Capital One 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 31

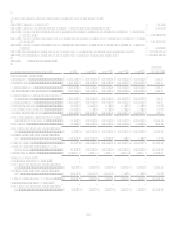

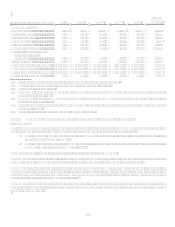

Effective January 1, 2008, the Company adopted Statement of Financial Accounting Standards (SFAS) No. 157, Fair Value

Measurements (SFAS 157) for all financial assets and liabilities and for nonfinancial assets and liabilities measured at fair value on

a recurring basis. SFAS 157 defines fair value as the exchange price that would be received for an asset or paid to transfer a liability

(an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market

participants on the measurement date. SFAS 157 also establishes a fair value hierarchy which prioritizes the valuation inputs into three

broad levels. Based on the underlying inputs, each fair value measurement in its entirety is reported in one of the three levels. These

levels are:

Level 1 Valuation is based upon quoted prices for identical instruments traded in active markets. Level 1 assets and

liabilities include debt and equity securities traded in an active exchange market, as well as U.S. Treasury securities.

Level 2 Valuation is based upon quoted prices for similar instruments in active markets, quoted prices for identical or

similar instruments in markets that are not active, and model based valuation techniques for which all significant

assumptions are observable in the market or can be corroborated by observable market data for substantially the full term

of the assets or liabilities.

Level 3 Valuation is determined using model-based techniques with significant assumptions not observable in the

market. These unobservable assumptions reflect the Companys own estimates of assumptions that market participants

would use in pricing the asset or liability. Valuation techniques include the use of third party pricing services, option

pricing models, discounted cash flow models and similar techniques.

SFAS 157 requires that valuation techniques maximize the use of observable inputs and minimize the use of unobservable inputs.

When available, we use quoted market prices to measure fair value. If market prices are not available, fair value measurement is based

upon models that use primarily market-based or independently-sourced market parameters, including interest rate yield curves,

prepayment speeds, option volatilities and currency rates. When market observable inputs for model-based valuation techniques may

not be readily available, we are required to make judgments about assumptions market participants would use in estimating the fair

value of the financial instrument.

The extent of management judgment involved in measuring the fair value of financial instruments is dependent upon the availability

of quoted prices or observable market data. For financial instruments that have quoted prices in active markets or whose fair value is

measured using data observable in the market, there is minimal management judgment involved in measuring fair value. When quoted

prices or observable market data is not fully available, management judgment is necessary to estimate fair value. In addition, changes

in market conditions may reduce the availability of quoted prices or observable market data. For example, an increase in dislocation

and corresponding decrease in new issuance and trading volumes could result in observable market data becoming unavailable. When

market data is not available, we use valuation techniques with assumptions that management believes other market participants would

also use to estimate fair value.

Effective January 1, 2008, the Company adopted SFAS No. 159, The Fair Value Option for Financial Assets and Liabilities (SFAS

159). SFAS 159 permits entities to choose to measure many financial instruments and certain other items at fair value with changes

in fair value included in current earnings. The election is made on specified election dates, can be made on an instrument by

instrument basis, and is irrevocable. The initial adoption of SFAS 159 did not have a material impact on the consolidated earnings and

financial position of the Company.

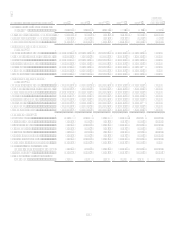

Determination of Allowance for Loan and Lease Losses

The allowance for loan and lease losses is maintained at the amount estimated to be sufficient to absorb probable principal losses, net

of principal recoveries (including recovery of collateral), inherent in the existing reported loan portfolios. The provision for loan and

lease losses is the periodic cost of maintaining an adequate allowance. The amount of allowance necessary is based on distinct

allowance methodologies depending on the type of loans which include specifically identified criticized loans, migration analysis,

forward loss curves and historical loss trends. In evaluating the sufficiency of the allowance for loan and lease losses, management

takes into consideration many factors including, but not limited to: recent trends in delinquencies and charge-offs including bankrupt,

deceased and recovered amounts; forecasting uncertainties and size of credit risks; the degree of risk inherent in the composition of the

loan portfolio; economic conditions; legal and regulatory guidance; credit evaluations and underwriting policies; seasonality; and the

value of collateral supporting the loans. To the extent credit experience is not indicative of future performance or other assumptions

used by management do not prevail, loss experience could differ significantly, resulting in either higher or lower future provision for

loan losses, as applicable. The evaluation process for determining the adequacy of the allowance for loan and lease losses and the

periodic provisioning for estimated losses is undertaken on a quarterly basis, but may increase in frequency should conditions arise

that would require the Companys prompt attention. Conditions giving rise to such action are business combinations or other

acquisitions or dispositions of large quantities of loans, dispositions of non-performing and marginally performing loans by bulk sale

or any development which may indicate a significant trend.