Capital One 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 40

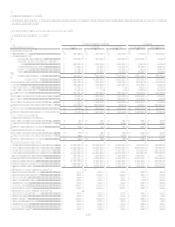

V. Management Summary and Business Outlook

Management Summary

The following discussion provides a summary of 2008 results compared to 2007 results and 2007 results compared to 2006 results on

a continuing operations basis, unless otherwise noted. Each component is discussed in further detail in subsequent sections of this

analysis. The results of the Companys mortgage origination operations of GreenPoint, which was acquired as part of the North Fork

Bancorporation acquisition in December 2006, are accounted for as discontinued operations.

Year Ended December 31, 2008 Compared to Year Ended December 31, 2007

The Company had a net loss of $46.0 million, or $(0.21) per share (diluted) for the year ended December 31, 2008, compared to net

income of $1.6 billion, or $3.97 per share (diluted) for the year ended December 31, 2007. Net loss for 2008 included an after-tax loss

from discontinued operations of $130.5 million, or $(0.35) per share (diluted), compared to an after-tax loss from discontinued

operations of $1.0 billion, or $(2.58) per share (diluted) in 2007.

Income from continuing operations for 2008 was $84.5 million, a decrease of $2.5 billion, or 96.7% from $2.6 billion in 2007. Diluted

earnings per share from continuing operations for 2008 was $0.14, a decrease of 97.9% from $6.55 in 2007.

2008 Summary of Significant Events

U.S. Economic Recession and Credit Deterioration

The U.S. economic recession has impacted the Company in multiple ways during the year. Most notably we have seen significant

deterioration in credit performance. As the recession deepened, the Company responded by fortifying its balance sheet, exiting the

riskiest areas we operated in and reducing costs as appropriate. The following demonstrates how the U.S. economic recession and

credit deterioration, and the Companys actions to anticipate and respond to economic worsening, have impacted the Company:

Increased managed charge-off rate and managed delinquency rate by 147 basis points and 62 basis points, respectively, to

4.35% and 4.49%, respectively,

Increased the allowance for loan and lease losses by $1.6 billion to $4.5 billion, increasing the coverage ratio of allowance

as a percentage of loans held for investment by 157 basis points to 4.48%,

Increased our provision for loan and lease losses by $2.5 billion to $5.1 billion,

Reduced the fair value of the interest-only strips by $224.8 million,

Revenue suppression, which is the amounts billed to customers but not recognized as revenue, increased to $1.9 billion

from $1.1 billion,

Experienced a $4.4 billion reduction in managed loans held for investment, due to weaker spending and loan demand from

credit-worthy customers, tightening underwriting, an exit from lending activities not resilient to the economic downturn

and an increase in charge-offs,

Deposit growth was primarily invested in high-quality agency mortgage backed securities and AAA-rated securities

backed by consumer loans. Increasing our securities available for sale by $11.2 billion to $31.0 billion.

U.S. Treasury Departments Capital Purchase Program Participation

On November 14, 2008 the Company entered into an agreement (the Securities Purchase Agreement) to issue 3,555,199 Fixed Rate

Cumulative Perpetual Preferred Shares, Series A, par value $0.01 per share (the Series A Preferred Stock), to the United States

Department of the Treasury (U.S. Treasury) as part of the Companys participation in the U.S. Treasurys Troubled Asset Relief

Program Capital Purchase Program (CPP), having a liquidation amount per share equal to $1,000. The Series A Preferred Stock

pays cumulative dividends at a rate of 5% per year for the first five years and thereafter at a rate of 9% per year. The Company may

not redeem the Series A Preferred Stock during the first three years except with the proceeds from a qualified equity offering. The

ARRA includes provisions that would allow the Company to redeem the Series A Preferred Stock using proceeds other than those

received from a qualified equity offering under certain circumstances and with regulatory approval. After three years, the Company

may, at its option, redeem the Series A Preferred Stock at the liquidation amount plus accrued and unpaid dividends. The Series A

Preferred Stock is generally non-voting.