Capital One 2008 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

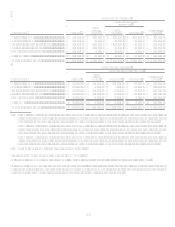

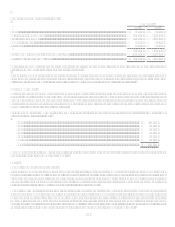

Weighted average yields were determined based on amortized cost and are distributed based on expected maturities. Actual maturities

could differ because issuers and/or the underlying borrowers may have the right to call or prepay obligations.

Gross realized gains on sales and calls of securities were $14.6 million, $71.2 million, and $36.8 million for the years ended

December 31, 2008, 2007, and 2006, respectively. Gross realized losses on sales and calls of securities were $0.9 million, $1.2

million, and $66.0 million for the years ended December 31, 2008, 2007, and 2006, respectively. Tax expenses (benefits) on net

realized gains (losses) were $5.0 million, $25.0 million, and $(10.6) million for the years ended December 31, 2008, 2007 and 2006.

Securities available for sale included pledged securities of $13.7 billion, $9.3 billion, and $9.5 billion at December 31, 2008, 2007,

and 2006, respectively.

Note 5

Loans Held for Investment, Allowance for Loan and Lease Losses and Unfunded Lending Commitments

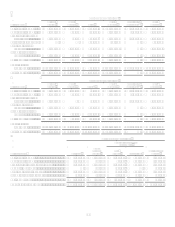

Loans Held for Investment

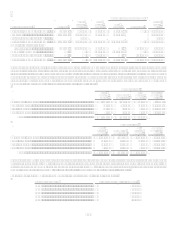

The composition of the loans held for investment portfolio was as follows:

December 31

2008

2007

Year-End Balances:

Reported loans:

Consumer loans:......................................................................................................................

.

Credit cards....................................................................................................................

.

Domestic ..............................................................................................................

.

$ 16,954,281 $ 13,130,866

International .........................................................................................................

.

2,873,764 3,661,661

Total credit cards ...........................................................................................................

.

19,828,045 16,792,527

Installment loans

Domestic ..............................................................................................................

.

10,130,678 9,966,818

International .........................................................................................................

.

119,320 354,556

Total installment loans...................................................................................................

.

10,249,998 10,321,374

Auto loans ...............................................................................................................................

.

21,491,285 25,038,294

Mortgage loans........................................................................................................................

.

10,663,598 12,296,575

Total consumer loans ........................................................................................................................

.

62,232,926 64,448,770

Commercial loans .............................................................................................................................

.

38,784,845 37,356,257

Total reported loans held for investment ..........................................................................................

.

$ 101,017,771 $ 101,805,027

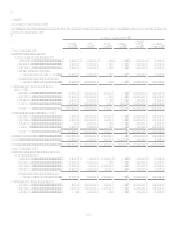

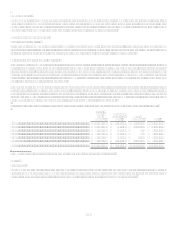

Loans totaling approximately $998.6 million and $799.9 million, representing amounts which were greater than 90 days past due,

were included in the Companys reported loan portfolio as of December 31, 2008 and 2007, respectively. These delinquencies include

nonaccrual consumer auto loans of $164.6 million in 2008 and $159.8 million in 2007.

Loans that were considered individually impaired in accordance with SFAS No. 114 at December 31, 2008 and 2007 were $461.2

million and $122.8 million, respectively. The Company had a corresponding specific allowance for loan and lease losses of $64.3

million and $8.4 million at December 31, 2008 and 2007, respectively, relating to impaired loans of $272.2 million and $48.8 million

at December 31, 2008 and 2007, respectively. The average balance of impaired loans was $271.9 million in 2008 and $74.8 million in

2007. Interest income recognized during 2008 and 2007 related to impaired loans was not material.