Capital One 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

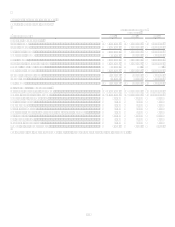

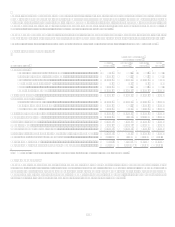

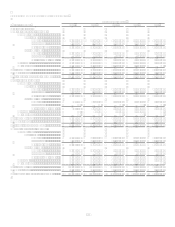

Table 12 summarizes the amounts and maturities of the contractual funding obligations of the Company, including off-balance sheet

funding.

Table 12: Contractual Funding Obligations

As of December 31, 2008

Total

Up to 1 year

1-3 years

4-5 years

After 5 years

Interest-bearing time deposits(1).........................

.

$ 47,125,682 $ 16,285,419 $ 19,510,165 $ 8,714,897 $ 2,615,201

Senior and subordinated notes ..........................

.

8,308,843 1,447,245 1,626,511 1,483,635 3,751,452

Other borrowings(2) ............................................

.

14,869,648 4,995,418 8,064,669 8,908 1,800,653

Operating leases................................................

.

1,231,829 132,780 241,673 222,935 634,441

Off-balance sheet securitization amortization(3)

.

44,299,597 6,932,463 20,677,117 8,026,987 8,663,030

Total obligations ...............................................

.

$ 115,835,599 $ 29,793,325 $ 50,120,135 $ 18,457,362 $ 17,464,777

(1) Includes only those interest bearing deposits which have a contractual maturity date.

(2) Other borrowings includes secured borrowings for the Companys on-balance sheet auto loan securitizations, junior

subordinated capital income securities and debentures, FHLB advances, federal funds purchased and resale agreements and

other short-term borrowings.

(3) Includes scheduled maturities of the external investors interest in securitizations.

Corporation Shelf Registration Statement

As of December 31, 2008, the Corporation had an effective shelf registration statement under which the Corporation from time to time

may offer and sell an indeterminate aggregate amount of senior or subordinated debt securities, preferred stock, depositary shares

representing preferred stock, common stock, warrants, trust preferred securities, junior subordinated debt securities, guarantees of trust

preferred securities and certain back-up obligations, purchase contracts and units. There is no limit under this shelf registration

statement to the amount or number of such securities that the Corporation may offer and sell. Under SEC rules, the Automatic Shelf

Registration Statement expires three years after filing. Accordingly, the Corporation must file a new Automatic Shelf Registration

Statement at least once every three years. The Automatic Shelf Registration Statement must be updated by May 2009 to remain

effective.

Borrowing Capacity

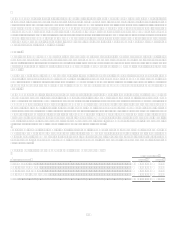

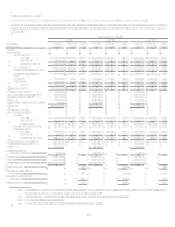

The Company has access to a variety of established funding sources. Table 13 illustrates details of the Companys Global Bank Note

Program, FHLB Advance capacity, securitization warehouses and conduits and government programs as of December 31, 2008.

Table 13: Borrowing Capacity

(Dollars or dollar equivalents in millions)

Effective/

Issue Date

Capacity (1)

Outstanding

Availability(1)

Final

Maturity(2)

Senior and Subordinated Global Bank Note Program ............. 6/05 $ 3,561 $ 1,761 $ 1,800

FHLB Advances(3) .................................................................... $ 12,733 $ 4,877 $ 7,856

Capital One Auto Loan Facility I............................................. 3/02 $ 1,050 $ $ 1,050

Capital One Auto Loan Facility II ........................................... 3/05 $ 500 $ $ 500

Committed Securitization Conduits(4)....................................... $ 12,020 $ 6,173 $ 5,847 09/11

FDIC Debt Guarantee Program................................................ $ 1,200 $ $ 1,200 06/12

Federal Reserve Discount Window.......................................... $ 4,200 $ $ 4,200

Federal Reserve Term Auction Facility ................................... $ 2,100 $ $ 2,100

(1) All funding sources are non-revolving except for the Capital One Auto Loan Facilities. Funding availability under all other

sources is subject to market conditions. Capacity is the maximum amount that can be borrowed. Availability is the amount that

can still be borrowed against the facility.

(2) Maturity date refers to the date the facility terminates, where applicable.

(3) There are no effective or final maturity dates on the available lines for FHLB Advances. The ability to draw down funding is

based on membership status, and the amount is dependent upon the Banks ability to post collateral.

(4) Securitization committed capacity was established at various dates and is scheduled to terminate between 03/09 and 09/11.