Capital One 2008 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

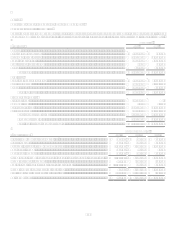

152

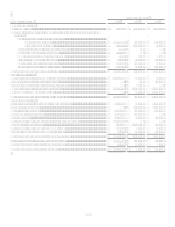

Year Ended December 31

Statements of Cash Flows

2008

2007

2006

Operating Activities:

Net income (loss)........................................................................................................ $ (45,998) $ 1,570,332 $ 2,414,493

Adjustments to reconcile net income (loss) to net cash provided by operating

activities:

Equity in (earnings) loss of subsidiaries:...........................................................

Continuing operations.............................................................................. 1,289,184 (723,020) (475,123)

Discontinued operations .......................................................................... 130,515

1,021,387 11,884

Loss on sale of securities available for sale....................................................... 9,353

223

Gain on repurchase of senior notes ................................................................... (43,249)

Amortization of discount of senior notes .......................................................... 2,864

7,293 1,347

Stock plan compensation expense ..................................................................... 59,283

301,972 212,317

Decrease (increase) in other assets .................................................................... 106,782

(216,052) 19,159

Increase (decrease) in other liabilities ............................................................... 673,561

522,714 (448,363)

Net cash provided by operating activities ................................................................... 2,182,295 2,484,849 1,735,714

Investing Activities:

Decrease (increase) in investment in subsidiaries....................................................... (1,384,682) 969,122 68,953

Purchases of securities available for sale ....................................................................

(127) (52,686)

Proceeds from sale of securities available for sale......................................................

53,569

Decrease (increase) in loans to subsidiaries................................................................ 5,414,902

(1,930,666) (1,065,622)

Net payment for companies acquired..........................................................................

(10,464) (5,010,821)

Net cash provided by (used in) investing activities..................................................... 4,030,220 (918,566) (6,060,176)

Financing Activities:

Increase (decrease) in borrowings from subsidiaries .................................................. (268,347) 166,876 1,379,497

Issuance of senior notes ..............................................................................................

1,495,740 3,185,588

Maturities of senior notes............................................................................................ (550,000) (462,500) (225,000)

Repurchases of senior notes........................................................................................ (713,383) (150,000)

Dividends paid ............................................................................................................ (568,255) (42,055) (32,324)

Net proceeds from issuance of preferred stock and warrant ....................................... 3,555,199

Purchases of treasury stock......................................................................................... (12,501) (3,024,969) (21,615)

Net proceeds from issuances of common stock .......................................................... 772,017

43,493 36,751

Proceeds from share based payment activities............................................................ 95,048

192,361 238,355

Net cash provided by (used in) financing activities .................................................... 2,309,778 (1,781,054) 4,561,252

Increase (decrease) in cash and cash equivalents........................................................ 8,522,293 (214,771) 236,790

Cash and cash equivalents at beginning of year.......................................................... 24,702

239,473 2,683

Cash and cash equivalents at end of year.................................................................... $ 8,546,995 $ 24,702 $ 239,473