Capital One 2008 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.145

In 2007, a number of individual plaintiffs, each purporting to represent a class of cardholders, filed antitrust lawsuits in the United

States District Court for the Northern District of California against several issuing banks, including the Company (the In Re Late

Fees Litigation). These lawsuits allege, among other things, that the defendants conspired to fix the level of late fees and over-limit

fees charged to cardholders, and that these fees are excessive. In May 2007, the cases were consolidated for all purposes and a

consolidated amended complaint was filed alleging violations of federal statutes and state law. The amended complaint requests civil

monetary damages, which could be trebled. In November 2007, the court dismissed the amended complaint. Plaintiffs appealed that

order to the Ninth Circuit Court of Appeals. The plaintiffs appeal challenges the dismissal of their National Bank Act, Depository

Institutions Deregulation Act of 1980 and California Unfair Competition Law claims, but not their antitrust conspiracy claims.

The Company believes it has meritorious defenses and intends to defend these cases vigorously. Given the complexity of the issues

raised by these lawsuits and the uncertainty regarding: (i) the outcome of these suits, (ii) the likelihood and amount of any possible

judgments, (iii) the likelihood, amount and validity of any claim against the member banks, including the Company and its subsidiary

banks, (iv) changes in industry structure that may result from the suits and (v) the effects of these suits, in turn, on competition in the

industry, member banks and interchange fees, the Company cannot determine at this time the long-term effects of these suits.

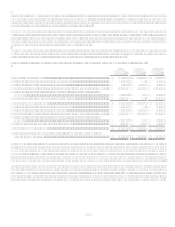

In 2007, the Company recorded indemnification liabilities of $90.9 million for certain Visa-related litigation. This total includes $31.8

million related to the settled Amex lawsuit which is discussed above, and $59.1 million, recorded in accordance with FIN 45,

reflecting Capital Ones estimated share of potential damages as a Visa member from certain other Visa-related litigation.

In the first quarter of 2008, Visa completed an IPO of its stock. With IPO proceeds Visa established an escrow account for the benefit

of member banks to fund certain litigation settlements and claims. As a result, in the first quarter of 2008, the Company reduced its

Visa-related indemnification liabilities of $90.9 million recorded in other liabilities with a corresponding reduction of other non-

interest expense.

Other Pending and Threatened Litigation

In addition, the Company is commonly subject to various pending and threatened legal actions relating to the conduct of its normal

business activities. In the opinion of management, the ultimate aggregate liability, if any, arising out of any such pending or threatened

legal actions will not be material to its consolidated financial position or its results of operations.

Tax issues for years 1995-1999 are pending in the U.S. Tax Court. Although the final resolution of the case is uncertain and involves

unsettled areas of law, the Company has accounted for this matter applying the recognition and measurement criteria of FIN 48.

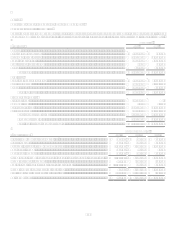

Note 20

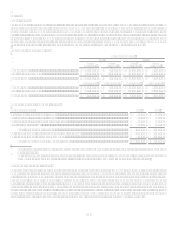

Other Variable Interest Entities

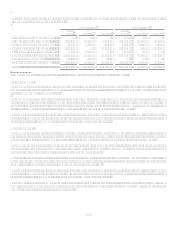

The Company has various types of off-balance sheet arrangements that we enter into in the ordinary course of business. Off-balance

sheet activities typically utilize SPEs that may be in the form of limited liability companies, partnerships or trusts. The SPEs raise

funds by issuing debt to third party investors. The SPEs hold various types of financial assets whose cash flows are the primary source

of repayment for the liabilities of the SPE. Investors only have recourse to the assets held by the SPE but may also benefit from other

credit enhancements.

The Company is involved with various SPEs that are considered to be VIEs, as defined by FIN 46(R). With respect to its investments,

the Company is required to consolidate any VIE in which it is determined to be the primary beneficiary. The Company reviews all

significant interests in VIEs it is involved with such as amounts and types of financial and other support including ownership interests,

debt financing and guarantees. The Company also considers its rights and obligations as well as the rights and obligations of other

variable interest holders to determine whether it is required to consolidate the VIEs. To provide the necessary disclosures, the

Company aggregates similar VIEs based on the nature and purpose of the entities.

The Companys involvement in these arrangements can take many different forms, including securitization activities, servicing

activities, the purchase or sale of mortgage-backed and other asset backed securities in connection with our investment portfolio, and

loans to VIEs that hold debt, equity, real estate or other assets. In certain instances, the Company also provides guarantees to VIEs or

holders of variable interests in VIEs. In addition to the information contained in this Note, the Company has disclosed its involvement

with other types of VIEs in Note 13 Mortgage Servicing Rights, Note 18 Securitizations and Note 19 Commitments,

Contingencies and Guarantees.