Capital One 2008 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

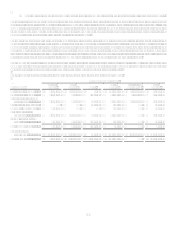

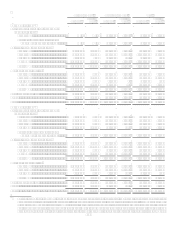

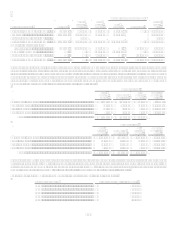

Less than 12 Months

Greater than 12 Months

Total

Fair Value

Unrealized

Losses

Fair Value

Unrealized

Losses

Fair Value

Unrealized

Losses

December 31, 2007(1)

U.S. Treasury and other U.S. government

agency obligations

Freddie Mac...............................................$ $ $ 74,509 $ 1,614 $ 74,509 $ 1,614

Total U.S. Treasury and other U.S.

government agency obligations ............ 74,509 1,614

74,509 1,614

Collateralized mortgage obligations

Fannie Mae................................................ 435,748 2,117 249,805 5,519 685,553 7,636

Freddie Mac............................................... 659,394 6,076 903,774 14,219

1,563,168 20,295

Other GSE ................................................. 12,073 80 17,246 435

29,319 515

Non GSE ................................................... 1,241,739 7,328 376,222 8,452

1,617,961 15,780

Total CMO ................................................ 2,348,954 15,601 1,547,047 28,625 3,896,001 44,226

Mortgage backed securities

Fannie Mae................................................ 286,778 575 415,219 8,709 701,997 9,284

Freddie Mac............................................... 708,329 8,253 291,447 7,784

999,776 16,037

Other GSE ................................................. 49,715 258 2,010 5

51,725 263

Non GSE ................................................... 598,677 5,955 52,761 43

651,438 5,998

Total MBS................................................. 1,643,499 15,041 761,437 16,541 2,404,936 31,582

Asset backed securities ....................................... 569,440 5,702 411,997 5,259 981,437 10,961

Other ................................................................... 59,750 1,599 182,422 6,518

242,172 8,117

Total....................................................................$ 4,621,643 $ 37,943 $ 2,977,412 $ 58,557 $ 7,599,055 $ 96,500

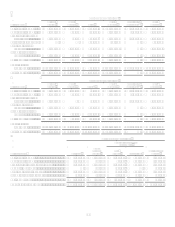

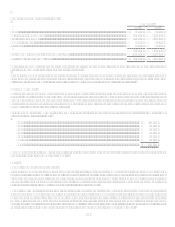

December 31, 2006(1)

U.S. Treasury and other U.S. government

agency obligations

U.S. Treasury.............................................$ 53,965 $ 298 $ 173,192 $ 4,843 $ 227,157 $ 5,141

Fannie Mae................................................ 203,878 203 594,273 7,318

798,151 7,521

Freddie Mac............................................... 189,544 566 371,783 9,126

561,327 9,692

Other GSE ................................................. 212,225 1,380 66,387 540

278,612 1,920

Total U.S. Treasury and other U.S.

government agency obligations ............ 659,612 2,447 1,205,635 21,827

1,865,247 24,274

Collateralized mortgage obligations

Fannie Mae................................................ 897,476 4,067 339,487 11,790 1,236,963 15,857

Freddie Mac............................................... 1,771,406 11,208 1,283,738 32,836

3,055,144 44,044

Other GSE ................................................. 190,424 439 25,035 2,191

215,459 2,630

Non GSE ................................................... 448,559 2,714 352,944 13,510

801,503 16,224

Total CMO ................................................ 3,307,865 18,428 2,001,204 60,327 5,309,069 78,755

Mortgage backed securities

Fannie Mae................................................ 1,099,100 5,149 636,219 18,953 1,735,319 24,102

Freddie Mac............................................... 353,428 2,019 341,669 15,441

695,097 17,460

Other GSE ................................................. 67,316 545 6,703 170

74,019 715

Total MBS................................................. 1,519,844 7,713 984,591 34,564 2,504,435 42,277

Asset backed securities ....................................... 248,271 1,499 466,765 9,871 715,036 11,370

Other ................................................................... 621,320 1,889 15,393 242

636,713 2,131

Total....................................................................$ 6,356,912 $ 31,976 $ 4,673,588 $ 126,831 $ 11,030,500 $ 158,807

(1) Certain information at December 31, 2007, and 2006 has been revised in these tables from the versions that appeared in prior

10-Ks to correct the classification of securities in an unrealized loss position and to reclassify securities among investment

categories and make certain other immaterial revisions. Fair values and gross losses for investments in an unrealized loss

position have been classified based on the period of time the investments have been in an unrealized loss position rather than

based on contractual maturity. This revision resulted in fewer investments in an unrealized loss position greater than 12 months