Capital One 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 68

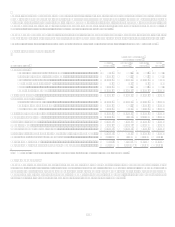

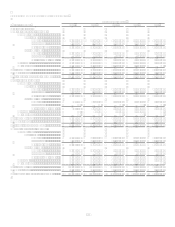

Covenants

In connection with the issuance of certain of its trust preferred capital securities, the Company has entered into a Replacement Capital

Covenant (RCC) granting certain rights to the holders of covered debt, as defined in the RCC, that prohibit the repayment,

redemption or purchase of the trust preferred capital securities except, with limited exceptions, to the extent that the Company has

received specified amounts of proceeds from the sale of certain qualifying securities. Currently, the Companys covered debt is its

5.35% Subordinated Notes due May1, 2014. For more information regarding this covenant, reference is made to the RCC entered into

by the Corporation in connection with the issuances of such trust preferred capital securities, which are filed with the U.S. Securities

and Exchange Commission under cover of Forms 8-K. The Company will provide a copy of the RCC to holders of the covered debt

upon request made to Investor Relations.

The terms of the lease and credit facility agreements related to certain other borrowings and operating leases in Table 12 require

several financial covenants (including performance measures and equity ratios) to be met. If these covenants are not met, there may be

an acceleration of the payment due dates noted above. As of December 31, 2008, the Company was not in default of any such

covenants.

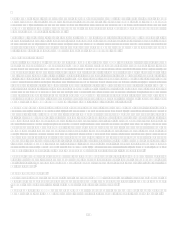

Equity

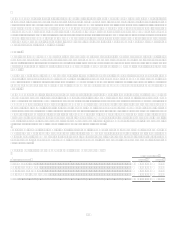

The Company may also access the equity markets from time to time to raise additional liquidity. During 2008 the Company issued

approximately 15.5 million common shares in a secondary offering, raising $760.8 million in 2008.

The Company, as noted above, issued 3,555,199 preferred shares to the U.S. Treasury under the CPP, raising $3.55 billion in 2008.

IX. Market Risk Management

Interest Rate Risk

The management of interest rate risk, or the risk that earnings will be diminished by changes in interest rates, is fundamental for

banking institutions. Like other banks, the Company borrows money from other institutions and depositors, which it uses to make

loans to customers and to invest in debt securities and other earning assets. The Company earns interest on these loans and assets and

pays interest on the money it borrows from institutions and depositors. If the rate of interest it pays on its borrowings and deposits

increases more than the rate of interest it earns on its assets, the Companys net interest income, and therefore its earnings, will be

diminished. The Companys earnings could also be negatively impacted if the interest rates it charges on its earning assets fall more

quickly than the rates it pays on its borrowings and deposits. Changes in interest rates and competitor responses to those changes may

affect the rate of customer payments or pre-payments for mortgages and auto and installment loans and commercial loans and may

affect the balances customers carry on their credit cards. These changes can reduce the overall yield on its earning asset portfolio.

Changes in interest rates and competitor responses to these changes may also impact customer decisions to maintain balances in the

deposit accounts they have with the Company. These changes may require the Company to replace withdrawn balances with higher

cost alternative sources of funding.

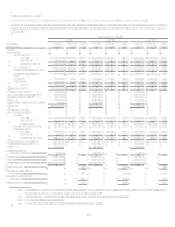

In addition to the impact to current earnings, interest rate risk also refers to changes in the net present value of assets and off-balance

sheet positions less liabilities (termed economic value of equity) due to interest rate changes. Economic value of equity could be

affected to the extent that the market value of the Companys assets, liabilities and off-balance sheet positions do not respond equally

to changes in interest rates.

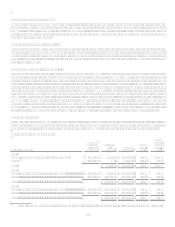

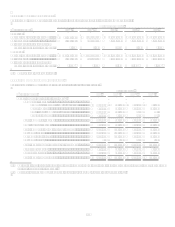

The Companys measurement of interest rate risk considers both earnings and market value exposures. The consolidated balance sheet

and all off-balance sheet positions are included in the analysis. The analysis reflects known balances and contractual maturities when

available. Balance sheet positions lacking contractual maturities and those with a likelihood of maturity prior to their contractual term

are assumed to mature consistent with business line expectations or, when available in the case of marketable securities, market

expectations. As of December 31, 2008, the Companys Asset/Liability Management Policy limited the change in projected 12-month

earnings due to a gradual +/-200 basis points change in interest rates over the course of nine months to less than 5% of base net

interest income. The measurement of impact to current earnings includes the change in net interest income and the change in the

valuation of mortgage servicing rights driven by the change in interest rates. Given the absolute low level of interest rates that

prevailed as of December 31, 2008 and the inability for market rates to fall below 0%, the declining rate scenario reflects a gradual 50

basis point rate decline versus the customary 200 basis point scenario. As of December 31, 2008 the Company estimated a 0.4%

increase in 12-month net interest income for a gradual 200 basis point rate increase and a 0.2% reduction in 12-month net interest

income for a gradual 50 basis point rate decline.

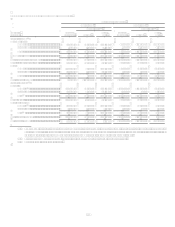

In addition to limits related to possible changes in 12-month net interest income, as of December 31, 2008 the Asset/Liability

Management Policy limited the pre-tax change in economic value of equity due to instantaneous parallel rate shocks of 200 basis

points to less than 12%. As of December 31, 2008, the estimated reduction in economic value of equity due to an adverse 200 basis

point rate shock was 4.3%.