Capital One 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 65

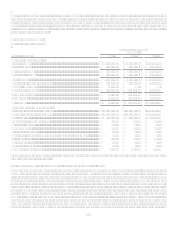

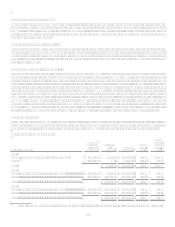

Federal Home Loan Bank Advances

The Banks are members of various Federal Home Loan Banks (FHLB). The FHLB provides additional sources of funding through

advances to the Banks. The FHLB advances are secured by the Companys securities, residential mortgage loan portfolio, multifamily

loans, commercial real estate loans and home equity lines of credit. As of December 31, 2008, the Company had approximately $20.1

billion in securities and loans pledged as collateral to the FHLB. In addition, the Companys FHLB membership is secured by the

Companys investment in FHLB stock, which totaled $267.5 million at December 31, 2008 and is included in other assets. Total

advances with FHLB agencies at December 31, 2008 were $4.9 billion. During 2008, the Company received $15.4 billion in new

advances and had $17.3 billion in advances mature.

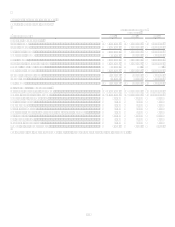

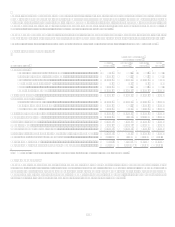

Collateralized Revolving Credit Facilities

In March 2002, the Company entered into a revolving warehouse credit facility collateralized by a security interest in certain auto loan

assets (the Capital One Auto Loan Facility I). As of December 31, 2008, the Capital One Auto Loan Facility I had the capacity to

issue up to $1.05 billion in secured notes. The Capital One Auto Loan Facility I has multiple participants each with separate renewal

dates. The facility does not have a final maturity date. Instead, each participant may elect to renew the commitment for another set

period of time. Interest on the facility is based on commercial paper rates. The Capital One Auto Loan Facility I was paid down in

January 2008.

In March 2005, the Company entered into a second revolving warehouse credit facility collateralized by a security interest in certain

auto loan assets (the Capital One Auto Loan Facility II). As of December 31, 2008, the Capital One Auto Loan Facility II had the

capacity to issue up to $0.5 billion in secured notes. The facility does not have a final maturity date. Instead, the participant may elect

to renew the commitment for another set period of time. Interest on the facility is based on commercial paper rates. The Capital One

Auto Loan Facility II was paid down in January 2008.

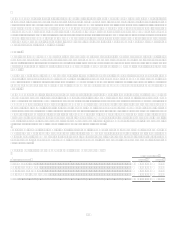

Government Programs

The Company is eligible or may be eligible to participate in a number of U.S. government programs designed to support financial

institutions and increase access to credit markets. The Company evaluates each of these programs and determines, based on the costs

and benefits of each program, whether to participate. During 2008, the Company participated in or was eligible to participate in the

U.S. Treasury Departments Capital Purchase Program (CPP), the FDICs Temporary Liquidity Guarantee Program (TLGP), the

Federal Reserves Discount Window (the Discount Window) and the Federal Reserves Term Auction Facility (TAF).

U.S. Treasury Departments Capital Purchase Program

On October 27, 2008, the Company announced its intention to take part in the CPP. On November 14, 2008 the Company entered into

an agreement (the Securities Purchase Agreement) to issue 3,555,199 Fixed Rate Cumulative Perpetual Preferred Shares, Series A,

par value $0.01 per share, liquidation preference $1,000 per share (the Series A Preferred Stock), to the U.S. Treasury as part of the

Companys participation in the CPP. The Series A Preferred Stock pays cumulative dividends at a rate of 5% per year for the first five

years and thereafter at a rate of 9% per year. In addition, the Company issued a warrant (the Warrant) to purchase 12,657,960 of the

Companys common shares to the U.S. Treasury as part of the Securities Purchase Agreement. The Company received proceeds of

$3.55 billion for the Series A Preferred Stock and the Warrant.

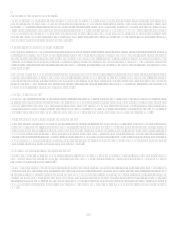

FDICs Temporary Liquidity Guarantee Program

As of December 31, 2008, the Company is a participant in the FDICs TLGP. The TLGP is comprised of the Debt Guarantee Program

(DGP) and the Transaction Account Guarantee Program (TAGP). For further information regarding the TLGP and TAGP see

Item 1 Supervision and Regulation.

The DGP provides an FDIC guarantee of certain senior unsecured debt of FDIC-insured institutions and their holding companies. The

unsecured debt must be issued on or after October 14, 2008 and not later than October 31, 2009, and the guarantee is effective through

the earlier of the maturity date or June 30, 2012. The DGP coverage limit is generally 125% of the eligible entitys eligible debt

outstanding on September 30, 2008 and scheduled to mature on or before June 30, 2009 or, for certain insured institutions, 2% of their

liabilities as of September 30, 2008. Based on the Companys outstanding senior unsecured debt as of September 30, 2008, the

Company has capacity to issue $1.2 billion under the DGP. As of December 31, 2008, the Company has not issued any debt under the

DGP.