Capital One 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 49

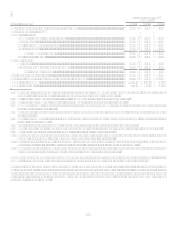

Provision for loan and lease losses

Provision for loan and lease losses increased $2.5 billion, or 93% for the year ended December 31, 2008. The increase in the provision

is a result of continued worsening of the economy which rapidly deteriorated during the later part of 2008 as evidenced by increases in

both the charge-off rate and delinquency rate, rising to 3.51% and 4.37%, respectively, from 2.10% and 3.66%, respectively. The

provision for loan and lease loses increased $1.0 billion in the fourth quarter alone as the Company increased the allowance for loan

and lease losses as the unemployment rate and housing prices showed significant worsening during the fourth quarter of 2008.

Provision for loan and lease losses increased $1.2 billion, or 79% for the year ended December 31, 2007. The increase in provision is a

result of the continued normalization of consumer credit following the unusually favorable credit environment in 2006, adverse

charge-off and delinquency trends in our National Lending businesses and the increase in our coverage ratio of allowance to loans

held for investment as a result of economic weakening in the latter part of 2007 as evidenced by increased delinquency rates and

consistent with recently released economic indicators.

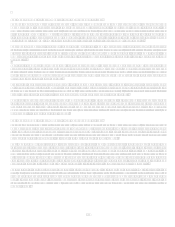

Non-interest expense

Non-interest expense consists of marketing, goodwill impairment and operating expenses.

For the year ended December 31, 2008, non-interest expense, excluding goodwill impairment, decreased 8%. For the year ended

December 31, 2007, non-interest expense increased 16%. See detailed discussion of the components of non-interest expense below.

Marketing

Marketing expenses decreased 17% for the year ended December 31, 2008. The decrease in marketing expenses was due to

selective pull-backs in certain marketing channels and other reductions in response to the changes in the economic environment.

Marketing expenses decreased 7% for the year ended December 31, 2007. The decrease in marketing expenses was due to

selective pull-backs in certain marketing channels.

Goodwill impairment

The Company recorded an impairment to goodwill of $810.9 million, as a result of a reduced estimate of the fair value of the

Auto Finance sub-segment due to business decisions to scale back origination volume in that business. For additional

information, see Section II Critical Accounting Estimates, Valuation of Goodwill and Other Intangible Assets.

Operating Expenses

Operating expenses decreased 7% for the year ended December 31. 2008. The decrease in operating expenses was a direct result

of benefits from the Companys continued cost reduction initiatives.

Operating expenses increased 22% for the year ended December 31. 2007. The increase The increase in operating expense was

driven by the addition of North Forks operating expenses, CDI amortization and integration expenses associated with our bank

acquisitions, litigation accruals related to industry litigation, restructuring charges associated with our cost initiative, and the

accelerated vesting of restricted stock related to the transition to new management in our Local Banking segment.

Income Taxes

The Companys effective tax rate was 85.5%, 33.0% and 33.9% for the years ended December 31, 2008, 2007 and 2006, respectively.

The effective rate includes federal, state, and international tax components. The increase in the 2008 rate compared to the 2007 rate

was primarily due to the non-deductible portion of the goodwill impairment recognized during 2008. The Companys effective tax rate

excluding the goodwill impairment was 37.8%. The decrease in the 2007 rate compared to the 2006 rate was primarily due to changes

in the Companys international tax position recognized in the second quarter 2007 in the amount of $69.0 million and increases in

certain tax credits.

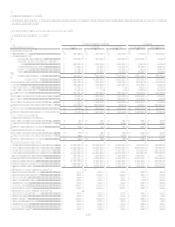

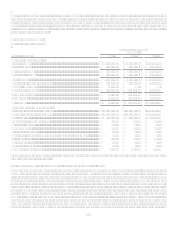

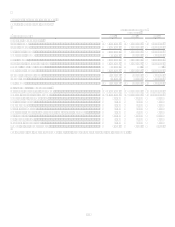

Loan Portfolio Summary

The Company analyzes its financial performance on a managed loan portfolio basis. The managed loan portfolio is comprised of on-

balance sheet and off-balance sheet loans. The Company has retained servicing rights for its securitized loans and receives servicing

fees in addition to the excess spread generated from the off-balance sheet loan portfolio.

Average managed loans held for investment from continuing operations grew $3.1 billion, or 2%, for the year ended December 31,

2008. The modest growth in 2008 was a result of increases in Local Banking and U.S. Card which was mostly offset by reductions in

our International and Auto Finance sub-segments.

Average managed loans held for investment from continuing operations grew $33.4 billion, or 30%, for the year ended December 31,

2007. The increase in average managed loans held for investment during 2007 was due to the North Fork acquisition in late 2006.