Capital One 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 42

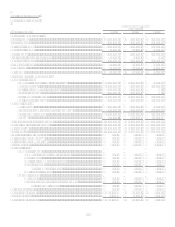

Sale of MasterCard Shares

During the second quarter of 2008, the Company recognized a gain of $44.9 million in other non-interest income from the sale of

154,991 shares of MasterCard class B common stock.

Visa IPO

During the first quarter of 2008, Visa completed an initial public offering (IPO) of its stock. With IPO proceeds Visa established an

escrow account for the benefit of member banks to fund certain litigation settlements and claims. As a result, in the first quarter of

2008, the Company reduced its Visa-related indemnification liabilities of $90.9 million recorded in other liabilities with a

corresponding reduction of other non-interest expense. In addition, the Company recognized a gain of $109.0 million in non-interest

income for the redemption of 2.5 million shares related to the Visa IPO. Both items were included in the Other segment.

Debt Refinancing

During the first quarter of 2008, the Company repurchased approximately $1.0 billion of certain senior unsecured debt, recognizing a

gain of $52.0 million in non-interest income. The Company initiated the repurchases to take advantage of the current market

environment and replaced the repurchased debt with lower-rate unsecured funding.

Chevy Chase Bank Acquisition

On December 4, 2008, the Company announced its intention to acquire Chevy Chase Bank F.S.B., the largest retail depository

institution in the Washington, D.C. region in a cash and stock transaction valued at approximately $520 million. On February 13,

2009, the Company received approval from the Federal Reserve to acquire all of the shares of Chevy Chase Bank F.S.B. and certain of

its subsidiaries. The Company expects the transaction to close in the first quarter of 2009.

The Company expects the acquisition to be accretive to operating earnings per share in 2009 and accretive to GAAP earnings per

share in 2010. The Company expects to incur approximately $225 million of merger and integration costs and achieve a reduction in

non-interest costs of $125 million as a result of the acquisition. The Company anticipates taking a fair value mark of approximately

$1.75 billion for expected losses on the Chevy Chase Bank loan portfolio.

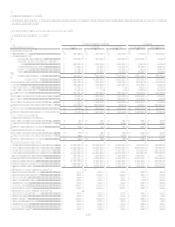

Year Ended December 31, 2007 Compared to Year Ended December 31, 2006

Net income was $1.6 billion, or $3.97 per share (diluted) for 2007, compared to $2.4 billion, or $7.62 per share (diluted) for 2006. Net

income for 2007 included an after-tax loss from discontinued operations of $1.0 billion, or $2.58 per share (diluted), compared to an

after-tax loss from discontinued operations of $11.9 million, or $0.03 per share (diluted) in 2006.

Income from continuing operations for 2007 was $2.6 billion, an increase of $165.3 million, or 7% from 2006. Diluted earnings per

share from continuing operations for 2007 was $6.55, a decrease of 14% from $7.65 in 2006.

Results from continuing operations for 2007 include:

The impact of a full year of results of operations from the North Fork Bank acquisition which was completed on

December 1, 2006 and the dilutive impact on earnings per share of the 103.8 million incremental shares issued in

December 2006 related to the acquisition.

Net interest income and non-interest income growth driven mainly by selective pricing and fee changes in the U.S. Card

portfolio.

Provision for loan and lease losses increase due to the continued normalization of consumer credit following the unusually

favorable credit environment in 2006, adverse delinquency and charge-off trends in our National Lending businesses and

the increase in our coverage ratio in allowance to loans held for investment as a result of economic weakening in the latter

part of 2007, as evidenced by increased delinquencies and consistent with recently released economic indicators.

Restructuring charges of $138.2 million resulting from the Companys broad-based initiative announced during the

second quarter of 2007 to reduce expenses and improve its competitive cost position.

Legal liabilities and reserves of $138.9 million in connection with the Visa antitrust lawsuit settlement with American

Express and estimated possible damages in connection with other pending Visa litigation.

The impact of the Companys $3.0 billion share repurchase program completed in 2007.

Moderate loan (held for investment) growth primarily attributable to the acquisition of North Fork in December 2006,

offset somewhat by a portfolio sale related to a co-branded credit card partnership during first quarter 2007 and our

significant pull back from prime revolver marketing in the U.S. Card sub-segment.