Capital One 2008 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

135

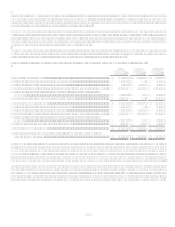

In June 2006, the FASB issued FIN 48. FIN 48 clarifies the accounting for uncertainty in income taxes recognized in accordance with

SFAS 109, and prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement

of a tax position taken or expected to be taken in a tax return. FIN 48 also provides guidance on derecognition, classification, interest

and penalties, accounting in interim periods, disclosure, and transition.

The Company adopted the provisions of FIN 48 effective January 1, 2007. As a result of adoption, the Company recorded a $29.7

million reduction in retained earnings. The reduction in retained earnings upon adoption is the net impact of a $46.5 million increase

in the liability for unrecognized tax benefits and a $16.8 million increase in deferred tax assets. In addition, the Company reclassified

$471.1 million of unrecognized tax benefits from deferred tax liabilities to current taxes payable to conform to the deferred tax

measurement and balance sheet presentation requirements of FIN 48.

The Company recognizes accrued interest and penalties related to unrecognized tax benefits as a component of income tax expense.

During 2008 and 2007, $30.5 million and 34.3 million, respectively, of net interest was included in income tax expense. The accrued

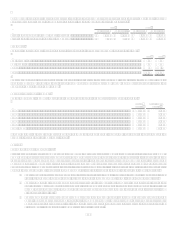

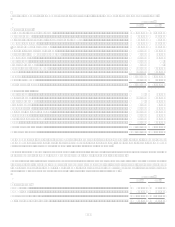

balance of interest and penalties related to unrecognized tax benefits is presented in the table below.

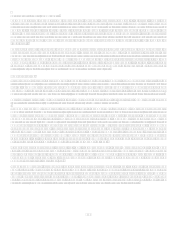

A reconciliation of the change in unrecognized tax benefits from January 1, 2007 to December 31, 2008 is as follows:

Gross

Unrecognized

Tax Benefits

Accrued

Interest and

Penalties

Gross Tax,

Interest and

Penalties

Balance at January 1, 2007 ............................................................................................

.

$ 663,779 $ 119,232 $ 783,011

Additions for tax positions related to the current year ...................................................

.

29,349 29,349

Additions for tax positions related to prior years...........................................................

.

4,054 60,484 64,538

Reductions for tax positions related to prior years due to IRS and other settlements....

.

(158,649) (39,891) (198,540)

Additions for tax positions related to acquired entities in prior years, offset to

goodwill ....................................................................................................................

.

12,049 412 12,461

Reductions resulting from lapsing statutes of limitation................................................

.

(10,080) (10,080)

Balance at December 31, 2007 ......................................................................................

.

$ 540,502 $ 140,237 $ 680,739

Additions for tax positions related to the current year ...................................................

.

21,185 21,185

Additions for tax positions related to prior years...........................................................

.

49,255 46,985 96,240

Reductions for tax positions related to prior years due to IRS and other settlements....

.

(53,879) (11,727) (65,606)

Additions for tax positions related to acquired entities in prior years, offset to

goodwill ....................................................................................................................

.

13,563 498 14,061

Other reductions for tax positions related to prior year..................................................

.

(9,546) (174) (9,720)

Balance at December 31, 2008 ......................................................................................

.

$ 561,080 $ 175,819 $ 736,899

Portion of balance at December 31, 2008 that, if recognized, would impact the

effective income tax rate ...........................................................................................

.

$ 143,180 $ 114,282 $ 257,462

The Company is subject to examination by the IRS and other tax authorities in certain countries and states in which the Company has

significant business operations. The tax years subject to examination vary by jurisdiction. The IRS is currently examining the

Companys federal income tax returns for the years 2005 and 2006. During 2007, the IRS concluded its examination of the

Companys federal income tax returns for the years 2003 and 2004, and its examinations of the final separate federal income tax

returns for certain acquired subsidiaries. During 2008 and 2007, the Company made cash payments to the IRS related to these

concluded examinations which resulted in a reduction of approximately $190.2 million to the balance of net unrecognized tax benefits.

Tax issues for years 1995-1999 are pending in the U.S. Tax Court and the conclusion of those matters could impact tax years after

1999. At issue are proposed adjustments by the IRS with respect to the timing of recognition of items of income and expense derived

from the Companys credit card business in various tax years. It is reasonably possible that a settlement related to these timing issues,

as well as a settlement of the audits of certain acquired subsidiaries, may be made within twelve months of the reporting date. At this

time, an estimate of the potential change to the amount of unrecognized tax benefits resulting from such a settlement cannot be made.