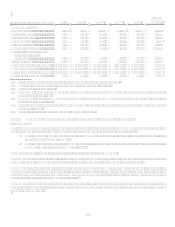

Capital One 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 30

During 2008, the Corporation completed several reorganizations and consolidations to streamline operations and regulatory

relationships. On January 1, Capital One Auto Finance Inc. (COAF) moved from a direct subsidiary of the Corporation to become a

direct operating subsidiary of CONA. In connection with the COAF move, one of COAFs direct operating subsidiaries, Onyx

Acceptance Corporation (Onyx), became a direct subsidiary of the Corporation. On March 1, the Corporation converted Capital One

Bank from a Virginia-state chartered bank to a national association, Capital One Bank (USA), National Association (COBNA). On

March 8, Superior Savings of New England, N.A. (Superior) merged with and into CONA. Both COBNA and CONA are primarily

regulated by the Office of the Comptroller of the Currency (the OCC). In May 2008, we consolidated the business and operations of

two registered broker-dealers, Capital One Securities, LLC (dba Capital One Investments, LLC) and Capital One Investment Services

Corporation (formerly NFB Investment Services Corporation), into Capital One Investments Services Corporation. In addition, in May

2008, we consolidated the business and operations of three insurance agencies, Capital One Agency Corp., GreenPoint Agency, Inc.

and Hibernia Insurance Agency, LLC into Green Point Agency, Inc., which is now known as Capital One Agency LLC.

During the first quarter of 2008, the Company reorganized its National Lending sub-segments. Segment and sub-segment results have

been restated for all periods presented. The National Lending segment consists of the following sub-segments:

U.S. Card sub-segment which consists of the Companys domestic credit card business, including small business credit

cards, and the installment loan businesses.

Other National Lending sub-segment which includes the Companys auto finance and international lending sub-segments.

On December 4, 2008, the Company announced its intention to acquire Chevy Chase Bank F.S.B., the largest retail depository

institution in the Washington, D.C. region in a cash and stock transaction valued at approximately $520 million. On February 13,

2009, the Company received approval from the Federal Reserve to acquire all of the shares of Chevy Chase Bank F.S.B. and certain of

its subsidiaries. The Company expects the transaction to close in the first quarter of 2009.

During 2007, Capital One F.S.B. and North Fork Bank merged with and into CONA.

During 2007, the Company shut down the mortgage origination operations of its wholesale mortgage banking unit, GreenPoint

Mortgage (GreenPoint), an operating subsidiary of CONA. Additional information can be found in Item 8Financial Statements

and Supplementary DataNotes to the Consolidated Financial StatementsNote 2.

II. Critical Accounting Estimates

The Notes to the Consolidated Financial Statements contain a summary of the Companys significant accounting policies, including a

discussion of recently issued accounting pronouncements. Several of these policies are considered to be more critical to the portrayal

of the Companys financial condition, since they require management to make difficult, complex or subjective judgments, some of

which may relate to matters that are inherently uncertain. Areas with significant judgment and/or estimates or that are materially

dependent on management judgment include: fair value measurements including assessments of other-than-temporary impairments of

securities available for sale; determination of the level of allowance for loan and lease losses; valuation of goodwill and other

intangibles; finance charge, interest and fee revenue recognition; valuation of mortgage servicing rights; valuation of representation

and warranty reserves; valuation of retained interests from securitization transactions; recognition of customer reward liability;

treatment of derivative instruments and hedging activities; and accounting for income taxes.

Additional information about accounting policies can be found in Item 8 Financial Statements and Supplementary DataNotes to

the Consolidated Financial StatementsNote 1.

Fair Value Measurements

Certain financial instruments are reported under generally accepted accounting principles, or GAAP, at fair value. The estimated fair

value of other financial instruments not recorded at fair value must be disclosed. Securities available for sale, derivatives, mortgage

servicing rights and retained interest in securitizations are financial instruments recorded at fair value on a recurring basis.

Additionally, from time to time, we may be required to record at fair value other financial instruments on a nonrecurring basis, such as

loans held for investment and mortgage loans held for sale. We include in Item 8 Financial Statements and Supplementary Data

Notes to the Consolidated Financial StatementsNote 12 information about the extent to which fair value is used to measure assets

and liabilities, the valuation methodologies used and impact to earnings. Additionally, for financial instruments not recorded at fair

value we disclose the estimate of their fair value.