Capital One 2008 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

139

Note 18

Securitizations

The Company actively engages in securitization transactions of loans for funding purposes. The Company receives the proceeds from

third party investors for securities issued from the Companys securitization vehicles which are collateralized by transferred

receivables from the Companys portfolio. The Company removes loans from the reported financial statements for securitizations that

qualify as sales in accordance with SFAS 140. Alternatively, when the transfer would not be considered a sale but rather a financing,

the assets will remain on the Companys reported financial statements with an offsetting liability recognized in the amount of proceeds

received. Loans included in securitization transactions which qualify as sales under GAAP have been removed from the Companys

reported balance sheet, but are included within the managed financial information, as shown in the table below.

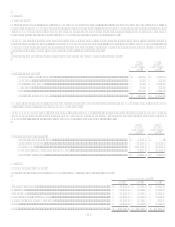

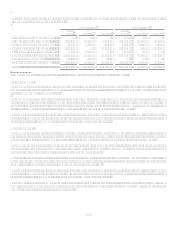

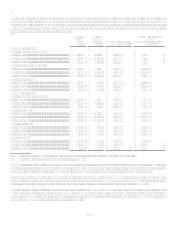

Supplemental Loan Information

Year Ended December 31

2008

2007

Loans

Outstanding

Loans

Delinquent

Loans

Outstanding

Loans

Delinquent

Managed loans ..................................................................... $ 146,936,754 $ 6,596,223

$ 151,362,417 $ 5,863,797

Securitization adjustments ................................................... (45,918,983) (2,178,400) (49,557,390) (2,142,353)

Reported loans ..................................................................... $ 101,017,771 $ 4,417,823

$ 101,805,027 $ 3,721,444

Average Loans

Net Charge-Offs

Average Loans

Net Charge-Offs

Managed loans ..................................................................... $ 147,812,266 $ 6,424,937

$ 144,727,007 $ 4,161,995

Securitization adjustments ................................................... (48,841,363) (2,946,766) (51,185,182) (2,201,454)

Reported loans ..................................................................... $ 98,970,903 $ 3,478,171

$ 93,541,825 $ 1,960,541

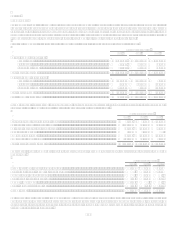

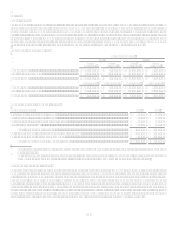

Accounts Receivable from Securitizations

Year Ended December 31

2008

2007

Interest-only strip classified as trading .....................................................................................................

.

$ 122,949

$ 408,013

Retained interests classified as trading .....................................................................................................

.

594,283

714,122

Retained interests classified as available for sale......................................................................................

.

753,153

173,363

Other retained interests (1) ..........................................................................................................................

.

831,275

965,865

Total retained residual interests.......................................................................................................

.

2,301,660

2,261,363

Collections on deposit for off balance sheet securitizations (2) ..................................................................

.

3,313,493

1,148,306

Collections on deposit for secured borrowings.........................................................................................

.

727,601

1,308,210

Total accounts receivable from securitizations................................................................................

.

$ 6,342,754 $ 4,717,879

(1) Other retained interests primarily includes investor accrued billed and unbilled interest receivable, net of related finance charge

and fee reserve.

(2) Collections on deposit for off-balance sheet securitizations includes $1.755 billion and $123 million of principal collections

accumulated for expected maturities of securitization transactions as of December 31, 2008 and 2007, respectively.

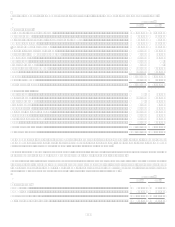

Off-Balance Sheet Securitizations

Off-balance sheet securitizations involve the transfer of pools of loan receivables by the Company to one or more third-party trusts or

QSPEs in transactions that are accounted for as sales in accordance with SFAS 140. The trusts can engage only in limited business

activities to maintain QSPE status. Certain undivided interests in the pool of loan receivables are sold to external investors as asset-

backed securities in public underwritten offerings or private placement transactions. The proceeds from off-balance sheet

securitizations are distributed by the trusts to the Company as consideration for the loan receivables transferred. Each new off-balance

sheet securitization results in the removal of loan principal receivables equal to the sold undivided interests in the pool of loan

receivables (off-balance sheet loans), the recognition of certain retained residual interests and a gain on the sale. Securities held by

external investors totaling $44.3 billion and $48.2 billion as of December 31, 2008 and 2007, respectively, represent undivided

interests in the pools of loan receivables that are sold in underwritten offerings or in private placement transactions.