Capital One 2008 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.114

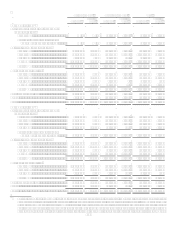

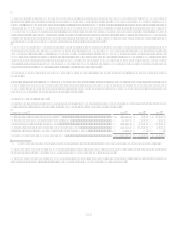

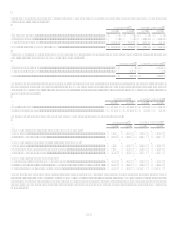

In December 2006, in connection with the North Fork acquisition, the Company assumed $150.0 million of 9.25% subordinated notes

due October 1, 2010, $350.0 million of 3.20% senior notes due June 6, 2008, $350.0 million of 5.875% fixed rate subordinated notes

due August 15, 2012 and $150.0 million of 5.00% fixed rate subordinated loans due August 15, 2012. The senior notes due June 6,

2008 were repaid at maturity.

In September 2006, the Company issued $1.1 billion of floating rate senior notes due September 10, 2009 and $1.1 billion of 5.7%

senior notes due September 15, 2011.

In August 2006, the Company issued $1.0 billion aggregate principal amount of 6.15% subordinated notes due September 1, 2016.

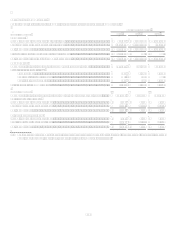

Corporation Shelf Registration Statement

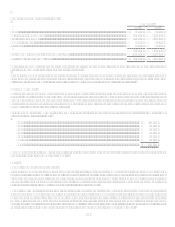

As of December 31, 2008, the Corporation had an effective shelf registration statement under which the Corporation from time to time

may offer and sell an indeterminate aggregate amount of senior or subordinated debt securities, preferred stock, depositary shares

representing preferred stock, common stock, warrants, trust preferred securities, junior subordinated debt securities, guarantees of trust

preferred securities and certain back-up obligations, purchase contracts and units. There is no limit under this shelf registration

statement to the amount or number of such securities that the Corporation may offer and sell. Under SEC rules, the Automatic Shelf

Registration Statement expires three years after filing. Accordingly, the Corporation must file a new Automatic Shelf Registration

Statement at least once every three years. The Automatic Shelf Registration Statement must be updated by May 2009 to remain

effective.

Other Borrowings

Secured Borrowings

The Company issued securitizations in which it transfers pools of consumer loans that are accounted for as secured borrowings at

December 31, 2008. The agreements were entered into between 2005 and 2007, relating to the transfers of pools of consumer loans

totaling $25.1 billion. Principal payments on the borrowings are based on principal collections, net of losses, on the transferred

consumer loans. The secured borrowings accrue interest at fixed and variable rates and mature between April 2009 and May 2011, or

earlier depending upon the repayment of the underlying consumer loans. At December 31, 2008 and 2007, $7.5 billion and $13.1

billion, respectively, of the secured borrowings were outstanding. See Note 18, for further discussion of secured borrowings.

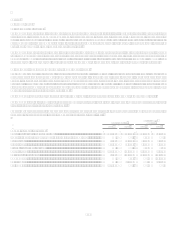

Junior Subordinated Debentures

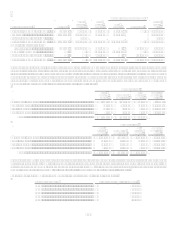

At both December 31, 2008 and 2007, the Company had junior subordinated debentures outstanding with a par amount of $1.6 billion.

The Company had previously established special purpose trusts for the purpose of issuing trust preferred securities. The proceeds from

such issuances, together with the proceeds of the related issuances of common securities of the trusts, were invested by the trusts in

junior subordinated deferrable interest debentures issued by the Company. Prior to FIN 46(R), these trusts were consolidated

subsidiaries of the Company. As a result of the adoption of FIN 46(R), the Company deconsolidated all such special purpose trusts, as

the Company is not considered to be the primary beneficiary.

During 2008, no securities were called or matured and there were no new issuances.

During 2007, securities totaling $450.0 million were called or matured, including $150 million of junior subordinated debentures

issued prior to 2006. In February 2007, the Company issued $500.0 million aggregate principal amount of junior subordinated

debentures that are scheduled to mature on February 17, 2037 and are callable beginning February 17, 2032. The debentures bear

interest at a rate of 6.745% until February 17, 2032, at which time they become floating rate through to the scheduled maturity date.

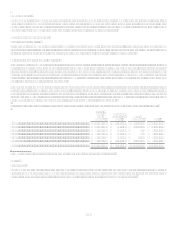

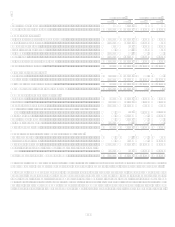

In December 2006, in connection with the North Fork acquisition, the Company assumed $100.0 million of 8.70% junior subordinated

debentures due December 15, 2026 and $200.0 million of 9.10% junior subordinated debentures due June 1, 2027. These junior

subordinated debentures were called during 2007, as noted above, resulting in a $17.4 million gain. In addition, the Company assumed

$100.0 million of 8.0% junior subordinated debentures due December 15, 2027 and $45.0 million of 8.17% junior subordinated

debentures due May 1, 2028. These junior subordinated debentures remain outstanding at December 31, 2008 and are callable

beginning March 23, 2009.

In August 2006, the Company issued $650.0 million aggregate principal amount of 7.686% junior subordinated debentures that are

scheduled to mature on August 15, 2036.

In June 2006, the Company issued $345.0 million aggregate principal amount of 7.5% junior subordinated debentures that are

scheduled to mature on June 15, 2066 and are callable beginning June 15, 2011.