Capital One 2008 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.105

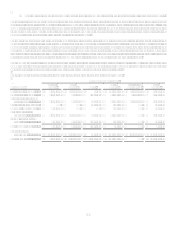

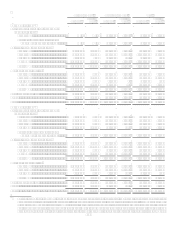

and more investments in an unrealized loss position less than 12 months. The information at December 31, 2006 has been

revised to reflect the fair value of only those investments with an unrealized loss. Further, information for the periods ended

December 31, 2006, and December 31, 2007, has been revised to reclassify securities among investment categories so that all

tables in this Note reflect consistent classification of securities among investment categories.

The Company has determined that these investments have only temporary impairment based on the analysis discussed above.

U.S. Treasury and Other U.S. Government Agency Obligations. The unrealized losses on the Companys investments in U.S.

Treasury obligations and direct obligations of U.S. government agencies were caused by interest rate increases. The contractual terms

of these investments do not permit the issuer to settle the securities at a price less than the amortized cost of the investment. Because

the Company has the ability and intent to hold these investments until a recovery of fair value, which may be maturity, the Company

did not consider these investments to be other-than-temporarily impaired at December 31, 2008, 2007, and 2006.

Collateralized Mortgage Obligations. The Companys portfolio includes investments in GSE mortgage-backed investments and

prime non-agency mortgage-backed investments. The unrealized losses on the Companys investment in collateralized mortgage

obligations were primarily caused by higher credit spreads and interest rates. As of December 31, 2008, the majority of the unrealized

losses in this category is due to prime non-agency collateral mortgage obligations, of which 61% are rated AAA. Approximately $49.8

million of the $654.1 million of collateralized mortgage obligations unrealized losses is related to GSE collateralized mortgage

obligations as of December 31, 2008.

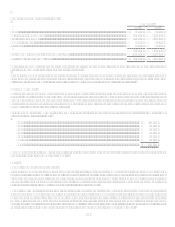

Since the Company believes there is sufficient subordination to protect the cash flows of these securities, and currently has the ability

and intent to hold these investments until a recovery of fair value, which may be maturity, the Company did not consider its

investments in collateral mortgage obligations to be other-than-temporarily impaired at December 31, 2008, 2007 and 2006.

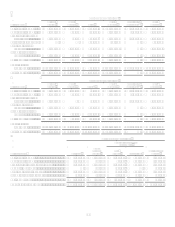

Mortgage-Backed Securities. The Companys portfolio includes investments in GSE mortgage-backed investments and prime non-

agency mortgage-backed investments. As of December 31, 2008, the unrealized losses of the Companys investment in GSE

mortgage-backed securities were primarily caused by higher credit spreads and interest rates. Approximately $36.8 million of the

$467.7 million of mortgage-backed securities unrealized losses is related to GSE mortgage-backed securities as of December 31,

2008. Since the contractual cash flows of these investments are guaranteed by a GSE of the U.S. government, it is expected that the

securities would not be settled at a price less than the amortized cost of the Companys investment.

As of December 31, 2008, the majority of unrealized losses is due to prime non-agency investments, of which 67% are rated AAA.

Since the Company believes there is sufficient subordination to protect cash flows and currently has the ability and intent to hold these

investments until a recovery of fair value, which may be maturity, the Company did not consider these investments to be other-than-

temporarily impaired at December 31, 2008, 2007, and 2006.

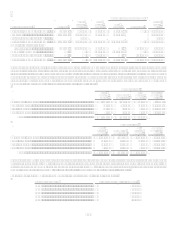

Asset-Backed Securities. This category is comprised of investments backed by credit card, auto and student consumer loans,

commercial mortgage backed loans, as well as minor investments backed by home equity lines of credit. As of December 31, 2008,

the portfolio is 96% rated AAA and is comprised of 41% credit card, 24% auto, 23% commercial mortgage backed loans, 12% student

consumer loans, and 0.3% home equity lines of credit. The unrealized losses on the Companys investments in asset-backed securities

were primarily caused by higher credit spreads and interest rates. The Company recognized $4.8 million in other-than-temporary

impairment charges in the fourth quarter of 2008 related to two home equity line of credit asset-backed securities which experienced

significant decreases in market value due to increased default rates and loss severities of the underlying collateral. Other than the two

home equity line of credit asset-backed securities, referenced above, which were impaired as of December 31, 2008, based on its view

of the sufficiency of its subordination to protect cash flows and its ability and intent to hold these investments until a recovery of fair

value, which may be maturity, the Company did not consider its asset backed investments to be other-than-temporarily impaired at

December 31, 2008, 2007, and 2006.

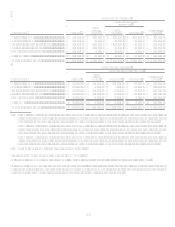

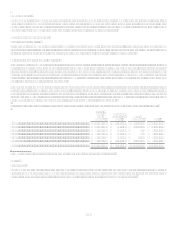

Other. This category consists primarily of municipal securities and limited investments in equity securities, primarily related to CRA

activities. The unrealized losses on the Companys investments in other items were primarily caused by higher risk premiums and/or

interest rates. The Company recognized $6.1 million in other-than-temporary impairment charges on an equity investment related to

CRA investments in the year ended December 31, 2008 due to declining stock values and market concerns on performance. For the

remaining investments, since the Company believes it has the ability and intent to hold these investments until recovery of fair value,

which may be maturity, the Company did not consider these investments to be other-than-temporarily impaired at December 31, 2008,

2007, and 2006, respectively.