Capital One 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

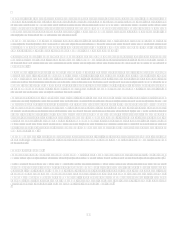

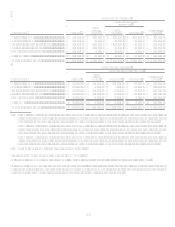

Note 4

Securities Available for Sale

Securities available-for-sale, aggregated by investment category, and based on expected maturities as of December 31, 2008, 2007,

and 2006 were as follows:

Expected Maturity Schedule(1)

1 Year

or Less

15

Years

510

Years

Over 10

Years

Market

Value

Totals

Amortized

Cost Totals

December 31, 2008

U.S. Treasury and other U.S.

government agency obligations(2)

U.S. Treasury......................................

.

$ 40,751 $ 181,925 $ $ $ 222,676 $ 201,305

Fannie Mae.........................................

.

86,584 245,427 332,011 316,749

Freddie Mac........................................

.

30,097 109,219 139,316 130,570

Other GSE and FDIC Debt

Guaranteed Program (DGP).......

.

265,733 650,593 916,326 900,499

Total U.S. Treasury and other U.S.

Government agency obligations ....

.

423,165 1,187,164 1,610,329 1,549,123

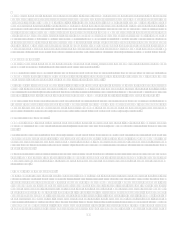

Collateralized mortgage obligations

(CMO)

Fannie Mae.........................................

.

836,826 2,830,452 78,555 3,745,833 3,711,950

Freddie Mac........................................

.

467,790 4,745,804 5,213,594 5,161,772

Other GSE ..........................................

.

63,168 153,712 216,880 211,767

Non GSE ............................................

.

167,221 1,750,758 730 7,209 1,925,918 2,530,224

Total CMO .........................................

.

1,535,005 9,480,726 79,285 7,209 11,102,225 11,615,713

Mortgage backed securities (MBS)

Fannie Mae.........................................

.

29,206 7,651,869 18,976 7,700,051 7,618,060

Freddie Mac........................................

.

80,504 4,619,503 1,295 4,701,302 4,670,441

Other GSE ..........................................

.

617 487,683 488,300 474,854

Non GSE ............................................

.

40,118 783,098 823,216 1,254,152

Total MBS..........................................

.

150,445 13,542,153 20,271 13,712,869 14,017,507

Asset backed securities ................................

.

1,508,087 2,369,443 218,527 4,096,057 4,433,428

Other ............................................................

.

162,975 128,267 44,566 145,983 481,791 495,860

Total.............................................................

.

$ 3,779,677 $ 26,707,753 $ 362,649 $ 153,192 $ 31,003,271 $ 32,111,631

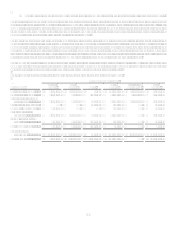

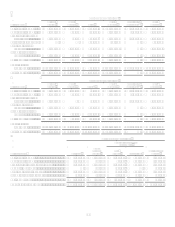

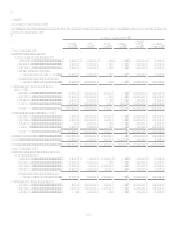

December 31, 2007(1)

U.S. Treasury and other U.S. government

agency obligations

U.S. Treasury......................................

.

$ 30,495 $ 88,300 $ 118,810 $ $ 237,605 $ 232,242

Fannie Mae.........................................

.

205,211 326,311 531,522 525,632

Freddie Mac........................................

.

149,542 84,820 102,125 336,487 334,958

Other GSE ..........................................

.

159,573 120,077 1,039 280,689 277,005

Total U.S. Treasury and other U.S.

Government agency obligations ....

.

544,821 619,508 221,974 1,386,303 1,369,837

Collateralized mortgage obligations

Fannie Mae.........................................

.

7,444 1,697,318 96,900 1,801,662 1,798,157

Freddie Mac........................................

.

25,022 3,625,163 314,032 3,964,217 3,960,157

Other GSE ..........................................

.

177,708 177,708 177,738