Capital One 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 18

As in the U.S., in non-U.S. jurisdictions where we operate, we face a risk that the laws and regulations that are applicable to us (or the

interpretations of existing laws by relevant regulators) may change in ways that adversely impact our business.

The OFT is investigating Visas and MasterCards current methods of setting interchange fees applicable to U.K. domestic

transactions. Cross-border interchange fees are also coming under scrutiny from the European Commission (EC), which in

December 2007 issued a decision notice stating that MasterCards interchange fees applicable to cross border transactions are in

breach of European Competition Law. MasterCard has appealed this decision. A similar decision is expected in relation to Visas

cross border interchange fees. The timing of any final resolution of the matter by EC or OFT is uncertain and it is most unlikely that

there will be any determination before the end of 2009. However, it is likely that interchange fees will be reduced, which could

adversely affect the yield on U.K. credit card portfolios.

Following a referral by the OFT, the Competition Commission (CC) launched a market investigation into the supply of Payment

Protection Insurance (PPI) in the U.K. PPI on mortgages, credit cards, unsecured loans (personal loans, motor loans and hire

purchase) and secured loans are included. The CC published its final report on remedies on January 29, 2009, which included point of

sale changes and the introduction of an annual PPI statement to customers. All changes will take effect in 2010. The U.K. Bank will

likely see an increase in customer cancellations and complaints beginning in 2009, and will stop selling PPI to new customers in

2010. The U.K. Bank continues to consider alternative products to help mitigate these impacts.

Following the change in the U.S. regulator of COBNA in 2008 to the OCC, U.K. Bank has been included in various discovery

examinations by the OCC. Following their visit to the U.K. Bank in November 2008, the OCC has requested that all U.K. lenders

which have a U.S. parent company amend the way in which they calculate the minimum monthly payment requested from customers.

The new calculation goes beyond what is currently required of UK lenders under the Banking Code and other U.K. legislation, and

therefore means that the U.K. Bank will be subject to additional regulation over and above its U.K. competitors who are not U.S.

owned. The potential exists for further U.S. legislation to be selectively applied by the OCC to U.K. banks with U.S. parents.

The European Payment Services Directive (PSD) aims to harmonize the regulatory regime for payment services across the

European Union (E.U.). The PSD, which is due to be implemented on November 1, 2009, sets minimum standards for payment

services, including new information which must be provided to consumers and the introduction of new faster execution times for

payment transactions. The PSD is intended to allow U.K. payment institutions to significantly expand their markets by offering their

services across the E.U. It may encourage new entrants to the payment arena, in particular for mobile phone technology to be used to

enable payments. The changes may also offer benefits to consumers by increasing competition in the market leading to lower prices

and a wider choice of services. The final payment services regulations have not been issued, but the U.K. Bank is exploring its impact

given the short time frame for implementation.

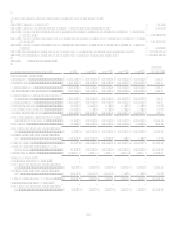

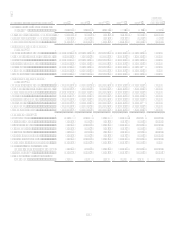

Statistical Information

The statistical information required by Item 1 can be found in Item 6 Selected Financial Data, Item 7 Management Discussion and

Analysis of Financial Condition and Results of Operations and in Item 8, Financial Statements and Supplementary Data.

Item 1A. Risk Factors

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. We also may make written or oral forward-looking statements in our periodic reports to the Securities and

Exchange Commission on Forms 10-Q and 8-K, in our annual report to shareholders, in our proxy statements, in our offering circulars

and prospectuses, in press releases and other written materials and in statements made by our officers, directors or employees to third

parties. Statements that are not about historical facts, including statements about our beliefs and expectations, are forward-looking

statements. Forward-looking statements include, but are not limited to, information relating to our future earnings per share, growth in

managed loans outstanding, product mix, segment growth, tangible common equity, managed revenue margin, funding costs,

operations costs, employment growth, marketing expense, delinquencies and charge-offs. Forward looking statements also include

statements using words such as expect, anticipate, hope, intend, plan, believe, estimate or similar expressions.

Forward-looking statements are not guarantees of future performance. They involve risks, uncertainties and assumptions, including the

risks discussed below. Our future performance and actual results may differ materially from those expressed in forward-looking

statements. Many of the factors that will determine these results and values are beyond our ability to control or predict. Forward-

looking statements speak only as of the date that they are made, and we undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise.