Capital One 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and Alt-A exposure in the portfolio is under 1% and we hold no securities backed by option

Adjustable Rate Mortgages (ARMs). In short, we do not invest in the types of securities that so

far have driven the big and often unanticipated mark-to-market losses many other banks have

suffered during this cycle.

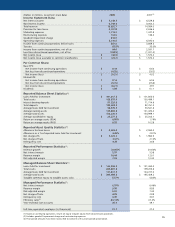

We ended 2008 with a TCE ratio of 5.6%, within our long-term target range. Our regulatory capital

ratios remained strong, with Tier 1 capital to risk weighted assets of 13.8%.

We further bolstered our balance sheet in September of 2008 by seizing favorable market conditions

and raising $761 million in common equity in the public equity markets. The additional capital

served two purposes. It better positioned our already strong company to weather the economic

turmoil. And it put us in a position to capitalize on select opportunities to acquire high-quality

depository institutions at attractive prices, such as our acquisition of Chevy Chase Bank.

In November of 2008, Capital One was one of the healthy banks invited to participate in the

Capital Purchase Program (CPP), which allowed the U.S. Treasury to make equity investments in

banks. While we were already in a strong capital position, we accepted the invitation to participate

in the CPP and issued $3.55 billion of preferred stock to the U.S. Treasury. While the preferred

stock does not count towards banks’ TCE ratios, it does count as Tier 1 capital. We intend to use

the CPP funds for all the stated purposes of the program, including absorbing troubled assets

and lending responsibly in a manner consistent with safety and soundness. We also intend to

continue to work with our mortgage customers to modify loans to help them stay in their homes.

And we will strive to generate appropriate returns on the capital over the cycle for all our investors,

including the U.S. Treasury.

The financial crisis is likely to persist throughout 2009. Our balance sheet is the financial bedrock

of our company and we believe that it will provide the necessary stability to operate through

the challenging economy.

Our National Lending Businesses Are Building For The Future

Our U.S. Card business was challenged in 2008 by the daunting economic environment, but still

generated $1 billion of net income with a managed charge-off rate of 6.33%. The reduction in

net income from 2007 was largely attributable to significantly higher allowance build driven by

the economic worsening. Managed loans ended the year at $71 billion, roughly flat with the year

before, as asset generation in this choppy environment was purposefully tepid.

The underlying fundamentals of our credit card business remained solid. Revenues in 2008 were

healthy at $10.6 billion. U.S. Card continued to drive efficiency gains, reducing expenses by 8%

during the year. And U.S. Card generated $1.7 billion of capital in 2008, further fortifying the

company and fueling investments and the return of capital to investors. Returns on allocated capital

remained strong, in excess of 35%.

5