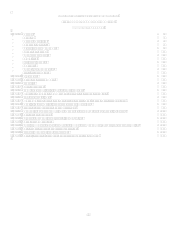

Capital One 2008 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Rewards are not just for credit cards anymore. At Capital One, we believe that customers should be

rewarded for their banking transactions. So in 2008, we launched the Capital One Rewards Checking

account, a breakthrough product that enables customers to earn rewards quickly and easily for

everyday banking activities, like shopping at the mall, debit card purchases, cash withdrawals,

and paying bills online.

The landscape of consumer practices in the credit card industry changed in 2008 when the Federal

Reserve released sweeping new rules to be implemented by mid-2010. Among other things, the

new rules will ban highly criticized practices such as double-cycle billing and “universal default”

(where issuers increase interest rates because of customer behavior on other loans or changes to

credit bureau scores). The new rules also will change significantly how and when customers’

interest rates can be changed.

While adapting to the new rules will have a substantial cost across the industry, Capital One is

well positioned to compete and win on a more level playing field. We never engaged in many of

the banned practices in the first place, including double-cycle billing and universal default. And

years ago we voluntarily introduced the most customer-friendly repricing policy in the industry. We

already are well down the path of compliance, having made a number of these changes well before

the industry was under a spotlight and before the new rules were even contemplated. We believe

that our practices will continue to drive long-term customer loyalty.

Our Great People Deliver At Work And In Their Communities

The greatest franchise we have at Capital One is not our credit card franchise or our banking franchise.

It is our people.

Greatness often is on display during periods of adversity. Our great people at Capital One are facing

perhaps the most challenging industry and economic environment in their lifetimes. They are not

deterred. They continue to give it their all as they mitigate losses, re-position our businesses, and

build for future growth.

Our associates challenge everything we do to make sure that we are positioning the company to win

during these tough times. And they are harnessing the energy of this financial crisis by leveraging

the learnings to drive changes across our company that will pay off for years to come.

My most important job as CEO has been to attract great people and then to create an environment

where they can be great. We have assembled two decades of hand-picked, incredibly talented

people at Capital One. Collectively, they are laser-focused on leading our company through these

challenging times.

Our executive team and our board of directors continued to provide strong leadership. Their advice

and guidance were instrumental with respect to many important decisions, such as our equity capital

raise and the acquisition of Chevy Chase Bank.

11