Capital One 2008 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.91

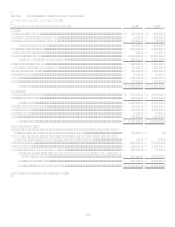

Loan securitization involves the transfer of a pool of loan receivables to a trust or other special purpose entity. The trust sells an

undivided interest in the pool of loan receivables to third-party investors through the issuance of asset backed securities and distributes

the proceeds to the Company as consideration for the loans transferred. The Company removes loans from the reported financial

statements for securitizations that qualify as sales in accordance with SFAS 140. Alternatively, when the transfer would not be

considered a sale but rather a financing, the assets will remain on the Companys reported financial statements with an offsetting

liability recognized in the amount of proceeds received.

The Company uses QSPEs to conduct off-balance sheet securitization activities and SPEs that are considered VIEs to conduct other

securitization activities. See Note 19 Loan Securitizations for information regarding our continuing involvement as transferor of

assets to QSPEs and VIEs in accordance with the new disclosure requirements of FSP FAS 140-4 and FIN 46(R)-8. Additionally, refer

to Note 1 for information regarding the proposed amendments to SFAS 140 and FIN 46(R).

Interests in the securitized and sold loans may be retained in the form of subordinated interest-only strips, senior tranches,

subordinated tranches, cash collateral and spread accounts. The Company also retains a sellers interest in the receivables transferred

to the trusts which is carried on a historical cost basis and classified as loans held for investment on the Reported Consolidated

Balance Sheet.

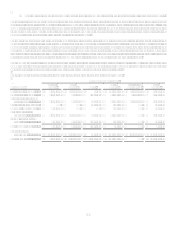

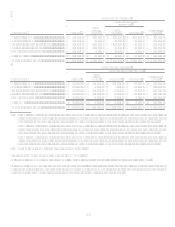

Gains on securitization transactions and fair value adjustments related to residual interests in securitizations are recognized in

servicing and securitizations income and amounts due from the trusts are included in accounts receivable from securitizations. As of

December 31, 2008 and 2007, accounts receivable from securitization totaled $6.34 billion and $4.72 billion. This balance consists of

retained residual interests that are recorded at estimated fair value and totaled $2.30 billion and $2.26 billion at December 31, 2008

and 2007, respectively. The remaining balance relates to cash collections held at financial institutions that are expected to be returned

to the Company on future distribution dates, and principal collections accumulated for expected maturities of securitization

transactions with the subsequent return of loan receivables.

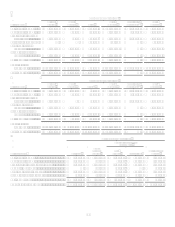

The gain on sale recorded from off-balance sheet securitizations is recorded based on the estimated fair value of the assets sold and

retained and liabilities incurred, and is recorded at the time of sale, net of transaction costs, in servicing and securitizations income.

The related receivable is the interest-only strip, which is based on the present value of the estimated future cash flows from excess

finance charges and past-due fees over the sum of the return paid to security holders, estimated contractual servicing fees and credit

losses. The interest-only strip, cash collateral and subordinated tranches are subject to substantial credit, repayment and interest rate

risks on transferred assets if the off-balance sheet loans are not paid when due. As such, the interest-only strip and subordinated

retained interests are classified as trading assets in accordance with SFAS 155 and changes in the estimated fair value are recorded in

servicing and securitization income. Additionally, the Company may also retain senior tranches in the securitization transactions

which are considered to be higher investment grade securities and subject to lower risk of loss. The retained senior tranches are

classified as available for sale securities in accordance with SFAS 115 and changes in the estimated fair value are recorded in other

comprehensive income.

The Company does not typically recognize servicing assets or servicing liabilities for servicing rights retained from credit card, auto

loan and installment loan securitizations since the servicing fee approximates adequate compensation to the Company for performing

the servicing.

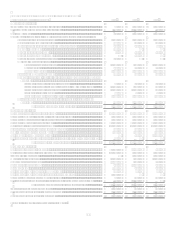

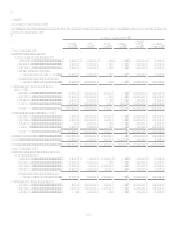

Loans Held for Investment

Loans held for investment include consumer and commercial loans. Consumer loans include credit card, installment, auto and

mortgage loans. Credit card loans are reported at their principal amounts outstanding and include uncollected billed interest and fees.

All new originations of consumer and commercial loans, except for certain mortgage loans previously originated under GreenPoint,

are deemed to be held for investment at origination because management has the intent and ability to hold them for the foreseeable

future or until maturity or payoff. Management believes the foreseeable future is relatively short based on the weighted average life of

the consumer loans and the homogeneous nature of the receivables. In determining the amount of loans held for investment,

management makes judgments about the Companys ability to fund these loans through means other than securitization, such as

investments, deposits and other borrowings. Management assesses whether loans can continue to be held for investment on a quarterly

basis by considering capital levels and scheduled maturities of funding instruments used.