Capital One 2008 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

147

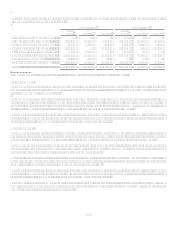

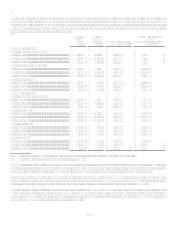

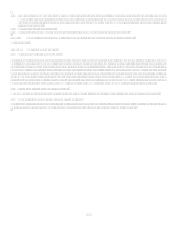

The following table presents the carrying amount of assets and liabilities of those VIEs of which the Company is the primary

beneficiary, the carrying amount of assets and liabilities and maximum exposure to loss of those VIEs of which the Company is not

the primary beneficiary but holds a significant variable interest.

Consolidated(1)

Unconsolidated

Carrying

Amount of

Assets

Carrying

Amount of

Liabilities

Carrying

Amount of

Assets

Carrying

Amount of

Liabilities

Maximum

Exposure to

Loss(2)(3)

Variable interest entities, December 31, 2008

Affordable housing entities .......................................................

.

$ $ $ 971,151 $ 554,605 $ 97,151

Entities that provide capital to low-income and rural

communities..........................................................................

.

189,700 37,701 46,558 46,558

Other..........................................................................................

.

246,038 246,038

Total variable interest entities ......................................

.

$ 189,700 $ 37,701 $ 1,263,747 $ 554,605 $ 1,263,747

Variable interest entities, December 31, 2007

Affordable housing entities .......................................................

.

$ $ $ 509,668 $ 324,227 $ 509,668

Entities that provide capital to low-income and rural

communities..........................................................................

.

102,090 12,010 12,010

Other..........................................................................................

.

Total variable interest entities ......................................

.

$ 102,090 $ $ 521,678 $ 324,227 $ 521,678

(1) The Company consolidates a VIE when it is the primary beneficiary that will absorb the majority of the expected losses,

majority of the expected residual returns or both.

(2) The maximum exposure to loss represents the amount of loss the Company would incur in the unlikely event that all of the

assets in the VIEs became worthless.

(3) The difference between the carrying amount of the liability and the maximum exposure to loss is the Companys variable

interest in the VIEs. In the event that the assets of the VIEs became completely worthless, the Company would lose its variable

interest in the VIEs. The Company is not required to provide any support to these entities other than what it was previously

contractually required to provide, therefore the Companys maximum exposure to loss is limited to its variable interests in the

VIEs.

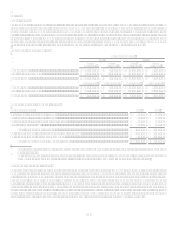

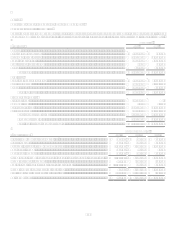

Note 21

Regulatory Matters

The Company is subject to capital adequacy guidance adopted by the Federal Reserve Board (the Federal Reserve), and CONA and

COBNA (collectively, the Banks) are subject to capital adequacy guidelines adopted by the Office of the Comptroller of the

Currency (the OCC, and with the Federal Reserve, collectively, the regulators). The capital adequacy guidelines set minimum

risk-based and leverage capital requirements that are based on quantitative and qualitative measures of their assets and off-balance

sheet items. The Federal Reserve holds the Corporation to similar minimum capital requirements. Failure to meet minimum capital

requirements can result in possible additional, discretionary actions by a federal banking agency that, if undertaken, could have a

material adverse effect on the Corporations consolidated financial statements.