Capital One 2008 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126

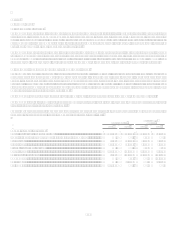

The Company also adopted SFAS 159 on January 1, 2008. SFAS 159 allows an entity the irrevocable option to elect fair value for the

initial and subsequent measurement for certain financial assets and liabilities on a contract-by-contract basis. SFAS 159 requires that

the difference between the carrying value before election of the fair value option and the fair value of these instruments be recorded as

an adjustment to beginning retained earnings in the period of adoption. The initial adoption of SFAS 159 did not have a material effect

on the consolidated earnings and financial position of the Company.

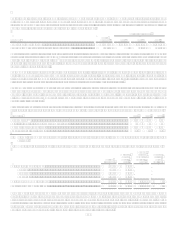

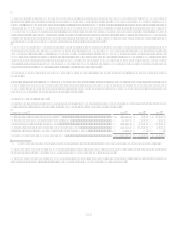

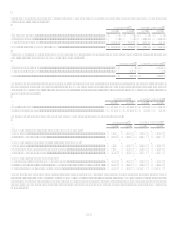

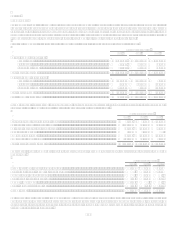

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The following table reflects the fair values of assets and liabilities measured and recognized at fair value on a recurring basis on the

consolidated balance sheet.

December 31, 2008

Fair Value Measurements Using

Level 1

Level 2

Level 3

Assets/Liabilities

at Fair Value

Assets

Securities available for sale....................................................... $ 291,907 $ 28,331,103 $ 2,380,261 $ 31,003,271

Other assets ...............................................................................

Mortgage servicing rights ................................................ 150,544 150,544

Derivative receivables(1) ................................................... 8,020 1,768,902 59,895 1,836,817

Retained interests in securitizations................................. 1,470,385 1,470,385

Total Assets ........................................................... $ 299,927 $ 30,100,005 $ 4,061,085 $ 34,461,017

Liabilities

Other liabilities..........................................................................

Derivative payables(1) ....................................................... $ 937 $ 1,260,062 $ 60,672 $ 1,321,671

Total Liabilities..................................................... $ 937 $ 1,260,062 $ 60,672 $ 1,321,671

(1) The Company does not offset the fair value of derivative contracts in a loss position against the fair value of contracts in a gain

position. The Company also does not offset fair value amounts recognized for derivative instruments and fair value amounts

recognized for the right to reclaim cash collateral or the obligation to return cash collateral arising from derivative instruments

executed with the same counterparty under a master netting arrangement.

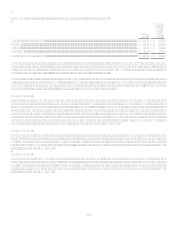

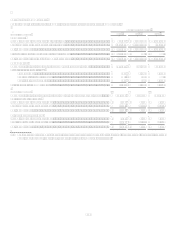

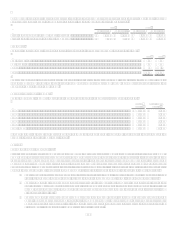

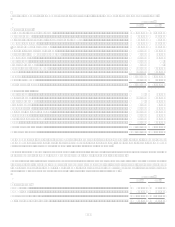

Financial instruments are considered Level 3 when their values are determined using pricing models, discounted cash flow

methodologies or similar techniques and at least one significant model assumption or input is unobservable. Level 3 financial

instruments also include those for which the determination of fair value requires significant management judgment or estimation. The

table below presents a reconciliation for all assets and liabilities measured and recognized at fair value on a recurring basis using

significant unobservable inputs (Level 3) during 2008. All Level 3 instruments presented in the table were carried at fair value prior to

the adoption of SFAS 159.