Capital One 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

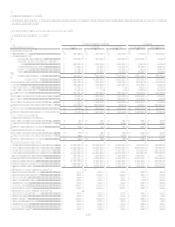

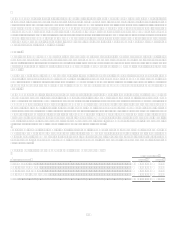

Local Banking Segment

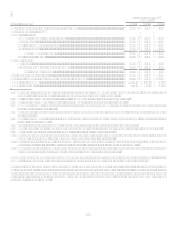

Table 2: Local Banking

As of and for the Year ended

December 31

(Dollars in thousands) 2008

2007

2006

Earnings (Managed Basis)

Interest income.....................................................................................................

.

$ 6,096,293 $ 6,937,321 $ 2,792,024

Interest expense....................................................................................................

.

3,673,482 4,601,269 1,785,044

Net interest income ..............................................................................................

.

2,422,811 2,336,052 1,006,980

Non-interest income.............................................................................................

.

813,742 939,638 595,096

Total revenue .......................................................................................................

.

3,236,553 3,275,690 1,602,076

Provision for loan and lease losses ......................................................................

.

447,643 32,178 602

Non-interest expense............................................................................................

.

2,443,369 2,333,955 1,269,868

Income before taxes .............................................................................................

.

345,541 909,557 331,606

Income taxes ........................................................................................................

.

120,939 316,464 116,062

Net income...........................................................................................................

.

$ 224,602 $ 593,093 $ 215,544

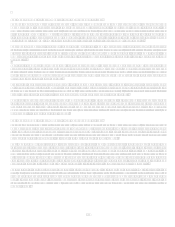

Selected Metrics (Managed Basis)

Commercial lending

Commercial and multi-family real estate (4) ................................................

.

13,382,909 12,414,263 891,140

Middle market (5) .........................................................................................

.

10,081,823 8,288,476 3,524,564

Small ticket commercial real estate (6).........................................................

.

2,609,123 2,948,402

Specialty lending (7).....................................................................................

.

3,547,287 3,396,100

Total commercial lending...........................................................................

.

29,621,142 27,047,241 4,415,704

Small business lending (8) ............................................................................

.

4,747,783 4,612,500 3,640,787

Consumer lending

Mortgages (9) ...............................................................................................

.

7,187,805 8,513,216 444,108

Branch based home equity & other consumer (10)........................................

.

3,773,397 4,095,228 3,816,185

Total consumer lending..............................................................................

.

10,961,202 12,608,444 4,260,293

Other (11) ......................................................................................................

.

(247,146 ) (295,390) (171,251)

Period end loans held for investment...................................................................

.

$ 45,082,981 $ 43,972,795 $ 12,145,533

Average loans held for investment.......................................................................

.

$ 44,318,212 $ 42,272,403 $ 13,225,559

Core deposits (1).....................................................................................................

.

$ 67,546,102 $ 62,977,637 $ 27,071,324

Total deposits.......................................................................................................

.

$ 78,938,391 $ 73,089,284 $ 35,187,965

Loans held for investment yield...........................................................................

.

6.42 % 7.04 % 7.75 %

Net interest marginloans (2) ...............................................................................

.

2.00 % 1.86 % 3.24 %

Net interest margindeposits (3) ...........................................................................

.

2.07 % 2.03 % 1.56 %

Efficiency ratio ....................................................................................................

.

75.49 % 71.25 % 79.26 %

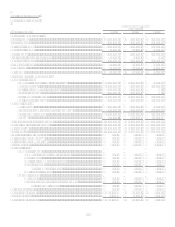

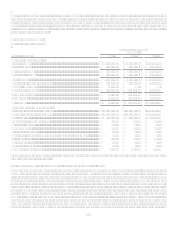

Charge-off rates

Commercial lending ...................................................................................

.

Commercial and multi-family real estate..........................................

.

0.36 % 0.02 % 0.00 %

Middle market...................................................................................

.

0.21 % 0.04 % 0.14 %

Small ticket commercial real estate ..................................................

.

0.31 % 0.18 % 0.00 %

Specialty lending...............................................................................

.

0.24 % 0.11 % 0.00 %

Total commercial lending........................................................

.

0.29 % 0.05 % 0.11 %

Small business lending......................................................................

.

1.04 % 0.47 % 0.44 %

Consumer lending ......................................................................................

.

Mortgages .........................................................................................

.

0.35 % 0.11 % 0.07 %

Branch based home equity & other consumer ..................................

.

1.14 % 0.75 % 0.53 %

Total consumer lending...........................................................

.

0.62 % 0.31 % 0.37 %

Net charge-off rate ...............................................................................................

.

0.50 % 0.21 % 0.43 %

Non performing loans ..........................................................................................

.

$ 565,791 $ 178,385 $ 57,824

Foreclosed assets..................................................................................................

.

63,970 14,058 11,838

Non performing assets .........................................................................................

.

$ 629,761 $ 192,443 $ 69,662