Capital One 2008 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

137

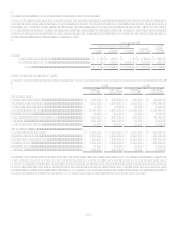

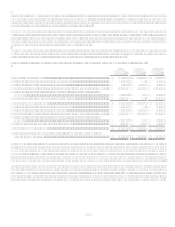

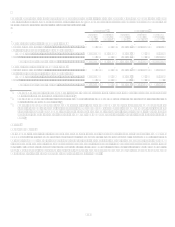

The following table provides the Notional Value and Fair Values of the Companys derivative instruments, aggregated by category, as

of December 31, 2008 and December 31, 2007.

December 31, 2008

December 31, 2007

Notional

Amount

FV Positive

FV Negative

Notional

Amount

FV Positive

FV Negative

Fair Value Foreign Exchange Hedges.......$ $ $

$ 59,664 $ 976 $

Fair Value Interest Rate Hedges ............... 6,760,477 608,162 (10,201) 3,145,750

105,303 (17,407)

Cash Flow Foreign Exchange Hedges ...... 810,973 29,065 (8,679) 926,806

19,369 (6,602)

Cash Flow Interest Rate Hedges ............... 6,430,065 (225,459) 9,064,277

2,208 (148,445)

Net Investment in Foreign Operations ...... 48,238 10,889

66,097

604

Non-Trading Interest Rate Derivatives ..... 18,345,040 879,100 (784,372) 22,922,450

382,632 (330,787)

Non-Trading TBA Forwards..................... 850,000 8,020 (939)

Trading Interest Rate Derivatives(1) ........... 7,874,072 301,581 (292,021) 3,291,941 52,180 (46,740)

Totals ........................................................$ 41,118,865 $ 1,836,817 $ (1,321,671) $ 39,476,955 $ 563,272 $ (549,981)

(1) The Companys trading derivatives relate to customer-oriented derivative financial instruments.

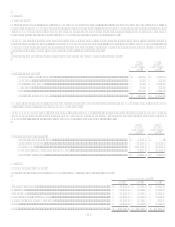

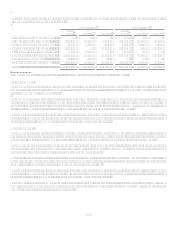

Fair Value Hedges

The Company has entered into forward exchange contracts to hedge foreign currency denominated investments against fluctuations in

exchange rates. The purpose of the Companys foreign currency hedging activities is to protect the Company from the risk of adverse

effects from movements in exchange rates.

The Company has also entered into interest rate swap agreements that modify the Companys exposure to interest rate risk by

effectively converting a portion of the Companys senior notes, public fund certificates of deposit, and U.S. Agency investments from

fixed rates to variable rates over the next nine years. The agreements involve the receipt of fixed rate amounts in exchange for floating

rate interest payments over the life of the agreement without an exchange of underlying principal amounts.

Adjustments related to the ineffective portion of the fair value hedging instruments are recorded in interest income, interest expense or

non-interest income depending on the hedged item. For the years ended December 31, 2008 and 2007, net gains or losses related to the

ineffective portion of the Companys fair value hedging instruments were not material.

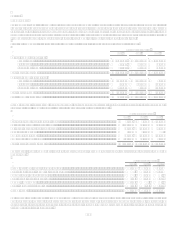

Cash Flow Hedges

The Company has entered into interest rate swap agreements that effectively modify the Companys exposure to interest rate risk by

converting floating rate debt to a fixed rate over the next five years. The agreements involve the receipt of floating rate amounts in

exchange for fixed rate interest payments over the life of the agreement without an exchange of underlying principal amounts.

The Company has entered into forward exchange contracts to reduce the Companys sensitivity to foreign currency exchange rate

changes on its foreign currency denominated loans. The forward rate agreements allow the Company to lock-in functional currency

equivalent cash flows associated with the foreign currency denominated loans.

Any unrealized gains or losses related to cash flow hedging instruments are reclassified from other comprehensive income (loss) into

earnings in the same period or periods during which the hedged forecasted transaction affects earnings and are recorded in interest

income, interest expense or non-interest income depending on the hedged item.

Adjustments related to the ineffective portion of the cash flow hedging instruments are recorded in interest income, interest expense or

non-interest income depending on the hedged item. For the years ended December 31, 2008 and 2007, net gains or losses related to the

ineffective portion of the Companys fair value hedging instruments were not material.

At December 31, 2008, the Company expects to reclassify $12.9 million of net gains, after tax, on derivative instruments from

cumulative other comprehensive income to earnings during the next 12 months as terminated swaps are amortized and as interest

payments and receipts on derivative instruments occur.