Capital One 2008 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

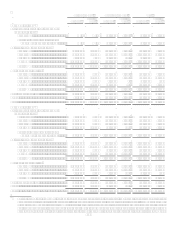

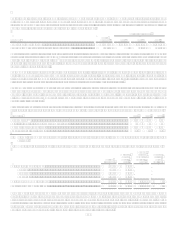

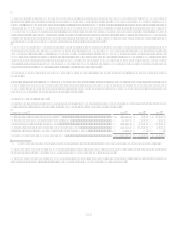

Other National Lending sub-segments

National Lending Detail

U.S. Card

Global

Financial

Services

Other

National

Lending

Auto

Finance

International

National

Lending

Total

Balance at December 31, 2006 ........

.

$ 762,284 $ 752,948 $ 763,648 $ 763,648 $ $ 2,278,880

Transfers ..........................................

.

2,242,896 1,044,389 666,740 666,740 3,954,025

Foreign currency translation ............

.

2,795

2,795

Balance at December 31, 2007 ........

.

$ 3,005,180 $ 1,800,132 $ 1,430,388 $ 1,430,388 $ $ 6,235,700

Impact of reporting structure

reorganization..............................

.

756,138 (1,800,132) 956,146 956,146 (87,848)

Goodwill impairment.......................

.

(810,876) (810,876) (810,876)

Foreign currency translation ............

.

(33,677) (33,677) (33,677)

Balance at December 31, 2008 ........

.

$ 3,761,318 $ $ 1,541,981 $ 619,512 $ 922,469 $ 5,303,299

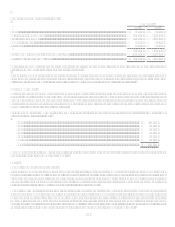

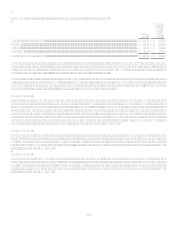

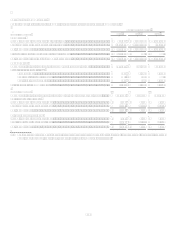

In connection with the acquisitions of Hibernia and North Fork, the Company recorded intangible assets that consisted of core deposit

intangibles, trust intangibles, lease intangibles, and other intangibles, which are subject to amortization. The core deposit and trust

intangibles reflect the estimated value of deposit and trust relationships. The lease intangibles reflect the difference between the

contractual obligation under current lease contracts and the fair market value of the lease contracts at the acquisition date. The other

intangible items relate to customer lists, brokerage relationships and insurance contracts. The following table summarizes the

Companys purchase accounting intangible assets subject to amortization.

December 31, 2008

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Remaining

Amortization

Period

Core deposit intangibles............................................................................

.

$ 1,320,000 $ (497,178) $ 822,822 9.1 years

Lease intangibles.......................................................................................

.

44,862 (16,695) 28,167 18.9 years

Trust intangibles .......................................................................................

.

10,500 (3,326) 7,174 14.9 years

Other intangibles.......................................................................................

.

7,947 (3,850) 4,097 9.9 years

Total ................................................................................................

.

$ 1,383,309 $ (521,049) $ 862,260

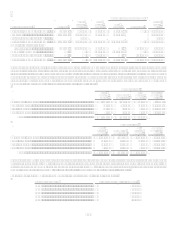

December 31, 2007

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Remaining

Amortization

Period

Core deposit intangibles......................................................................... $ 1,320,000 $ (305,606) $ 1,014,394 10.1 years

Lease intangibles.................................................................................... 44,862 (9,725) 35,137 19.9 years

Trust intangibles .................................................................................... 10,500 (2,330) 8,170 15.9 years

Other intangibles.................................................................................... 7,949 (2,836) 5,113 10.9 years

Total ............................................................................................. $ 1,383,311 $ (320,497) $ 1,062,814

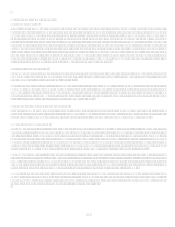

Intangibles are amortized on an accelerated basis over their respective estimated useful lives. Intangible assets are recorded in Other

assets on the balance sheet. Amortization expense related to purchase accounting intangibles totaled $200.6 million and $221.4 million

for the years ended December 31, 2008 and 2007, respectively. Amortization expense for intangibles is recorded to non-interest

expense. The weighted average amortization period for all purchase accounting intangibles is 9.4 years.

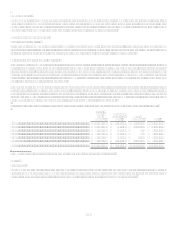

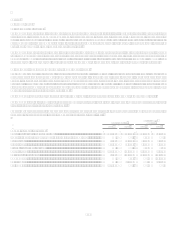

The following table summarizes the Companys estimated future amortization of intangibles:

Year Ended December 31

Estimated Future Amortization Amounts

2009 ........................................................................

.

$ 178,230

2010 ........................................................................

.

$ 156,476

2011 ........................................................................

.

$ 135,546

2012 ........................................................................

.

$ 114,480

2013 ........................................................................

.

$ 93,104