Capital One 2008 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128

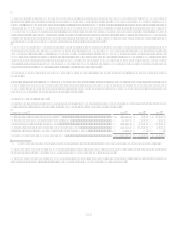

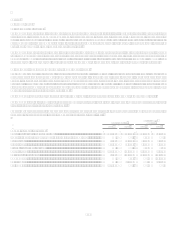

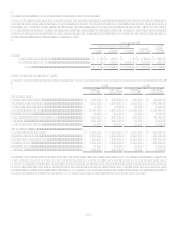

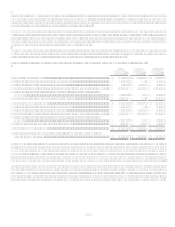

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

The Company is also required to measure and recognize certain other financial assets at fair value on a nonrecurring basis in the

consolidated balance sheet. For assets measured at fair value on a nonrecurring basis in 2008 and still held on the consolidated balance

sheet at December 31, 2008, the following table provides the fair value measures by level of valuation assumptions used and the

amount of fair value adjustments recorded in earnings for those assets in 2008. Fair value adjustments for mortgage loans held for sale

are recorded in other non-interest expense and fair value adjustments for loans held for investment are recorded in provision for loan

and lease losses in the consolidated statement of income.

December 31, 2008

Fair Value Measurements Using

Level 1

Level 2

Level 3

Assets at

Fair Value

Total

Losses in

2008

Assets

Mortgage loans held for sale ...................................................... $ $ 68,462 $ $ 68, 462 $ 14,386

Loans held for investment .......................................................... 64,737 142,768 207,505 62,747

Total ................................................................................. $ $ 133,199 $ 142,768 $ 275,967 $ 77,133

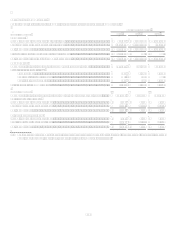

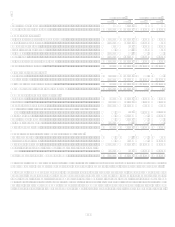

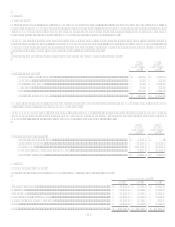

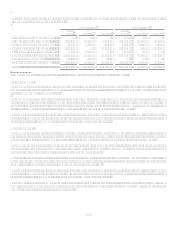

Fair Value of Financial Instruments

The following reflects the fair value of financial instruments whether or not recognized on the consolidated balance sheet at fair value.

2008

2007

Carrying

Amount

Estimated

Fair Value

Carrying

Amount

Estimated

Fair Value

Financial Assets

Cash and cash equivalents ........................................................ $ 7,491,343 $ 7,491,343

$ 4,821,409 $ 4,821,409

Securities available for sale ...................................................... 31,003,271 31,003,271

19,781,587 19,781,587

Mortgage loans held for sale..................................................... 68,462 68,462

315,863 315,863

Loans held for investment......................................................... 101,017,771 86,370,194

101,805,027 104,822,251

Interest receivable ..................................................................... 827,909 827,909

839,317 839,317

Accounts receivable from securitization................................... 6,342,754 6,342,754

4,717,879 4,717,879

Derivatives................................................................................ 1,836,817 1,836,817

563,272 563,272

Mortgage servicing rights ......................................................... 150,544 150,544

247,589 247,589

Financial Liabilities ................................................................

Non-interest bearing deposits $ 11,293,852 $ 11,293,852

$ 11,046,549 $ 11,046,549

Interest-bearing deposits ........................................................... 97,326,937 98,031,913

71,714,627 70,528,579

Senior and subordinated notes .................................................. 8,308,843 6,922,300

10,712,706 10,141,310

Other borrowings ...................................................................... 14,869,648 12,948,145

26,812,969 26,290,579

Interest payable......................................................................... 676,398 676,398

631,609 631,609

Derivatives................................................................................ 1,321,671 1,321,671

529,390 529,390

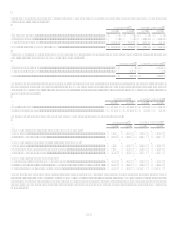

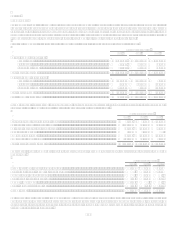

The following describes the valuation techniques used in estimating the fair value of the Companys financial instruments as of

December 31, 2008 and 2007. At December 31, 2008, the Company applied the provisions of SFAS 157 to the fair value

measurements of financial instruments not recognized on the consolidated balance sheet at fair value, which include loans held for

investment, interest receivable, non-interest bearing and interest bearing deposits, other borrowings, senior and subordinated notes,

and interest payable. The provisions requiring the Company to maximize the use of observable inputs and to measure fair value using

a notion of exit price were factored into the Companys selection of inputs into its established valuation techniques.