Capital One 2008 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

151

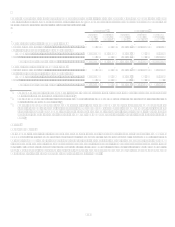

Note 25

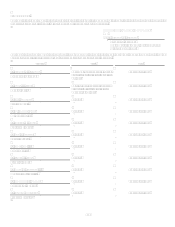

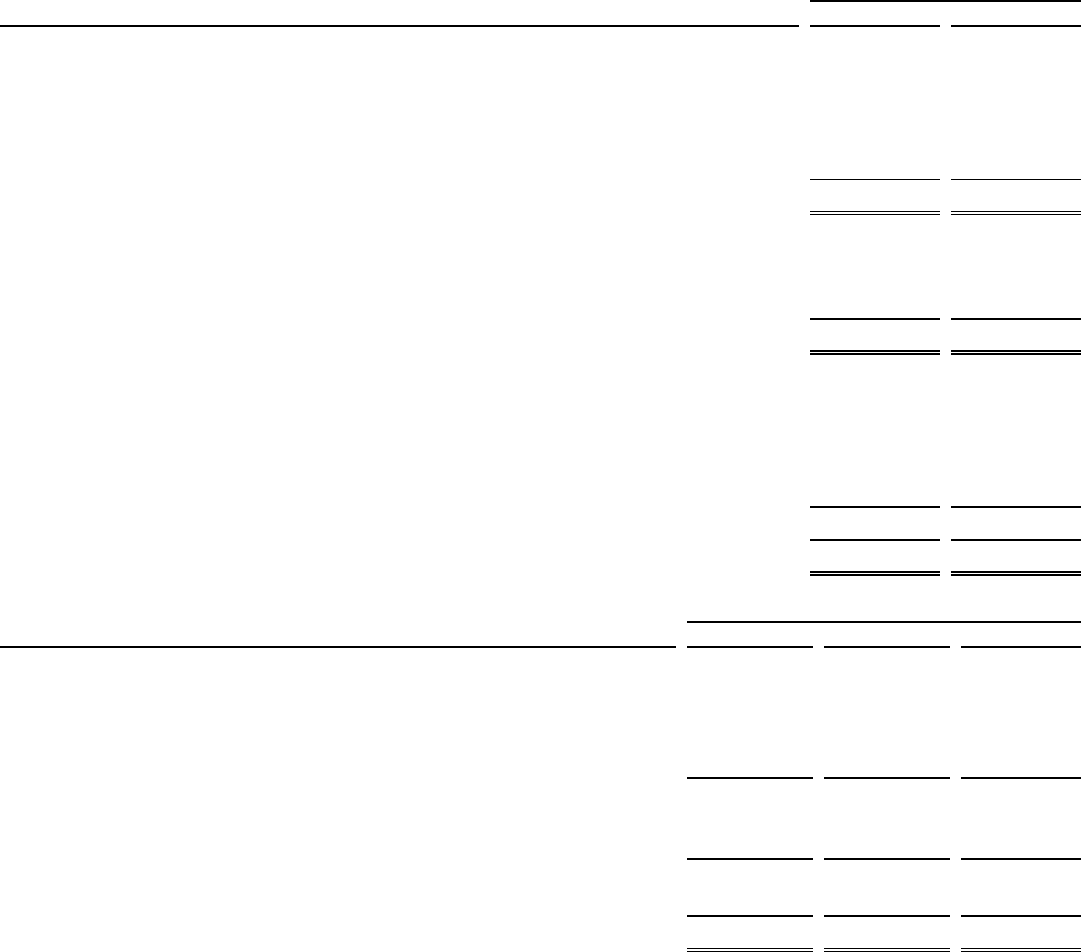

Capital One Financial Corporation (Parent Company Only)

Condensed Financial Information

The following Parent Company Only financial statements are provided in accordance with Regulation S-X of the Securities and

Exchange Commission which requires all issuers or guarantors of registered securities to include separate annual financial statements.

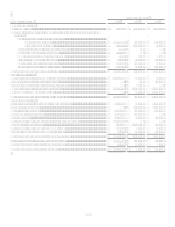

December 31

Balance Sheets

2008

2007

Assets: .................................................................................................................................................

.

Cash and cash equivalents ...................................................................................................................

.

$ 8,546,995

$ 24,702

Investment in subsidiaries....................................................................................................................

.

25,323,057

26,916,546

Loans to subsidiaries............................................................................................................................

.

1,189,173

6,604,075

Securities available for sale .................................................................................................................

.

6,840

16,420

Other ....................................................................................................................................................

.

983,920

566,297

Total assets .................................................................................................................................

.

$ 36,049,985 $ 34,128,040

Liabilities:

Senior and subordinated notes .............................................................................................................

.

$ 6,385,417

$ 7,187,007

Other borrowings .................................................................................................................................

.

1,652,948

1,921,295

Other ....................................................................................................................................................

.

1,399,187

725,626

Total liabilities............................................................................................................................

.

9,437,552

9,833,928

Stockholders Equity:

Preferred stock .....................................................................................................................................

.

3,096,466

Common stock .....................................................................................................................................

.

4,384

4,192

Paid-in-capital, net...............................................................................................................................

.

17,278,092

15,860,490

Retained earnings.................................................................................................................................

.

9,399,378

11,582,816

Less: Treasury stock, at cost.......................................................................................................

.

(3,165,887) (3,153,386)

Stockholders equity...................................................................................................................

.

26,612,433

24,294,112

Total liabilities and stockholders equity....................................................................................

.

$ 36,049,985 $ 34,128,040

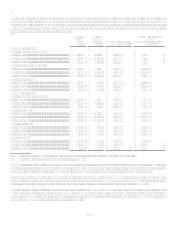

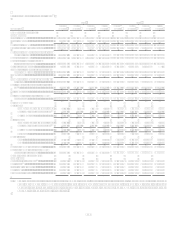

Year Ended December 31

Statements of Income

2008

2007

2006

Interest from temporary investments ........................................................................... $ 184,234 $ 300,394 $ 323,870

Interest expense............................................................................................................ 424,541

504,708 265,585

Dividends, principally from bank subsidiaries............................................................. 1,546,810

2,056,639 1,950,000

Non-interest income..................................................................................................... 110,911

12,982 4,807

Non-interest expense.................................................................................................... 137,265

241,660 129,491

Income before income taxes and equity in undistributed earnings of subsidiaries ...... 1,280,149 1,623,647 1,883,601

Income tax (benefit) expense ....................................................................................... (93,552) (245,052) (67,653)

Equity in undistributed earnings (loss) of subsidiaries ................................................ (1,289,184) 723,020 475,123

Income from continuing operations, net of tax ............................................................ 84,517 2,591,719 2,426,377

Loss from discontinued operations, net of tax ............................................................. (130,515) (1,021,387) (11,884)

Net income (loss)......................................................................................................... $ (45,998) $ 1,570,332 $ 2,414,493