Capital One 2008 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

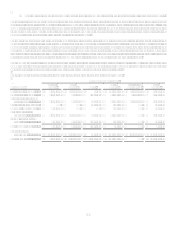

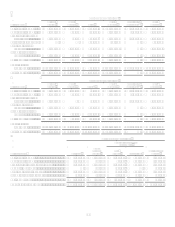

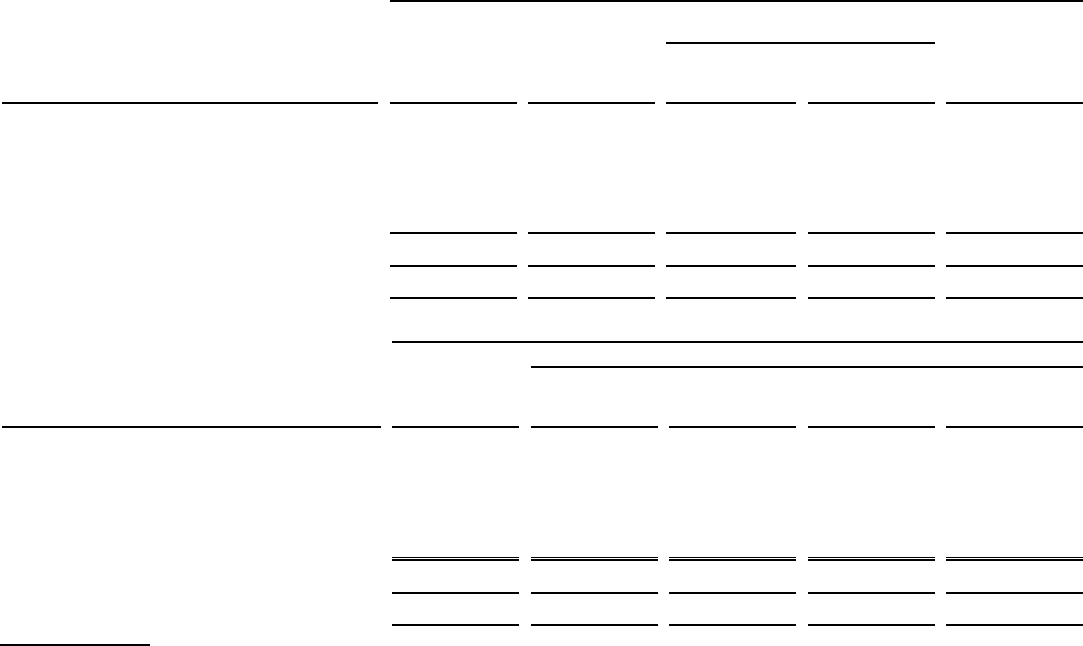

Year Ended December 31, 2007

Other National Lending

sub-segments

National Lending

U.S. Card

Other

National

Lending

Auto

Finance

International

Total National

Lending

Net interest income ........................................... $ 6,271,919 $ 2,569,317 $ 1,510,869 $ 1,058,448 $ 8,841,236

Non-interest income.......................................... 4,136,158 734,569 112,261

622,308 4,870,727

Provision for loan and lease losses ................... 3,033,217 1,658,470 1,056,120

602,350 4,691,687

Other non-interest expenses.............................. 3,934,574 1,485,630 618,568

867,062 5,420,204

Income tax provision (benefit).......................... 1,183,458 53,705 (17,736) 71,441 1,237,163

Net income (loss).............................................. $ 2,256,828 $ 106,081 $ (33,822) $ 139,903 $ 2,362,909

Loans held for investment................................. $ 69,723,169 $ 36,785,274 $ 25,128,352 $ 11,656,922 $ 106,508,443

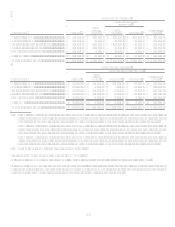

Year Ended December 31, 2006

Other National Lending sub-segments

National Lending

U.S. Card

Other

National

Lending

Auto Finance

International

Total National

Lending

Net interest income ...........................................

.

$ 5,539,500 $ 2,356,634 $ 1,372,517 $ 984,117 $ 7,896,134

Non-interest income..........................................

.

3,700,765 674,361 81,384 592,977 4,375,126

Provision for loan and lease losses ...................

.

2,016,476 1,191,170 494,835 696,335 3,207,646

Other non-interest expense ...............................

.

4,100,966 1,428,138 599,807 828,331 5,529,104

Income tax provision.........................................

.

1,093,289 147,319 125,740 21,579 1,240,608

Net income........................................................

.

$ 2,029,534 $ 264,368 $ 233,519 $ 30,849 $ 2,293,902

Loans held for investment.................................

.

$ 68,856,534 $ 33,502,646 $ 21,751,827 $ 11,750,819 $ 102,359,180

(1) Income statement adjustments for the year ended December 31, 2008 reclassify the net of finance charges of $5,563.4 million,

past due fees of $933.6 million, other interest income of $(158.1) million and interest expense of $2,065.6 million; and net

charge-offs of $2,946.8 million to non-interest income from net interest income and provision for loan losses, respectively.

Income statement adjustments for the year ended December 31, 2007 reclassify the net of finance charges of $6,334.8 million,

past due fees of $1,004.1 million, other interest income of $(167.3) million and interest expense of $2,681.7 million; and net

charge-offs of $2,201.5 million to non-interest income from net interest income and provision for loan losses, respectively.

Income statement adjustments for the year ended December 31, 2006 reclassify the net of finance charges of $5,485.0 million,

past due fees of $938.6 million, other interest income of $(239.7) million and interest expense of $2,342.7 million; and net

charge-offs of $1,747.5 million to non-interest income from net interest income and provision for loan losses, respectively.

(2) For 2006, Other segment includes North Fork Bank results.

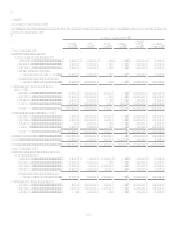

Significant Segment Adjustments That Affect Comparability

During 2008, the Company recognized a goodwill impairment charge of $810.9 million in the Auto Finance sub-segment.

During 2008, the Company repurchased approximately $1.0 billion of certain senior unsecured debt, recognizing a gain of $52.0

million in non-interest income and reported in the Other segment. The Company initiated the repurchases to take advantage of the

current market environment and replaced the repurchased debt with lower-rate unsecured funding.