Capital One 2008 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.129

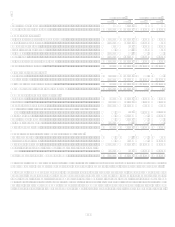

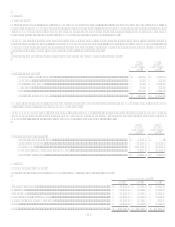

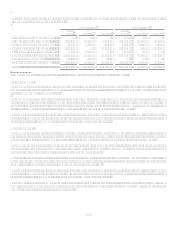

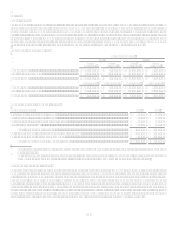

Financial Assets

Cash and cash equivalents

The carrying amounts of cash and due from banks, federal funds sold and resale agreements and interest-bearing deposits at other

banks approximate fair value.

Securities available for sale

Quoted prices in active markets are used to measure the fair value of U.S Treasury securities. For other investment categories, the

Company engages third party pricing services to provide fair value measurements. The techniques used by the pricing services utilize

observable market data to the extent available. The Company corroborates the pricing obtained the pricing services though comparison

of pricing to additional sources, including other pricing services, securities dealers, and internal sources.

Certain securities available for sale are classified as Level 3, the majority of which are non-agency mortgage-backed securities backed

by prime collateral. Classification of Level 3 indicates that significant valuation assumptions are not consistently observable in the

market. When significant assumptions are not consistently observable, fair values are derived using the best available data. Such data

may include quotes provided by a dealer, the use of external pricing services, independent pricing models, or other model-based

valuation techniques such as calculation of the present values of future cash flows incorporating assumptions such as benchmark

yields, spreads, prepayment speeds, credit ratings, and losses.

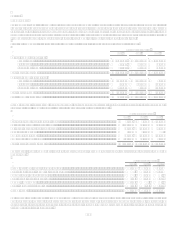

Mortgage loans held for sale

Mortgage loans held for sale are carried at the lower of aggregate cost, net of deferred fees, deferred origination costs and effects of

hedge accounting, or fair value. The fair value of mortgage loans held for sale is determined using current secondary market prices for

portfolios with similar characteristics. The carrying amounts as of December 31, 2008 and December 31, 2007 approximates fair

value.

Loans held for investment

The fair values of credit card loans, installment loans, auto loans, mortgage loans and commercial loans were estimated using a

discounted cash flow method, a form of the income approach. Discount rates were determined considering rates at which similar

portfolios of loans would be made under current conditions and considering liquidity spreads applicable to each loan portfolio based

on the secondary market. The fair value of credit card loans excluded any value related to customer account relationships. The

decrease in fair value below carrying amount at December 31, 2008 is primarily due to the significant level of illiquidity in the

secondary market experienced during 2008. The most significant discounts to carrying amount were seen in the Companys

commercial and mortgage portfolios.

Commercial loans are considered impaired in accordance with the provisions of SFAS 114 when it is probable that all amounts due in

accordance with the contractual terms will not be collected. From time to time, the Company records nonrecurring fair value

adjustments to reflect the fair value of the loans collateral. See table within Assets and Liabilities Measured at Fair Value on a

Nonrecurring Basis above.

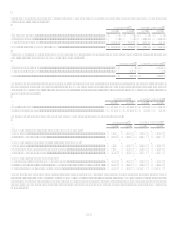

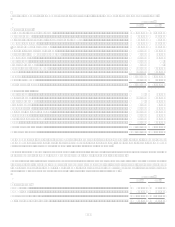

Interest receivable

The carrying amount approximates the fair value of this asset due to its relatively short-term nature.

Accounts receivable from securitizations

Retained interests in securitizations include the interest-only strip, retained senior tranches, retained subordinated notes, cash reserve

accounts and cash spread accounts. The Company uses a valuation model that calculates the present value of estimated future cash

flows. The model incorporates the Companys own estimates of assumptions market participants use in determining fair value,

including estimates of payment rates, defaults, discount rates including adjustments for liquidity, and contractual interest and fees.

Other retained interests related to securitizations are carried at cost, which approximates fair value.

Derivative Assets

Most of the Companys derivatives are not exchange traded but instead traded in over the counter markets where quoted market prices

are not readily available. The fair value of those derivatives is derived using models that use primarily market observable inputs, such

as interest rate yield curves, credit curves, option volatility and currency rates. Any derivative fair value measurements using

significant assumptions that are unobservable are classified as Level 3, which include interest rate swaps whose remaining terms

extend beyond market observable interest rate yield curves. The impact of Capital Ones non performance risk is considered when

measuring the fair value of derivative liabilities. These derivatives are included in other assets on the balance sheet.