Capital One 2008 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

156

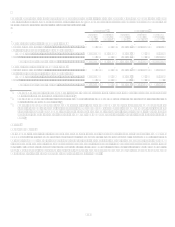

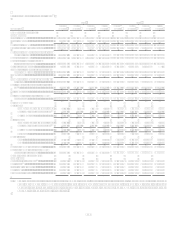

Selected Quarterly Financial Data(1)

2008

2007

(Unaudited)

Fourth

Quarter

Third

Quarter

Second

Quarter

First

Quarter

Fourth(4)

Quarter

Third

Quarter

Second

Quarter

First

Quarter

Summary of Operations:

(In Thousands)

Interest income ............................................ $ 2,768,821 $ 2,771,796 $ 2,691,857 $ 2,879,525 $ 2,960,194 $ 2,766,967 $ 2,638,686 $ 2,712,309

Interest expense ........................................... 966,424 965,151 964,101 1,067,608 1,197,947 1,142,493 1,100,105 1,107,766

Net interest income ...................................... 1,802,397 1,806,645 1,727,756 1,811,917 1,762,247 1,624,474 1,538,581 1,604,543

Provision for loan and lease losses............... 2,098,921 1,093,917 829,130 1,079,072 1,294,210 595,534 396,713 350,045

Net interest income after provision for loan

and lease losses ...................................... (296,524 ) 712,728 898,626 732,845 468,037 1,028,940 1,141,868 1,254,498

Non-interest income..................................... 1,368,286 1,696,891 1,622,316 2,056,478 2,158,340 2,149,662 1,971,851 1,774,370

Non-interest expense, excluding

restructuring expenses............................ 2,705,104 1,794,900 1,806,041 1,769,518 2,107,398 1,914,867 1,943,461 1,974,047

Restructuring expenses ................................ 52,839 15,306 13,560 52,759 27,809 19,354 91,074

Income (loss) from continuing operations

before income taxes................................ (1,686,181 ) 599,413 701,341 967,046 491,170 1,244,381 1,079,184 1,054,821

Income taxes................................................ (289,856 ) 213,624 238,843 334,491 169,558 428,010 311,572 368,697

Income (loss) from continuing operations,

net of tax ................................................ (1,396,325 ) 385,789 462,498 632,555 321,612 816,371 767,612 686,124

Loss from discontinued operations, net of

tax(2)........................................................ (25,221 ) (11,650 ) (9,593 ) (84,051 ) (95,044 ) (898,029 ) (17,240 ) (11,074 )

Net income (loss)......................................... $ (1,421,546 ) $ 374,139 $ 452,905 $ 548,504 $ 226,568 $ (81,658 ) $ 750,372 $ 675,050

Net income (loss) available to common

shareholders ........................................... $ (1,454,269 ) $ 374,139 $ 452,905 $ 548,504 $ 226,568 $ (81,658 ) $ 750,372 $ 675,050

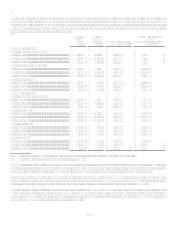

Per Common Share:

Basic EPS:

Income from continuing operations .. $ (3.67 ) $ 1.03 $ 1.24 $ 1.71 $ 0.85 $ 2.11 $ 1.96 $ 1.68

Loss from discontinued operations(2) (0.07 ) (0.03 ) (0.03 ) (0.23 ) (0.25 ) (2.32 ) (0.04 ) (0.03 )

Net Income (loss).............................. $ (3.74 ) $ 1.00 $ 1.21 $ 1.48 $ 0.60 $ (0.21 ) $ 1.92 $ 1.65

Diluted EPS:

Income from continuing operations .. $ (3.67 ) $ 1.03 $ 1.24 $ 1.70 $ 0.85 $ 2.09 $ 1.93 $ 1.65

Loss from discontinued operations(2) (0.07 ) (0.03 ) (0.03 ) (0.23 ) (0.25 ) (2.30 ) (0.04 ) (0.03 )

Net Income (loss).............................. $ (3.74 ) $ 1.00 $ 1.21 $ 1.47 $ 0.60 $ (0.21 ) $ 1.89 $ 1.62

Dividends.......................................... 0.375 0.375 0.375 0.375 0.03 0.03 0.03 0.03

Market prices

High.................................................. 32.34 53.00 39.89 50.19

72.94 78.94 81.85 83.61

Low................................................... 30.74 45.90 37.91 48.00

45.66 62.70 70.26 74.37

Average common shares (000s)................... 389,008 372,928 372,348 370,743 375,566 386,133 390,847 408,709

Average common shares and common

equivalent shares (000s) ......................... 389,008 374,293 373,653 372,272 378,439 390,844 397,473 415,530

Average Balance Sheet Data:

(In Millions)

Loans held for investment(3)......................... $ 99,335 $ 98,778 $ 97,950 $ 99,819 $ 97,785 $ 91,745 $ 91,145 $ 93,466

Total assets(3) ............................................... 161,976 156,958 154,288 149,460 150,926 143,291 142,690 143,130

Interest-bearing deposits .............................. 93,144 84,655 78,675 74,167 72,074 73,338 75,024 74,654

Total deposits............................................... 104,093 95,328 89,522 84,779 83,813 84,667 86,525 86,024

Stockholders equity .................................... $ 26,658 $ 25,046 $ 24,839 $ 24,569 $ 24,733 $ 25,344 $ 25,128 $ 25,610

(1) The above schedule is a tabulation of the Companys unaudited quarterly results for the years ended December 31, 2008 and

2007. The Companys common shares are traded on the New York Stock Exchange under the symbol COF. In addition, shares

may be traded in the over-the-counter stock market. There were 17,653 and 18,487 common stockholders of record as of

December 31, 2008 and 2007, respectively.