor Entities are financed with a combination of

invested equity capital and debt. The activities of the CDEs are financed solely with invested equity capital. The Company receives

federal and state tax credits for these investments. The Company consolidates the VIEs of which it absorbs the majority of the entities

expected losses or receives a majority of the entities expected residual returns. The assets of the entities consolidated by the Company

at December 31, 2008 and December 31, 2007 were approximately $189.7 million and $102.1 million, respectively. The assets and

liabilities of these consolidated VIEs were recorded in cash, loans held for investment, interest receivable, other assets and other

liabilities. The assets of the entities that the Company held a significant interest in but were not required to consolidate at

December 31, 2008 and December 31, 2007 were approximately $46.6 million and $12.0 million, respectively. The Company records

its interests in these unconsolidated VIEs in loans held for investment and other assets. As referenced in the table below, the

Companys maximum exposure to these entities is limited to its variable interests in the entities. The creditors of the VIEs have no

recourse to the general credit of the Company. The Company has not provided additional financial or other support during the period

that it was not previously contractually required to provide.

Other unconsolidated VIEs consist of a variable interest in a trust that has a royalty interest in certain oil and gas properties. The

activities of the trust are financed solely with debt. The assets of the trust at December 31, 2008 and December 31, 2007 were

approximately $538.5 million and zero, respectively. The Company is not required to consolidate the trust because it does not absorb

the majority of the trusts expected losses nor does it receive a majority of the trusts expected residual returns. The Company records

its interest in the trust in loans held for investment. As referenced in the table below, the Companys maximum exposure to the trust is

limited to its variable interest. The creditors of the trust have no recourse to the general credit of the Company. The Company has not

provided additional financial or other support during the period that it was not previously contractually required to provide.