Capital One 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

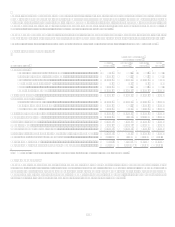

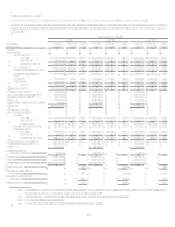

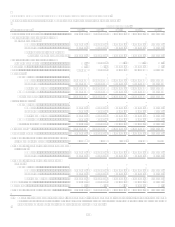

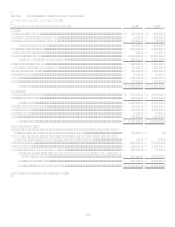

TABLE BINTEREST VARIANCE ANALYSIS

Year Ended December 31

2008 vs. 2007

2007 vs. 2006

Change due to(1)

Change due to(1)

(Dollars in

thousands)

Increase

(Decrease)

Volume

Yield/

Rate

Increase

(Decrease)

Volume

Yield/

Rate

Interest Income(3):

Consumer loans

Domestic.....................................................

.

$ (70,286) $ 139,786 $ (210,072) $ 614,854 $ 1,090,917 $ (476,063)

International................................................

.

8,323 (3,721) 12,044 3,242 (43,978) 47,220

Total ...........................................................

.

(61,963) 137,170 (199,133) 618,096 1,046,777 (428,681)

Commercial loans ..................................................

.

22,213 294,129 (271,916) 1,835,559 1,459,954 375,605

Total loans held for investment..............................

.

(39,750) 535,272 (575,022) 2,453,655 3,085,095 (631,440)

Securities available for sale ...................................

.

273,040 299,213 (26,173) 274,260 209,136 65,124

Other

Domestic.....................................................

.

(166,918) 17,014 (183,932) 181,807 230,549 (48,742)

International................................................

.

(32,529) (4,826) (27,703) 3,699 2,122 1,577

Total ...........................................................

.

(199,447) 8,671 (208,118) 185,506 221,064 (35,558)

Total interest income .............................................

.

33,843 1,016,186 (982,343) 2,913,421 3,432,439 (519,018)

Interest Expense(3):

Deposits

Domestic(2)..................................................

.

(359,130) 283,278 (642,408) 1,080,676 1,097,466 (16,790)

International................................................

.

(35,181) 45,344 (80,525) 10,878 (580) 11,458

Total(2) ........................................................

.

(394,311) 325,357 (719,668) 1,091,554 1,110,187 (18,633)

Senior notes ...........................................................

.

(132,274) (52,937) (79,337) 165,485 177,401 (11,916)

Other borrowings

Domestic(2)..................................................

.

(56,645) 114,038 (170,683) 213,879 141,852 72,027

International................................................

.

(1,797) (3,959) 2,162 4,104 (241) 4,345

Total(2) ........................................................

.

(58,442) 96,840 (155,282) 217,983 133,633 84,350

Total interest expense ............................................

.

(585,027) 407,879 (992,906) 1,475,022 1,481,092 (6,070)

Net interest income ................................................

.

$ 618,870 $ 626,509 $ (7,639) $ 1,438,399 $ 2,058,620 $ (620,221)

(1) The change in interest due to both volume and rates has been allocated in proportion to the relationship of the absolute

dollar amounts of the change in each. The changes in income and expense are calculated independently for each line in the

table. The totals for the volume and yield/rate columns are not the sum of the individual lines.

(2) Prior period amounts have been reclassified to conform with current period presentation.

(3) Based on continuing operations.