Capital One 2008 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

FHLB Advances

The Company utilizes FHLB advances which are secured by the Companys investment in FHLB stock and by a blanket floating lien

on portions of the Companys residential mortgage loan portfolio. FHLB advances outstanding were $4.9 billion and $6.8 billion at

December 31, 2008 and 2007, respectively and include fixed and variable rate advances. FHLB stock totaled $267.5 million and

$424.6 million at December 31, 2008 and 2007, respectively and is included in Other assets.

Other Short-Term Borrowings

Revolving Credit Facility

In June 2004, the Company terminated its Domestic Revolving and Multicurrency Credit Facilities and replaced them with a new

revolving credit facility (Credit Facility) providing for an aggregate of $750.0 million in unsecured borrowings from various lending

institutions to be used for general corporate purposes. On April 30, 2007, the Credit Facility was terminated.

Collateralized Revolving Credit Facilities

In March 2002, the Company entered into a revolving warehouse credit facility collateralized by a security interest in certain auto loan

assets (the Capital One Auto Loan Facility I). As of December 31, 2008, the Capital One Auto Loan Facility I had the capacity to

issue up to $1.05 billion in secured notes. The Capital One Auto Loan Facility I has multiple participants each with separate renewal

dates. The facility does not have a final maturity date. Instead, each participant may elect to renew the commitment for another set

period of time. Interest on the facility is based on commercial paper rates. The outstanding borrowings of the Capital One Auto Loan

Facility I was paid down in full in January 2008.

In March 2005, the Company entered into a second revolving warehouse credit facility collateralized by a security interest in certain

auto loan assets (the Capital One Auto Loan Facility II). As of December 31, 2008, the Capital One Auto Loan Facility II had the

capacity to issue up to $0.5 billion in secured notes. The facility does not have a final maturity date. Instead, the participant may elect

to renew the commitment for another set period of time. Interest on the facility is based on commercial paper rates. The outstanding

borrowings of the Capital One Auto Loan Facility II was paid down in full in January 2008.

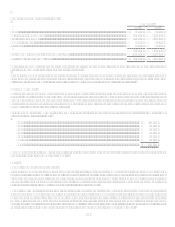

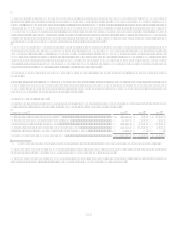

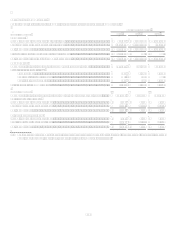

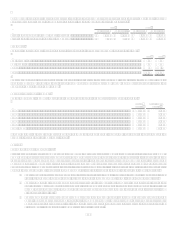

Interest-bearing time deposits, senior and subordinated notes and other borrowings as of December 31, 2008, mature as follows:

Interest-

Bearing

Time

Deposits(1)

Senior and

Subordinated

Notes

Other

Borrowings

Total

2009 .................................................................................................... $ 16,285,419 $ 1,447,245 $ 4,995,418 $ 22,728,082

2010 .................................................................................................... 14,495,385 687,80

0

8,064,202 23,247,387

2011 .................................................................................................... 5,014,780 938,711 467 5,953,958

2012 .................................................................................................... 1,895,750 663,448 292 2,559,490

2013 .................................................................................................... 6,819,147 820,18

7

8,616 7,647,950

Thereafter............................................................................................ 2,615,201 3,751,45

2

1,800,653 8,167,306

Total.................................................................................................... $ 47,125,682 $ 8,308,843 $ 14,869,648 $ 70,304,173

(1) Includes only those interest bearing deposits which have a contractual maturity date.

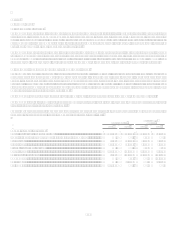

Note 9

Stock Plans

The Company has two active stock-based compensation plans, one employee plan and one non-employee director plan. Under the

plans, the Company reserves common shares for issuance in various forms including incentive stock options, nonstatutory stock

options, stock appreciation rights, restricted stock awards, restricted stock units, and performance share units.