Capital One 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

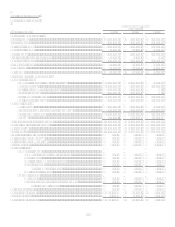

47

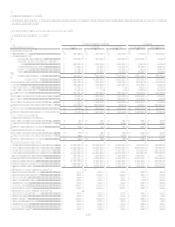

(1) In accordance with the Companys finance charge and fee revenue recognition policy, the amounts billed to customers but not

recognized as revenue were $1.9 billion, $1.1 billion and $0.9 billion for the years ended December 31, 2008, 2007 and 2006,

respectively.

(2) Certain prior period amounts have been reclassified to conform to current period presentation.

(3) Based on continuing operations.

(4) On December 1, 2006, the Company acquired 100% of the outstanding common stock of North Fork Bancorporation for total

consideration of $13.2 billion.

(5) Discontinued operations related to the shutdown of mortgage origination operations of GreenPoints wholesale mortgage

banking unit in 2007.

(6) Risk adjusted margin equals total revenue less net charge-offs as a percentage of average earning assets.

(7) Efficiency ratio equals non-interest expense less restructuring expense and goodwill impairment charge divided by total

revenue.

(8) In the fourth quarter of 2008, the Company recorded impairment of goodwill in its Auto Finance sub-segment of $810.9 million.

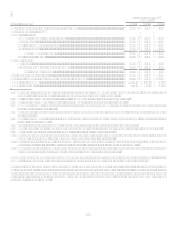

Summary of the Reported Income Statement

The following is a detailed description of the financial results reflected in Table 1. Additional information is provided in Section XI,

Tabular Summary as detailed in sections below.

The following discussion provides a summary of 2008 results compared to 2007 results and 2007 results compared to 2006 results on

a continuing operations basis, unless otherwise noted. Each component is discussed in further detail in subsequent sections of this

analysis.

Net interest income

Net interest income is comprised of interest income earned on securities and interest income and past-due fees earned and deemed

collectible from the Companys loans, less interest expense on interest-bearing deposits, senior and subordinated notes, and other

borrowings. For the year ended December 31, 2008, reported net interest income increased 9.5%, or $618.9 million.

Interest income on loans held for investment decreased modestly to $9.46 billion from $9.50 billion at the end of 2007 as the increase

in average loans held for investment from $93.5 billion to $99.0 billion was offset by the impact of increasing delinquencies which

caused our revenue suppression to increase to $1.9 billion from $1.1 billion in 2007, and by lower interest rates on our variable rate

products as interest rates declined throughout the year.

Interest income on securities available for sale increased $273.0 million driven by increases in the average portfolio from $18.9 billion

to $25.0 billion in 2008 while yields remained stable. The increase in the securities available for sale portfolio came as the Company

continued to grow its deposit base and maintained our approach of holding high quality, low risk investments rather than taking

excessive credit risk to generate incremental earnings. While interest rates declined throughout 2008, the Company maintained stable

yields in growing the securities portfolio by taking advantage of market illiquidity to purchase securities at an attractive yield.

Interest expense on interest-bearing deposits decreased $394.3 million from 2007. The average balance on interest-bearing deposits

increased to $82.7 billion from $74.0 billion while the yield decreased to 3.04% in 2008 from 3.94% as the Federal Reserve reduced

the federal funds rate throughout 2008.

For the year ended December 31, 2007, reported net interest income increased 28%, or $1.4 billion, compared to 2006. The increase

was driven by the acquisition of North Fork, modest loan growth and increased margins in the U.S Card sub-segment due to selective

pricing changes implemented after the completion of our card holder system conversion in 2007. Net interest margin decreased 68

basis points for the year ended December 31, 2007, primarily due to the addition of the lower net interest margin North Fork business.

For additional information, see section XI, Tabular Summary, Table A and Table B.

Non-interest income

Non-interest income is comprised of servicing and securitizations income, mortgage servicing and other, service charges and other

customer-related fees, interchange income and other non-interest income.

For the year ended December 31, 2008, non-interest income decreased 16%. For the year ended December 31, 2007, non-interest

income increased 15%. See detailed discussion of the components of non-interest income below.