Capital One 2008 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

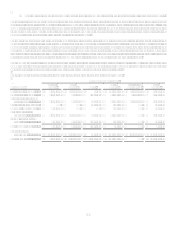

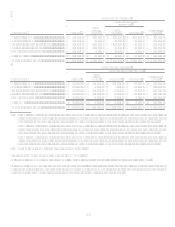

Other National Lending sub-segment which includes the Companys auto finance and international lending sub-segments.

The results of the GreenPoint mortgage origination operations are being reported as discontinued operations for 2008, 2007, and 2006,

and are not included in the segment results of the Company. The results of GreenPoints mortgage servicing business and small ticket

commercial real estate loans held for investment portfolio are reported as part of the Companys continuing operations and included in

the Local Banking segment. The results of GreenPoints consumer mortgage held for investment portfolio are reported as part of the

Companys continuing operations and included in the Other segment.

The Local Banking and National Lending segments are considered reportable segments based on quantitative thresholds applied to the

managed loan portfolio for reportable segments provided by SFAS 131, and are disclosed separately. The Other segment includes the

Companys liquidity portfolio, emerging businesses not included in the reportable segments, and various non-lending activities. The

Other segment also includes the results of GreenPoints consumer mortgage held for investment portfolio the GreenPoint home equity

line of credit portfolio, the net impact of transfer pricing, certain unallocated expenses, gains/losses related to the securitization of

assets, and restructuring charges related to the Companys cost initiative announced in the second quarter of 2007.

The Company maintains its books and records on a legal entity basis for the preparation of financial statements in conformity with

GAAP. The following tables present information prepared from the Companys internal management information system, which is

maintained on a line of business level through allocations from the consolidated financial results.

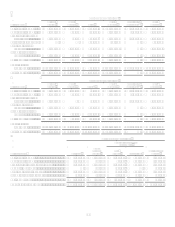

The following tables present certain information regarding our continuing operations by segment:

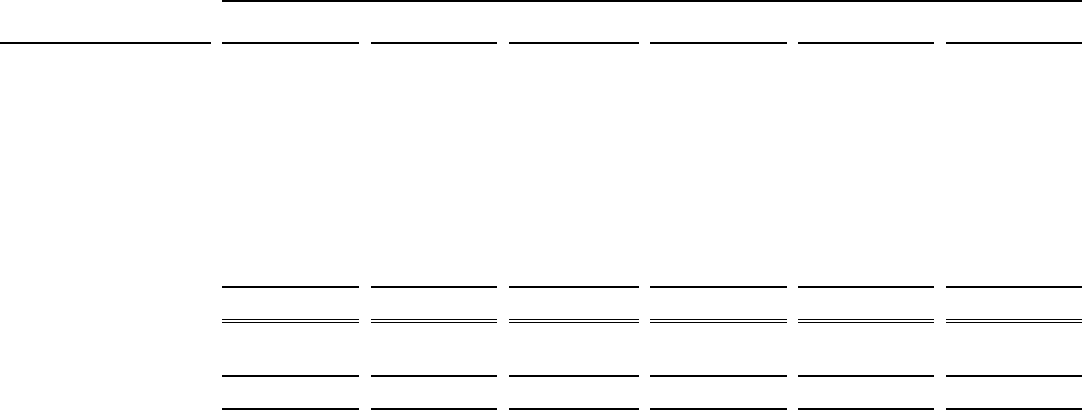

Year Ended December 31, 2008

Total Company

National

Lending

Local

Banking

Other

Total

Managed

Securitization

Adjustments(1)

Total

Reported

Net interest income .........

.

$ 8,990,874 $ 2,422,811 $ 8,370 $ 11,422,055 $ (4,273,340) $ 7,148,715

Non-interest income........

.

4,737,612 813,742 (133,956) 5,417,398 1,326,573 6,743,971

Provision for loan and

lease losses .................

.

7,428,476 447,643 171,688 8,047,807 (2,946,767) 5,101,040

Restructuring expenses ...

.

134,464 134,464 134,464

Goodwill impairment ......

.

810,876 810,876 810,876

Other non-interest

expenses .....................

.

4,893,898 2,443,369 (72,580) 7,264,687 7,264,687

Income tax provision

(benefit)......................

.

485,265 120,939 (109,102) 497,102 497,102

Net income (loss) ............

.

109,971 224,602 (250,056) 84,517 84,517

Loans held for

investment ..................

.

$ 101,147,134 $ 45,082,981 $ 706,639 $ 146,936,754 $ (45,918,983) $ 101,017,771

Total deposits..................

.

$ 1,459,131 $ 78,938,391 $ 28,223,267 $ 108,620,789 $ 108,620,789