Capital One 2008 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.143

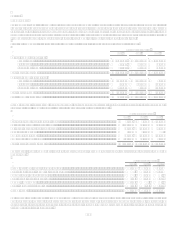

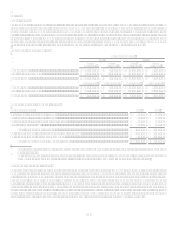

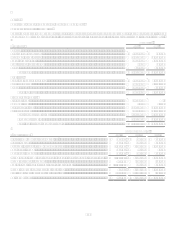

Guarantees and Other Obligations

Manufactured Housing

The Company retains the primary obligation for certain provisions of corporate guarantees, recourse sales and clean-up calls related to

the discontinued manufactured housing operations of GreenPoint Credit LLC (GPC) which was sold to a third party in 2004.

Although the Company is the primary obligor, recourse obligations related to former GPC whole loan sales as well as commitments to

exercise mandatory clean-up calls on certain GPC securitization transactions, and servicing was transferred to a third party in the sale

transaction.

The Company was required to fund letters of credit in 2004 to cover losses, is obligated to fund amounts under credit default swaps for

certain transactions, has the right to any funds remaining in the letters of credit after the securities are released, the right to residual

funds in the securitizations after all other certificates have been paid and the obligation to pay certain negligible ongoing fees related

to the transactions. The balance of the funded letters of credit was $221 million and $227 million at December 31, 2008 and 2007,

respectively. The fair value of the expected residual balances on the funded letters of credit was $11 million and $9 million at

December 31, 2008 and 2007, respectively, and is included in other assets. The Companys maximum exposure under the credit

default swaps was $37.5 million and $40.9 million at December 31, 2008 and 2007, respectively. The fair value of the Companys

obligations under the credit default swaps was $20.8 million and $30.8 million at December 31, 2008 and 2007, respectively, and is

recorded as other liabilities.

The principal balance of manufactured housing securitization transactions where the Company is the residual interest holder was $1.7

billion and $1.9 billion, as of December 31, 2008 and 2007 respectively. In the event the third party does not fulfill on its obligations

to exercise the clean-up calls on certain transactions, approximately $420 million of loans receivable would be assumed by the

Company upon execution of the call.

The Company could be required to cover losses on certain whole loan sales in the event the third party did not perform on its

obligations. There have been no instances of non-performance by the third party.

Management monitors the underlying assets for trends in delinquencies and related losses, and reviews the purchasers financial

strength as well as servicing performance. These factors are considered in assessing the appropriateness of the liabilities established

against these obligations and the valuations of the assets.

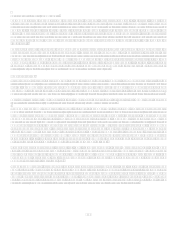

Securitization Guarantees

In connection with certain installment loan securitization transactions, the transferee (off-balance sheet special purpose entity

receiving the installment loans) entered into interest rate hedge agreements (the swaps) with a counterparty to reduce interest rate

risk associated with the transactions. In connection with the swaps, the Corporation entered into letter agreements guaranteeing the

performance of the transferee under the swaps. If at anytime the Class A invested amount equals zero and the notional amount of the

swap is greater than zero resulting in an Early Termination Date (as defined in the securitization transactions Master Agreement),

then (a) to the extent that, in connection with the occurrence of such Early Termination Date, the transferee is obligated to make any

payments to the counterparty pursuant to the Master Agreement, the Corporation shall reimburse the transferee for the full amount of

such payment and (b) to the extent that, in connection with the occurrence of an Early Termination Date, the transferee is entitled to

receive any payment from the counterparty pursuant to the Master Agreement, the transferee will pay to the Corporation the amount of

such payment. At December 31, 2008, the maximum exposure to the Corporation under the letter agreements was approximately

$13.0 million. These guarantees are not recorded on the balance sheet because they are grandfathered under the provisions of FIN45.

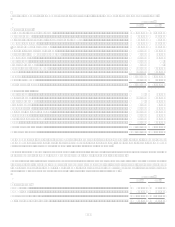

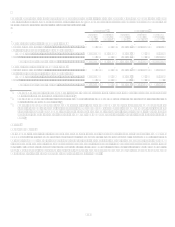

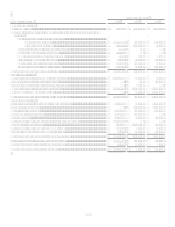

Note 19

Commitments, Contingencies and Guarantees

Letters of Credit

The Company issues letters of credit (financial standby, performance standby and commercial) to meet the financing needs of its

customers. Standby letters of credit are conditional commitments issued by the Company to guarantee the performance of a customer

to a third party in a borrowing arrangement. Commercial letters of credit are short-term commitments issued primarily to facilitate

trade finance activities for customers and are generally collateralized by the goods being shipped to the client. Collateral requirements

are similar to those for funded transactions and are established based on managements credit assessment of the customer.

Management conducts regular reviews of all outstanding letters of credit and customer acceptances, and the results of these reviews

are considered in assessing the adequacy of the Companys allowance for loan and lease losses.

The Company had contractual amounts of standby letters of credit and commercial letters of credit of $1.3 billion at December 31,

2008. As of December 31, 2008, financial guarantees had expiration dates ranging from 2009 to 2015. The fair value of the guarantees

outstanding at December 31, 2008 that have been issued since January 1, 2003, was $3.5 million and was included in other liabilities.