Capital One 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

Trust Preferred Securities

The Company has raised financing through the issuance of trust preferred securities. In these transactions, the Company forms a

statutory business trust and owns all of the voting equity shares of the trust. The trust issues preferred equity securities to third-party

investors and invests the gross proceeds in junior subordinated deferrable interest debentures issued by the Company. These trusts

have no assets, operations, revenues or cash flows other than those related to the issuance, administration, and repayment of the

preferred equity securities held by third-party investors. These trusts obligations are fully and unconditionally guaranteed by the

Company.

Because the sole asset of the trust is a receivable from the Company, the Company is not permitted to consolidated the trusts under

FIN 46R, even though the Company owns all of the voting equity shares of the trust, has fully guaranteed the trusts obligations, and

has the right to redeem the preferred securities in certain circumstances. The Company recognizes the subordinated debentures on its

balance sheet as long-term liabilities. See Item 8 Financial Statements and Supplementary DataNotes to the Consolidated Financial

StatementsNote 8 for quantitative information regarding Deposits and Other Borrowings.

IV. Reconciliation to GAAP Financial Measures

The Companys consolidated financial statements prepared in accordance with accounting principles generally accepted in the United

States (GAAP) are referred to as its reported financial statements. Loans included in securitization transactions which qualify as

sales under GAAP have been removed from the Companys reported balance sheet. However, servicing fees, finance charges, and

other fees, net of charge-offs, and interest paid to investors of securitizations are recognized as servicing and securitizations income on

the reported income statement.

The Companys managed consolidated financial statements reflect adjustments made related to effects of securitization transactions

qualifying as sales under GAAP. The Company generates earnings from its managed loan portfolio which includes both the on-

balance sheet loans and off-balance sheet loans. The Companys managed income statement takes the components of the servicing

and securitizations income generated from the securitized portfolio and distributes the revenue and expense to appropriate income

statement line items from which it originated. For this reason, the Company believes the managed consolidated financial statements

and related managed metrics to be useful to stakeholders.

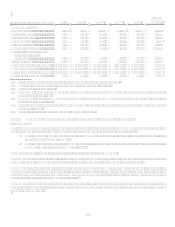

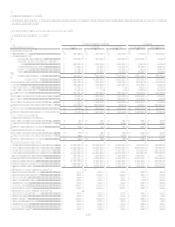

As of and for the year ended December 31, 2008

(Dollars in millions)

Total Reported

Securitization

Adjustments(1)

Total Managed(2)

Income Statement Measures(3)

Net interest income ........................................................................................................ $ 7,149 $ 4,273 $ 11,422

Non-interest income....................................................................................................... 6,744 (1,327) 5,417

Total revenue ................................................................................................................. 13,893 2,946 16,839

Provision for loan losses ................................................................................................ 5,101 2,946 8,047

Net charge-offs .............................................................................................................. $ 3,478 $ 2,946 $ 6,424

Balance Sheet Measures

Loans held for investment.............................................................................................. $ 101,018 $ 45,919 $ 146,937

Total assets..................................................................................................................... 165,913 43,962 209,875

Average loans held for investment................................................................................. 98,971 48,841 147,812

Average earning assets................................................................................................... 133,084 46,264 179,348

Average total assets ....................................................................................................... 156,268 47,262 203,530

Delinquencies................................................................................................................. $ 4,418 $ 2,178 $ 6,596

(1) Income statement adjustments for the year ended December 31, 2008 reclassify the net of finance charges of $5,563.4 million,

past due fees of $933.6 million, other interest income of $(158.1) million and interest expense of $2,065.6 million; and net

charge-offs of $2,946.8 million from non-interest income to net interest income and provision for loan losses, respectively.

(2) The managed loan portfolio does not include auto loans which have been sold in whole loan sale transactions where the

Company has retained servicing rights.

(3) Based on continuing operations.